Big news! Just now, Vanke announced!

China Fund News reporter Yishan

On June 5, Vanke disclosed the latest announcement, and then proved its solvency to the market with practical actions.

Repay the principal and interest of US$ 612.6 million medium-term notes in full.

On the evening of June 5, Vanke announced that on March 7, 2019, Vanke Real Estate (Hong Kong) Co., Ltd., a wholly-owned subsidiary, disclosed the announcement on the 4.20% medium-term notes (ISIN:XS1958532829) due in 2024 on the Hong Kong Stock Exchange. This bill will expire on June 7, 2024.

As of June 5, 2024, the outstanding principal amount of the notes together with the accumulated interest funds up to the maturity date, totaling USD 612.6 million, have been remitted to the overseas bank account of Vanke Real Estate (Hong Kong) Co., Ltd., and the company will deposit all the relevant funds into the bank account designated by the correspondent bank on June 6, 2024, so as to fully pay the principal and interest of the notes due.

Earlier, in early March, Vanke had fully paid the principal and interest of US$ 647 million in US dollar debt due.

Recently, good news has continued.

Since the beginning of this year, the market has paid more attention to Vanke.

According to the data of the 2023 annual report, as of the end of the reporting period, Vanke’s interest-bearing liabilities totaled about 320.05 billion yuan, accounting for 21.3% of the total assets. Interest-bearing liabilities due within one year are about 62.42 billion yuan, a decrease compared with the same period in 2022, accounting for 19.5%; Interest-bearing liabilities for more than one year are about 257.63 billion yuan, accounting for 80.5%.

Yu Liang, Chairman of Vanke’s Board of Directors, once said at the 2023 Annual General Meeting of Shareholders that the company has formulated a package of slimming and fitness, and made overall plans for debt reduction and high-quality development. In the next two years, the interest-bearing debt will be reduced by more than 100 billion yuan, and the total scale of interest-bearing debt will be reduced by more than half in the next five years; At the same time, the "transformation of financing mode" has been completed, from the mode of unified borrowing and unified repayment to the financing mode of project and asset credit.

Subsequently, in addition to the three dominant main businesses of comprehensive residential development, property services and apartment rental, Vanke will withdraw from other businesses, and clean up and transfer non-main financial investments. In addition, we will resolutely and vigorously promote large-scale asset transactions such as commercial offices, and plan to complete 20 billion yuan each year.

According to the first quarterly report in 2024, as of the end of the reporting period, Vanke held 83.07 billion yuan in monetary funds, which can cover short-term loans and interest-bearing liabilities due within one year. In terms of financing, the Group continued to receive support from financial institutions. In the first quarter, the comprehensive cost of new domestic financing was 3.33%, keeping the industry low.

In addition, since May, Vanke has had good news, including signing an agreement with head financial institutions such as China Merchants Bank to obtain a syndicated loan of 20 billion yuan to help the company improve its liquidity; The land use right of Shenzhen Bay Super Headquarters Base T208-0053 was successfully transferred for 2.235 billion yuan, which helped the company to continue to slim down and focus on its main business.

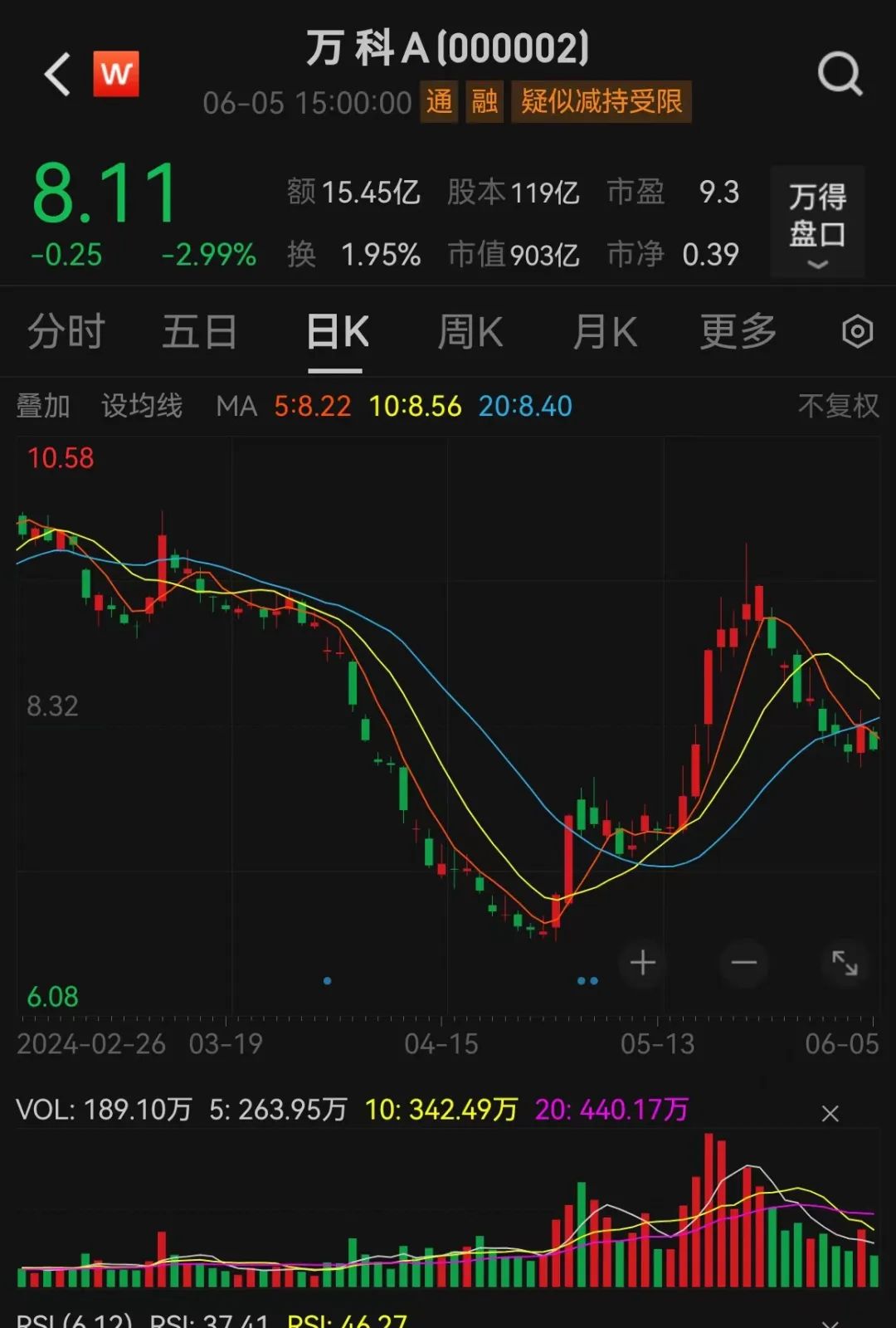

As of June 5, Vanke A’s share price closed at 8.11 yuan, with the latest market value of 90.3 billion yuan.

Editor: Joey

Audit: Xu Wen

Copyright statement: China Fund Newspaper enjoys the copyright of the original content published on this platform, and it is forbidden to reprint it without authorization, otherwise it will be investigated for legal responsibility. Authorized Reprinting Cooperation Contact: Yu Xiansheng (Tel: 0755-82468670)

Original title: "Big news! Just now, Vanke announced! 》

Read the original text