The Emergency Management Department released the basic situation of natural disasters in 2019.

2019In, natural disasters in China were mainly floods, typhoons, droughts, earthquakes and geological disasters, and forest and grassland fires, wind and hail, low-temperature freezing and snow disasters also occurred to varying degrees. Snowstorm in Yushu, Qinghai, forest fire in Muli, Sichuan, landslides in Xiangning, Shanxi and Shuicheng, Guizhou, and Changning, Sichuan occurred one after another throughout the year.6.0Major natural disasters, such as earthquake of magnitude 6.0, super typhoon "Likima", heavy rains and floods in many southern provinces during the main flood season, and drought in summer, autumn and winter in southern China. After consultation with the Ministry of Industry and Information Technology, the Ministry of Natural Resources, the Ministry of Housing and Urban-Rural Development, the Ministry of Transport, the Ministry of Water Resources, the Ministry of Agriculture and Rural Affairs, the Health and Wellness Commission, the Bureau of Statistics, the Meteorological Bureau, China Banking and Insurance Regulatory Commission, the Grain and Reserve Bureau, the Joint Staff of the Central Military Commission and the Political Work Department, the Red Cross Society, China National Railway Group Co., Ltd. and other member units of the National Disaster Reduction Committee, all kinds of natural disasters were caused throughout the year.1.3Hundreds of millions of people were affected,909People are dead and missing,528.6Ten thousand emergency transfer and resettlement;12.6Ten thousand houses collapsed,28.4Ten thousand rooms were seriously damaged,98.4Ten thousand rooms are generally damaged; Affected area of crops19256.9Thousands of hectares, of which no harvest.2802Thousand hectares; direct economic loss3270.9100 million yuan.

2019In, under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, the Emergency Management Department adhered to the guidance of the Supreme Leader’s Socialism with Chinese characteristics Thought in the New Era, conscientiously implemented the decision-making arrangements of the CPC Central Committee and the State Council, made every effort to modernize the emergency management system and capacity, kept an emergency state at all times, and guided the national emergency management system to do a good job in disaster prevention, mitigation and relief, effectively and orderly responding to a series of major natural disasters. The number of people who died and disappeared due to natural disasters, the number of houses collapsed and the direct economic losses accounted for.GDPClose specific gravityfiveThe annual average decreased respectively.25%、57%and24%.2019The main features of natural disasters in China in are:

First, the flood disaster is "more in the north and south, less in the middle", and the geological disasters are high in the south-central and southwest regions.

2019In, the precipitation in most parts of the country was on the high side, showing "more in the north and south and less in the middle" on the whole. Among them,six-eightIn October, several rounds of rainfall in southern China were concentrated and overlapped, and the main rain belt always lingered in Guangxi, Jiangxi and Hunan, leading to Guangxi, Jiangxi, Hunan, Guizhou and Sichuan.fiveSerious floods occurred in provinces (regions), causing heavy casualties and serious direct economic losses.seven-eightIn June, there was persistent rainfall in northwest and northeast China, and many rivers such as Heilongjiang and Songhua River exceeded the warning water level, and crops were affected in a large area. In Jiangsu, Anhui, Hubei, Henan, Shandong and other provinces from the north of the Yangtze River to the Yellow River basin, the rainfall in flood season is obviously less than that in the same period of normal years, and the flood disaster is at a low level in the same period of recent years. In addition, the number of geological disasters in Central and South China is the largest, and the geological disasters in Southwest China have caused the heaviest disaster losses and the largest number of people who died and disappeared due to disasters. On the whole,2019The losses caused by floods and geological disasters showed a downward trend in.

Second, there are many typhoons and few landings, and the super typhoon "Lichima" has great influence.

2019Annual totalfiveTyphoon landed in China, with an average of less than many years.2A.fiveThe intensity of the landing typhoon was weak as a whole, but the firstnineThe extreme characteristics of the super typhoon "Lichima" are obvious, which is1949Since, the typhoon has landed in mainland China with the fifth strongest intensity, and the maximum wind force near the center reached.16Level (fifty-tworice/Seconds), rainfall in parts of Zhejiang, Anhui, Jiangsu and Shandong reached.350-600Mm, far exceeding the local historical extreme, resulting in Zhejiang, Anhui, Fujian, Shandong and so on.nineProvince (city)209.7Ten thousand people were urgently transferred and resettled,1.5Ten thousand houses collapsed,13.3Ten thousand rooms were damaged to varying degrees. Besides,2019In 2000, there were few typhoons going inland westward, excepteightSuper typhoon "Lichima" and10Typhoon Mina brought strong rainfall to Zhejiang, Jiangsu and other places in August, but no other typhoon penetrated into the middle and lower reaches of the Yangtze River, which aggravated the development of drought in the middle and lower reaches of the Yangtze River to some extent.

Third, the drought has occurred in stages and regions, and the drought in summer, autumn and winter in southern China is serious.

2019Winter and spring drought, summer, autumn and winter drought and regional drought occurred successively in.2-fiveIn June, the northeast region suffered from spring drought, and most of Yunnan and southern Sichuan experienced winter and spring drought.five-eightIn September, the ground temperature in Jianghuai, Huanghuai and other places was high and there was little rain, among which the drought in Shanxi, Henan and other places was heavier, and there was a staged summer drought.sevenSince late October, the precipitation in eastern Hubei, central and eastern Hunan, most of Jiangxi, southern Anhui and central and northern Fujian has been less than normal.five-nineCheng, for1961Since, the same period in history has been the least, and the temperature in most of the above areas is higher than normal, which has caused the occurrence of near in Hubei, Hunan, Jiangxi and Anhui.40The worst drought in summer and autumn in years. Generally speaking, although the drought has reduced the production of cash crops and grain crops in some areas, it has not had a significant impact on the overall grain harvest in the whole year. YujinfiveCompared with the annual average,2019In, the number of people living in need of assistance due to drought in China increased.65%The affected area of crops and direct economic losses were reduced respectively.22%and4%.

Fourth, the seismic activity in the western region is relatively active.

2019It happened in mainland China in.twentytimefiveEarthquakes of magnitude above, among whichsixEarthquakes above magnitude2Time, did not happen.sevenEarthquakes of magnitude above. western part of the countryfiveEarthquakes above magnitude account for the national total85%, among which,fourmoon24Medog County, Xizang, Japan6.3Magnitude earthquake, yes2019The earthquake with the highest magnitude in 2000 caused a small number of cracks in houses in Medog County.sixmoon17Changning, Sichuan6.0Magnitude earthquake, yes2019The earthquake with the worst disaster in 2008 caused13People die,3500More than two houses collapsed,22.3Ten thousand houses were damaged to varying degrees. Besides,2moon24-25Rongxian county, Sichuan province4.7Level,4.3Grade sum4.9Magnitude earthquake,fivemoon18Rijilin Songyuan5.1Magnitude earthquake,ninemooneightRi Sichuan Weiyuan5.4Magnitude earthquake,10moon28Ri Gansu Xiahe5.7Magnitude earthquake,11moon25Jingxi, Guangxi5.2Magnitude earthquake,twelvemoon26Japan Hubei Yingcheng4.9The magnitude-8 earthquake also caused some losses.

Five, the temporal and spatial distribution of wind and hail disasters is relatively concentrated, and the low temperature freezing and snow disasters are significantly lighter.

2019Appeared all over the country in37Sub-strong convective weather process, closefiveThe annual average is less, and the temporal and spatial distribution of wind and hail disasters is more concentrated. Time is concentrated infour-eightIn June, the region was concentrated in East China, Central China and North China, and Inner Mongolia, Hebei, Tianjin, Beijing, Liaoning and other places had experienced super-development.10Strong winds caused heavy local losses. Low-temperature freezing and snow disasters mainly concentrated at the beginning of the year, affecting the eastern part of northwest China, Northeast China, Huanghuai, Jianghuai, Jianghan and other places. Crops in parts of Qinghai, Shanxi, Inner Mongolia, Shaanxi, Hunan and Yunnan suffered from low-temperature freezing and snow disasters. YujinfiveCompared with the annual average, the disasters caused by low-temperature freezing and snow disaster are obviously lighter, and the affected area of crops and direct economic losses are reduced respectively.70%and84%

Six, the forest and grassland fire situation is generally stable, and the number of occurrences and the affected area have achieved a "double decline."

2019A total of forest fires occurred in China in.2345, including major fire.eightOutbreaks and major firesoneArea of damaged forest13505Ha. and2018Compared with, the number of forest fires decreased.133Rise and fall5.4%; Decrease of damaged forest area2804Ha, decline17.2%. Grassland fires broke out all over the country.45, including major fire.oneOutbreaks and major fires2All of them were caused by fire from abroad, and the area of the affected grassland was about66705Ha.

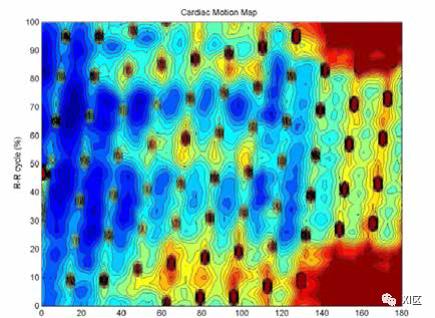

Cctv newsAccording to the website of the National Bureau of Statistics, according to preliminary accounting, the GDP in the first three quarters was 59,328.8 billion yuan, up 6.9% year-on-year at comparable prices, and the growth rate was the same as that in the first half of the year, 0.2 percentage points faster than that in the same period of the previous year. In terms of industries, the added value of the primary industry was 4,122.9 billion yuan, a year-on-year increase of 3.7%; The added value of the secondary industry was 23,810.9 billion yuan, an increase of 6.3%; The added value of the tertiary industry was 31,395.1 billion yuan, an increase of 7.8%. In the third quarter, the gross domestic product increased by 6.8% year-on-year, and the economy operated in the range of 6.7-6.9% for nine consecutive quarters, maintaining medium and high-speed growth.

Cctv newsAccording to the website of the National Bureau of Statistics, according to preliminary accounting, the GDP in the first three quarters was 59,328.8 billion yuan, up 6.9% year-on-year at comparable prices, and the growth rate was the same as that in the first half of the year, 0.2 percentage points faster than that in the same period of the previous year. In terms of industries, the added value of the primary industry was 4,122.9 billion yuan, a year-on-year increase of 3.7%; The added value of the secondary industry was 23,810.9 billion yuan, an increase of 6.3%; The added value of the tertiary industry was 31,395.1 billion yuan, an increase of 7.8%. In the third quarter, the gross domestic product increased by 6.8% year-on-year, and the economy operated in the range of 6.7-6.9% for nine consecutive quarters, maintaining medium and high-speed growth.