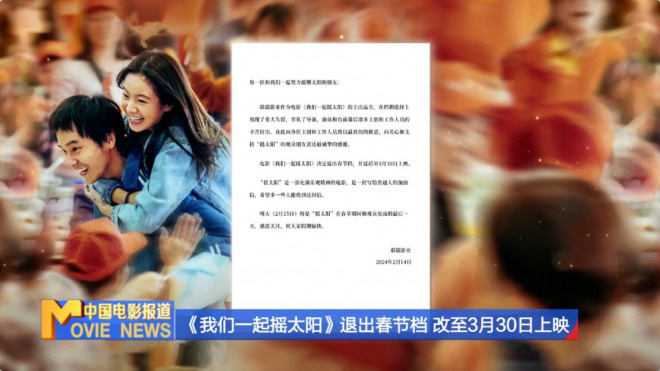

Exit the Spring Festival file and change it to 3.30! What’s good about Viva La Vida?

Special feature of 1905 film network On the evening of February 14th, Lianrui Film announced that due to a major mistake in the schedule selection, its main film withdrew from the highly competitive Spring Festival file and was postponed to March 30th this year. February 15th was the last day for the film to meet the audience during the Spring Festival.

Viva La Vida tells the story of two seriously ill young people, Lu Tu and Ling Min, who finally see the sunshine of life because of relay for life. The film was warm and cured, and gained a good audience reputation. Douban scored 7.9, but at present, the box office is less than 100 million yuan, and the market performance is far below expectations. Here we also hope that good movies can be seen by more people.

In this special program of Spring Festival "Spring Festival Movies Booming", the director of Viva La Vida leads the leading role and walks into Blue Feather Living Room, which is the final chapter of Han Yan’s trilogy of life and is full of moving and healing power. In the interview, the main creator revealed the behind-the-scenes of the film for us.

Lan Yu: Just now we have been cycling the song "Shake the Sun" in a single.

Han Yan: Yes, I heard it when I was a child. "Don’t miss a good time", isn’t that the theme of our movie? I decided to use the name of this song as the title of the film.

Lan Yu: You two have been singing just now. Who sings better?

Peng Yuchang: She sings well. The emotional part must be that she sings well.

Li Gengxi: On the aspect of all five tones, it has to be him.

Lan Yu: How did the director first think of letting them play this movie?

Han Yan: At that time, the script was not completely finished, and I didn’t think in my mind who would play these roles. At that time, after meeting them, the role seemed to be more concrete in my mind. For example, Geng Xi looks very thin and small, but when chatting with her, I can feel that there are many special things in my heart, which is very similar to the role of Ling Min. What about Pumbaa? You see, he is always sincere and innocent, and so is his performance.

Lan Yu: Did you observe his innocent face?

Xu Fan: He is innocent. I think my son just wants to wake him up.

Lan Yu: Today we are about to usher in Pumbaa’s "social death" moment. Because Pumbaa actually performed in a variety show six years ago.

Peng Yuchang: I’m really sweating.

Han Yan: Very sincere and innocent.

Lan Yu: What kind of impression did you have on director Han Yan’s works at that time?

Peng Yuchang: Worship.

Han Yan: It’s so hypocritical. I just said that he is sincere.

Peng Yuchang: Worship, really, really.

Li Gengxi: I think he was very pure at that time. Now, after all, people are almost thirty, and there will still be one thing, that is, a sense of vicissitudes and a sense of story.

Lan Yu: I heard that the director said before taking this play that he could not take other plays for six months. Did he make such a request?

Han Yan: Right. Because I want them to spend as much time as possible immersed in the role to be played, I don’t trust that you can get into this role instantly by pulling away from the role in another play.

Li Gengxi: At that time, it happened that I hadn’t filmed for half a year. I was completely in the state of my own life, and then I could devote myself to this play. I have been with the role every day for five months, and this experience will be a very precious experience in my career.

Lan Yu: So this time you two should walk into different lives. What lessons did you do, Geng Xi?

Li Gengxi: Basically, I experienced the local life in Changsha. Later, we went to the hospital, visited those patients, talked with them and learned about their lives. The most striking thing is that it is too real, such as someone’s eyes, or a patient showed me a fistula in his arm.

Lan Yu: Geng Xi has many details in the movie, for example, she eats lemons. Does this detail come from these real patients?

Han Yan: I have observed that some patients’ daily life, such as eating lemons, including how they control salt, potassium and water, including some normal things, will be concentrated on Ling Min.

Lan Yu: Is it cool for Geng Xi to eat citric acid every day?

Li Gengxi: My teeth will be very astringent, and my mouth will be drooling all the time. My lips may be pickled and broken a little, and it will be very sour if I eat it again.

Lan Yu: What about Pumbaa?

Peng Yuchang: The patients we met were different. I think even before, you were afraid to touch life and life and death, but after talking to them, they gave me an optimistic, positive and sunny attitude, which made me ashamed. On the contrary, I am still a more sensitive person who may be afraid of this.

Lan Yu: This is what the film wants to present. It was a very interesting scene when you two met. Was it entirely the director’s design?

Han Yan: Right. Lu tu, like a stone, knocked the quiet lake out of the waves. A meeting changed Ling Min’s life and the direction of our movies, so I hope that meeting is interesting.

Lan Yu: What’s the code word?

Han Yan: "Ollie gives". This code word … Let me guess that Lu Tu is a state in which his life is always half a beat slower than this era. Maybe many people think that the slogan "Ollie gives" is out of date now, but I think it may be the exciting period for Lu Tu.

Peng Yuchang: "For Ollie", it took four days.

Lan Yu: Another scene is your confession on the rooftop. At that time, how did you understand Lu Tu’s courageous confession?

Peng Yuchang: They are like complementary souls, and they have feelings there. Let’s send out the most sincere ones.

Lan Yu: How did Geng Xi feel when he heard Pumbaa say that?

Li Gengxi: I will feel that this is the first time he has said something different from his usual. That feeling is quite complicated. There are new feelings about him, new feelings about himself, and the past and future of two people.

Lan Yu: I feel that I have more love in this world, and there is someone who really loves you.

Li Gengxi: Maybe love was not enough at that time, but I felt as if I had found a bosom friend.

Lan Yu: That’s very good. The director nodded frequently just now, and I feel that Geng Xi’s understanding of this character is actually very thorough.

Han Yan: Yes, because I think that feeling she just said, I’ve been thinking. For example, many people ask me why I always make such movies related to the theme of life. The birth of mankind itself is a great miracle. The chance of our parents meeting and combining and giving birth to us is one in four hundred trillion. These two people can still meet in this situation. In our play, it means that this is one in three hundred million. Therefore, the meeting of the two of them that night and the unpretentious dialogue, in my opinion, are quite moving feelings.

Peng Yuchang: In the wedding scene, the director really didn’t ask us so much, but let us finally follow our feelings.

Han Yan: It’s also the last scene. They have gone through all the processes of the whole movie.

Peng Yuchang: I just watched everyone, my mother and the teacher. When everyone was down there, I saw the director sitting at a table, as if I had accompanied Lu Tu and Ling Min through this journey in recent months. Tears welled up in my eyes, and I felt moved by that moment.

Han Yan: I said one thing that they didn’t know, that is, I hesitated all the time in the process of making this film. In the end, did he get married bald or grew a little hair? After his first haircut, I saw him show that scar. At that moment, I felt that I should show this scar to get married. We also gave Ling Min a close-up, and she didn’t wear cuff again. Those scars are a medal for them to overcome life, get rid of life’s predicament or get out of trouble.

Lan Yu: Pumbaa has a lot of courage. He dares to completely shave his head in this scene. But when I saw the real shave, Pumbaa still had some fluctuations in his heart. Geng Xi comforted him with special jokes, saying that you were more handsome after shaving, right?

Han Yan: It’s not a joke, it’s true.

Peng Yuchang: Actually, I’m a little scared. I’m really scared, but I think later, in fact, I’m right to be scared. Because Lu Tu said the second time, I don’t want to go into the operating room again. I don’t want to experience this life again. That fear is really the fear of facing hardships. Facing this life, the fear of this disease is right.

Lan Yu: They are really trying very hard to get close to this role and find their true feelings. Mr. Xu Fan, when you were working with them on the set, could you feel the seriousness and persistence of young actors in their performance?

Xu Fan: Yes, because I think they just tried their best to be immersed in the role. This is meaningful. I remember that when we filmed the scene of cooking, Pumbaa was very real. He was full and ate a lot after just one shot.

Peng Yuchang: I’ve been eating.

Xu Fan: But when the director said to do it again, he said to do it again? If I had known, I would have eaten less. At the beginning, he devoted himself to this role, so when I saw them both, I felt very vivid. These two children were so interesting, but they went to do theirs and I did mine. This is called separation between the old and the young.

Lan Yu: This movie is full of fireworks. It was shot in Changsha, which is a city that makes us feel very fireworks. Pumbaa’s Hunan Supu, did you ask any friends around you?

Peng Yuchang: Yes, I asked the teacher, and the group also prepared a language teacher for me.

Lan Yu: Have you got any secrets about Su Pu in Hunan?

Peng Yuchang: At first, I thought it was just a change in tone. After filming for about seven days, I was particularly impressed. Suddenly one day, the director said that you should stop talking like that. You can talk like this. That day, it was the first time that I realized that the pitch didn’t have to be raised so high, but it must be like Su Pu, and normal speech was also Su Pu.

Lan Yu: If you use Su Pu to describe the three people present, what would you say? First of all, describe mom.

Peng Yuchang: Here’s Ollie.

Lan Yu: Here it is from Ollie. What about the director?

Peng Yuchang: What the director said … was wrong.

Han Yan: It means a liar.

Peng Yuchang: Because he lied to me. That bald guy looks good.

Han Yan: I lied to you, but it’s not just bald. I lied to you a lot.

Lan Yu: I am happy to be fooled. Where is Geng Xi?

Peng Yuchang: It’s beautiful.

Lan Yu: This dialect is very important. It immediately established the life quality of this character, including Mr. Xu Fan, in which you also spoke dialect.

Xu Fan: Yes, because I’m from Hubei, and the plastic arts in Hubei are different from those in Hunan. What’s the ending in Hubei? This ending is different, and sometimes I’m particularly afraid of stringing, so I have to control myself from stringing at any time, because a string of Hunan people says it doesn’t look like it, and Hubei people will say it doesn’t look like it, so I have to control it as much as possible.

Blue feather: the waves behind the Yangtze River push the waves before. Geng Xi is a post-00 generation. It is very surprising for us to see her performance strength. Can you join such a movie? Will you have your own confused moments during the performance?

Li Gengxi: Every play is like a new beginning. Han Dao is very particular about details, so I can’t use my experience. Experience is the most worthless thing. You need to forget all these things, but you have to put yourself in that shell and be at the mercy of Han Dao. So this thing is a wonderful feeling.

Han Yan: You forgot that you sent me a message the other day. She said something to me at that time, which impressed me deeply. She said that I thought they were too difficult and I didn’t know how to help them. I also want to make myself a little less comfortable. This kind of touch or feeling can really make this character’s heart feel melted.

Li Gengxi: (with tears in his eyes)

Han Yan: Did you mention anything sad?

Li Gengxi: No, no, no.

Lan Yu: You suddenly recalled that feeling, didn’t you?

Li Gengxi: Yes, I just have to say how bad this whole thing is for me.

Han Yan: I want to explain to you that the two of them didn’t just suffer some flesh and blood when they played this role, because I always shoot this kind of drama myself. I know very well that every time I shoot this kind of movie, I shoot Fuck off! Tumor jun, whether filmed or filmed, is born and died once with the role. I am well aware of the pressure and struggle behind their performance.

Lan Yu: What kind of new understanding does director Han Yan have of life after filming the trilogy of life?

Han Yan: I have been particularly sensitive to birth, illness and death since I was a child. Later, I filmed these things by myself, which was a process of self-healing. Why did I keep filming? Because I have never been cured, that is, the medicine can’t stop. I think people will always have doubts about life when they are alive.

Lan Yu: "Shake the sun" reminds me of a picture, as if the feeling that the sun is shaking brighter and brighter is releasing more and more light. As long as we live hard and upward, we will be able to shake out the sunshine that belongs to our own life.

Han Yan: This is a movie with vitality and warmth.