On the afternoon of July 9, 2020, 40 Haikou students and 12 Yongxing school students sat in their respective classrooms in the 5G synchronous classroom of Haikou Affiliated School of Beijing Normal University, and had a music lesson with them through 5G network connection, learning minority folk songs — — Brave Oroqen. Photo courtesy of vision china (data picture)

"I would like to inform you of some data. As of yesterday, the total number of views of the National Smart Education Platform was about 4 billion, and the total number of visitors exceeded 600 million. It should be said that this digital education platform has been accelerated on the existing basis, and accelerating the construction of high-quality resources has made positive efforts and contributions to promoting the digitalization of education and the international influence and discourse power of digital education in China. " On September 9th this year, Huai Jinpeng, Minister of Education, described the progress made in the informationization and digitalization of education in China with the latest data at the press conference organized by Publicity Department of the Communist Party of China.

In 2011, compulsory education was fully popularized in China, and the problem of school-age children’s "learning" was fundamentally solved, which was followed by the increasingly strong demand of parents of students for "learning".

After the founding of New China, China’s education has solved many problems: eliminating illiteracy, popularizing compulsory education, and developing higher education by leaps and bounds. However, when the development of education has reached a higher level, the challenges will be greater with each step. Especially in the decade after 2012, it is in the stage of faster knowledge updating and faster economic and social development. How to answer the compulsory question of "going to school" has become another challenge for education in China.

The top-level design is available.

In 2015, the Supreme Leader of president made it clear in his congratulatory letter to the International Conference on Education Informatization that in today’s world, scientific and technological progress is changing with each passing day, and modern information technologies such as the Internet, cloud computing and big data have profoundly changed the way people think, produce, live and learn, and profoundly demonstrated the prospects of world development.

The Supreme Leader said that China has made unremitting efforts to promote education informatization and expand the coverage of quality education resources by means of informatization. Through the informationization of education, we will gradually narrow the digital gap between regions and urban and rural areas, vigorously promote educational equity, and let hundreds of millions of children share quality education under the blue sky and change their destiny through knowledge.

Breaking the "fence": "a screen" illuminates the fair road

Zheng Xudong, a professor at the Department of Artificial Intelligence Education of Huazhong Normal University, said that China’s education informatization started at the turn of the century, and it has been more than 20 years, and the first stage was completed around 2010. The main task is the construction of information technology infrastructure, with the "Modern Distance Education Project in Rural Primary and Secondary Schools" as the representative. Through the application of modern information technology, the material foundation and technical environment of China’s education development have been greatly improved.

When the hardware conditions are guaranteed, it is possible to develop education in different regions in a balanced way and narrow the gap between urban and rural education.

In the decade after 2010, China’s education informatization ushered in a leap-forward development.

In 2010, the State Council promulgated the Outline of the National Medium-and Long-Term Education Reform and Development Plan (2010-2020), pointing out that "education informatization is the strategic commanding height to promote education reform and development, and information technology has a revolutionary impact on education development". In 2012, the Ministry of Education formulated and issued the first 10-year development plan of educational informatization to accelerate the process of educational informatization. In 2016, the Ministry of Education issued the 13th Five-Year Plan for Education Informatization. "At this stage, the top-level design and planning of education informatization at the national level are intensively released, which reflects the country’s firm implementation of ‘ Promoting educational modernization with educational informatization ’ The determination of the national strategy. " Professor Guo Jiong, Dean of the College of Educational Technology of Northwest Normal University, said.

Then, in October 2017, "running online education well" was written into the report of the 19 th National Congress of the Communist Party of China. In 2018, the Ministry of Education issued the Education Informatization 2.0 Action Plan; in 2019, the Central Committee of the Communist Party of China and the State Council issued the Education Modernization in China 2035; and the General Offices of the General Office of the Central Committee of the CPC and the State Council issued the Implementation Plan for Accelerating Education Modernization (2018-2022).

With the promotion of a series of heavy policies, China’s education informatization construction has formed a stable development model. It is understood that by the end of 2021, the internet access rate of primary and secondary schools (including teaching points) in China has reached 100%, and the schools that are not connected to the internet have been dynamically cleared. By the end of 2021, 99.5% of primary and secondary schools in China have multimedia classrooms, with the number exceeding 4 million, of which 87.2% have achieved full coverage of multimedia teaching equipment.

When "a screen" lights up in every classroom in urban and rural areas, what changes will it bring to education?

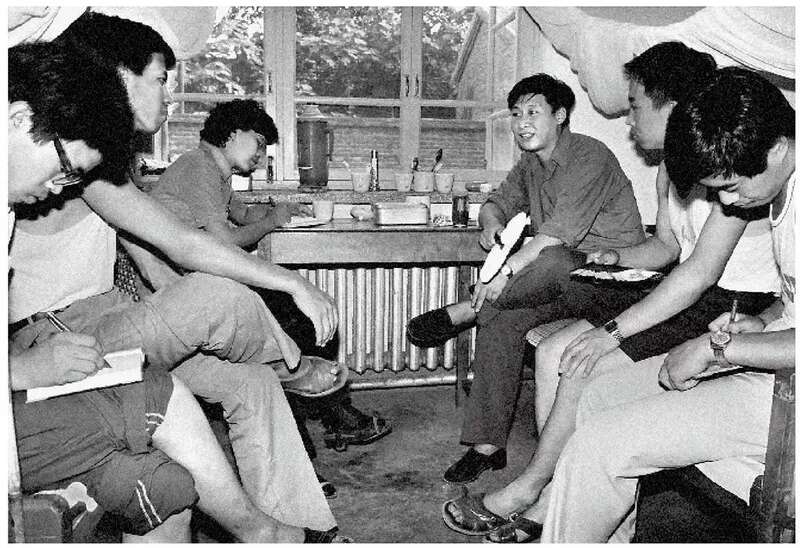

In 2017, the reporter of Zhongqingbao Zhongqingwang went to Yongxing School in Sansha City, Hainan Province for an interview. This school located at the southernmost tip of the motherland has a total of 32 students, including 24 kindergarten students. A mixed-age class has been established, with 8 primary school students, including 5 in grade one, 2 in grade two and 1 in grade five. The primary school adopts the re-examination teaching mode.

In order to let the children on the island also enjoy high-quality educational resources, some subjects in the school use the mode of information technology. When the reporter came to the school, eight primary school students in Yongxing School were having music lessons in a synchronous classroom with a class in Haikou Binhai Nine Primary School. I saw that the intelligent interactive whiteboard in front of the classroom had been networked, and the picture on the big screen was the teachers and students of Haikou Binhai Nine Primary School.

"Good teacher! Good friends! " Through the big screen, students from the two places greet each other in a familiar way. It is understood that this is also the practice of children’s vocalization.

According to a teacher, synchronous classes occupy a considerable proportion in school teaching. Only the Chinese subjects he teaches have synchronous classes twice a week.

“‘ A screen changes a child’s fate ’ The core is to realize the sharing of intellectual resources of excellent teachers. " Guo Jiong said that the "three classes" proposed by our country is a typical sharing of intellectual resources. Synchronous classes are designed to solve the problem that weak schools can’t open, can’t open completely, and can’t open well. The ideal state of a collaborative teaching activity between high-quality school teachers and weak schools is collaborative lesson preparation, collaborative teaching, collaborative reflection, etc. In this process, students in weak schools share teachers’ resources in high-quality schools and teachers in weak schools learn.

The success of "one screen" has made urban and rural education begin to integrate and broken the fence between classrooms. All this has opened a window for students, and "one screen" plays an important role in promoting educational equity.

Connecting the inside and outside: "one screen" opens the door to quality improvement

On October 12, 2021, many junior one teachers from Guangqumen Middle School in Dongcheng District of Beijing and Zhangziying Middle School in Daxing District entered the conference room of the online platform in their respective schools. On the same day, the teachers of the two schools will jointly prepare lessons for the "One Yuan One Equation" unit of Grade One. The difficult problems to be discussed and solved by several teachers are "analyzing students’ learning from ‘ Arithmetic thinking ’ To ‘ Algebraic thinking ’ The transformation process of ""design a large unit theme teaching design based on core literacy for the teaching content of this chapter ".

"Since 2020, China’s education has entered a new stage of digital transformation." Zheng Xudong said that education informatization began to devote itself to promoting the transformation of education from labor-intensive to technology-intensive through the innovative application of a new generation of information technology represented by artificial intelligence, driving the overall reform of education, changing teachers’ teaching methods, students’ learning methods and school development methods, and building a high-quality education system.

In 2022, the Ministry of Education launched the strategic action of digital education, and vigorously promoted the integration of high-quality resources and public services. The landmark event of this action was the opening of the national smart education platform. The National Smart Education Platform is a comprehensive platform for national education public service, focusing on five core functions: student learning, teacher teaching, school governance, empowering society and educational innovation. The first phase of the project includes four sub-platforms: the National Smart Education Platform for Primary and Secondary Schools, the National Smart Education Platform for Vocational Education, the National Smart Education Platform for Higher Education and the National Employment Service Platform for College Students.

On March 29th, 2022, Lv Yugang, Director of the Department of Basic Education of the Ministry of Education, introduced the trial operation of the National Smart Education Platform for Primary and Secondary Schools, which was revised and upgraded on the basis of the original National Network Cloud Platform for Primary and Secondary Schools.

"The total amount of resources has been greatly increased." Lv Yugang said that on the basis of the original two resource sections of thematic education and curriculum teaching, the platform has added eight sections, including sports, aesthetic education and labor education, with a total of 51 secondary columns; A number of important professional websites, such as China National Museum and China Digital Science and Technology Museum, are also linked, and the resources are more abundant.

As of October 10, 2022, the total existing resources of the platform have reached 44,000, four times that before the revision; It has integrated more than 10,000 ministerial-level excellent class resources precipitated by the previous activities of "One Teacher, One Excellent Class, One Teacher", and tens of thousands of ministerial-level excellent class resources are being sorted out and will be launched on the platform one after another; The number of visits to the national smart education platform for primary and secondary schools has reached 11.3 billion, with an average daily visit of 50.58 million, 69 times that of the same period last year.

"In geometry, and ‘ Brownian motion ’ Compared with ‘ Levy flight ’ You can cover a larger area with less distance and steps. If we say that traditional education is slow ‘ Brownian motion ’ , then information technology-enabled education is rapid ‘ Levy flight ’ . The key role of educational informatization in education is to greatly enhance its ability of system innovation. " Zheng Xudong said.

The promotion of technology is not only about upgrading, especially in the field of education. All technological revolutions are for higher quality education and teaching.

Many places are trying.

According to the relevant person in charge of the Beijing Municipal Education Commission, Beijing is trying to change the traditional single-teacher teaching mode into the guidance and simultaneous teaching mode of famous teachers or teams of famous teachers, and use new technologies to penetrate the boundaries of physical classrooms and schools, so that students from different schools and classes can have the same class; In Jiangsu, Suzhou carries out education evaluation with the support of big data, Taizhou "Taiwei Class" creates an application model based on micro-video to promote high-quality resource sharing, and Nantong Development Zone Experimental Primary School implements "smart homework" management and "Mr. Xiao" online hotline & HELIP; …

When the barriers between urban and rural areas are broken and the walls between classrooms are opened, the connection between the inside and outside of "a screen" is opened, and the development space of children is opened. As Zheng Xudong said, although a screen may change the fate of children, strictly speaking, it is not just this screen that changes the fate of children. The change of children’s fate is the result of the joint efforts of many parties with this screen as the hub. Only with good coordination can this screen really play a role.

Intelligent portrait "a screen" makes it possible to reach education accurately.

However, fairness is not "quick march", and higher quality education is not reflected in the data. Any change in education will eventually be reflected in children, and for children, a fairer and higher quality education is to teach students in accordance with their aptitude, which is to let every child get the most suitable education.

"One screen" makes this ideal come true quickly.

Huang Li, Party Secretary of xingqing district Huimin No.2 Primary School Education Group, Yinchuan City, said that through the secondary development of online education and teaching resources, the school has realized school-based and characteristic resources, and high-quality resources have reached every classroom. Every teacher and student has their own online learning space, and all learning processes and teaching activities can be completed in the online learning space and form process data records. Let the "cloud" resources become available digital resources to adapt to every student’s "end". At the same time, teachers can also cultivate students’ ability to obtain information, explore and think, solve problems and construct knowledge by using information technology through a new teaching model based on online learning space, improve students’ humanities and information literacy, explore personalized training, and promote the integrated application of online and offline teaching.

The reporter of Zhongqingbao Zhongqingwang learned that Beijing has built an "open online counseling service platform for junior high school teachers", where key teachers at district level and above provide online counseling services. The platform intelligently extracts the content that each teacher is good at, sets label attributes for teachers, and matches the label attributes of teachers with the diagnosis needs of students according to the results of students’ accurate diagnosis, thus realizing the refinement, automation and personalized push of teacher services. It is understood that up to now, the total number of teachers actually participating in counseling is more than 8,234, and 135,000 people have answered questions online, with a cumulative counseling of more than 3 million times.

Yang Fei, deputy director of the Education Technology and Resources Development Center (Central Audio-visual Education Center) of the Ministry of Education, said that accelerating the realization of personalized and accurate services for all kinds of users and improving the level of intelligent services on the platform are the key directions for upgrading the functions of the "National Smart Education Platform for Primary and Secondary Schools". The platform function is demand-oriented and iteratively upgraded. At present, it has run through five levels of collaborative management at the national, provincial, municipal, county and school levels, and has the ability to support self-study, teacher preparation, classroom teaching, after-school service, homework activities, answering and counseling, home-school communication, teacher training and other scene applications, and supports the use of computers, classroom screens, mobile phones, home TVs and other terminals, basically realizing the expansion from single resource browsing to comprehensive support of various educational and teaching activities. In the future, the platform will gradually provide users with personalized subscription, intelligent push recommendation, accurate retrieval and other functions through technologies such as big data and artificial intelligence, and gradually form a new ecology of digital-based basic education services.

"Whether it is digital resources, intellectual resources or educational services, data will be generated in the application process. These data are a kind of educational resources with tension, which can provide data basis for learner characteristic analysis, learning diagnosis and analysis, and further recommend personalized resources based on these data." Guo Jiong said that the promotion of educational resources will form a "portrait" according to everyone’s past study experience, and recommend resources to meet personal needs.

General Secretary of the Supreme Leader once emphasized during his visit to Beijing Bayi School in 2016 that the more the times move forward, the more important knowledge and talents become, and the more prominent the position and role of education becomes.

Today, with the rapid development of science and technology, the relationship between education and technology is getting closer and closer, and when they are combined, generate’s energy is also huge.

As Zheng Xudong described it, "In front of the screen are teachers and children from weak schools in rural areas. The screen shows excellent teachers and high-quality resources gathered together, while behind the screen is the systematic support ability for education and teaching formed by China’s educational informatization for decades."

"A screen" is like a stage, where the efforts of local teachers, distant teachers, national platforms, industrial enterprises and even all walks of life to achieve high-quality and fair education converge, and eventually become a great force to promote the vigorous development of education in China.

Zhongqingbao Zhongqingwang reporter Fan Weichen Source: China Youth Daily

Firebird

Firebird

The small audience responded enthusiastically to Firebird.

The small audience responded enthusiastically to Firebird.