LI’s revenue doubled in the first quarter and hit the delivery target of 30,000 vehicles in June, and the price reduction will not be considered for the time being.

In the industry environment where overspeed and stall occur frequently,It seems that it has always maintained its own rhythm.

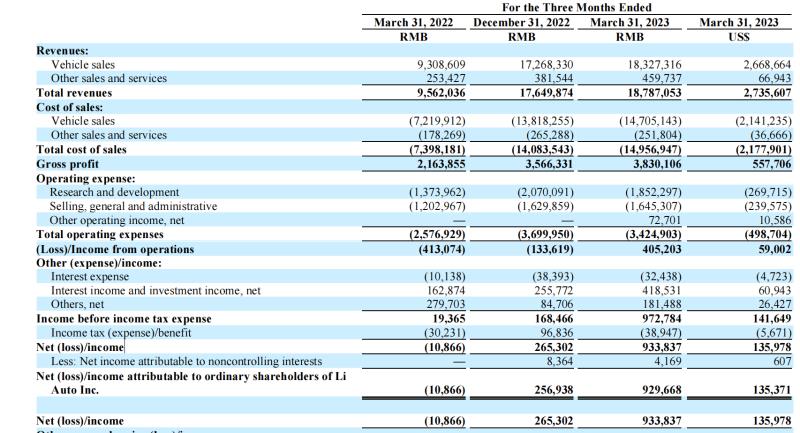

On May 10th, the published financial report for the first quarter of 2023 showed that it delivered 52,584 new cars during the period, up 65.8% year-on-year; Realized revenue of 18.79 billion yuan, a year-on-year increase of 96.5%; Operating profit and890 million yuan and 1.41 billion yuan respectively, grossAbout 20.4%, reaching the "healthy" threshold set by Chairman and CEO Li Xiang.

Based on the market feedback in the first quarter, the second quarterThe guideline gives a new high, and the delivery of new cars is expected to reach 76,000-81,000, up 164.9%-182.4% year-on-year; The total income is expected to be 24.22 billion-25.86 billion yuan, up 177.4%-196.1% year-on-year; Annual grossThe goal remains at 20%. At the first quarter performance meeting held on the same day, the management of LI also showed full confidence in the company’s development rhythm. Strive to deliver 30,000 vehicles in June, release pure electric vehicles in the fourth quarter, not consider price reduction for the time being, and adjust production capacity according to demand, which are the key words of management.

Maintain the gross profit margin target of 20% for the whole year.

Among the total revenue of 18.79 billion yuan in the first quarter, LI’s vehicle sales revenue was about 18.33 billion yuan, up 96.9% year-on-year and 6.1% quarter-on-quarter.

Li Tie, CFO of LI, said at the performance meeting that the year-on-year increase in vehicle sales revenue was mainly due to the increase in vehicle delivery and the increase in the average selling price contributed by the ideal L series models; The month-on-month increase in this revenue was mainly due to the increase in vehicle delivery, and at the same time, some of the increase in delivery was offset by the decrease in average selling price caused by the difference in product mix between the two quarters.

Main performance indicators of LI in the first quarter of 2023 (Source: EnterpriseScreenshot)

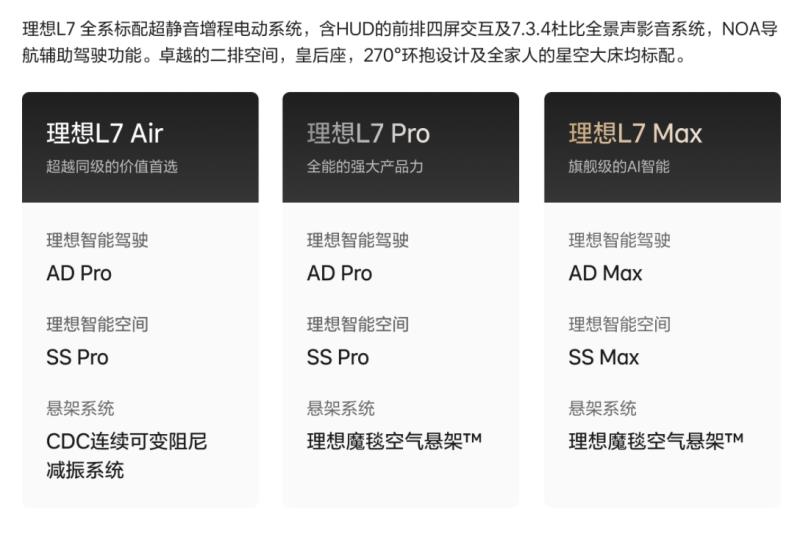

On February 8th this year, LI officially released the first five-seat product ideal L7, and launched the third model L7 Air; after L7 Pro and L7 Max on the same day. In addition, the L8 Air, the third model of the six-seat SUV, was also launched simultaneously. According to the official price published by LI, the national unified retail prices of L7 Air, L7 Pro and L7 Max are 319,800 yuan, 339,800 yuan and 379,800 yuan respectively, which are 20,000 yuan lower than the retail prices of ideal L8 models.

On March 11th, Ideal L7 was delivered. According to the data released by LI, the ideal retail volume of L7 terminals in March was 8,009, and the delivery volume in April exceeded 10,000.

The delivery of vehicles with relatively lower prices has increased, and its impact has also been fed back to the Maori side. In the first quarter of 2023, LI’s gross profit was 3.83 billion yuan, up 77.0% year-on-year and 7.4% quarter-on-quarter; The gross profit margin of bicycles was 19.8%, which was lower than 20.0% in the fourth quarter of 2022.

Among many new brands, LI has been at the forefront in cost control. Although nearly 50 stores have been expanded or optimized in LI since late June, 2022, the sales, general and management expenses in LI in the first quarter were basically the same, which remained at the level of 1.6 billion yuan, about 1.65 billion yuan. As of April 30th, LI has 302 retail centers, 318 after-sales maintenance centers and authorized car body panel repair and painting centers all over the country. In the first quarter, its research and development expenses dropped to 1.85 billion yuan.

"Overall, we are very confident about the steady increase in gross profit margin." Li Tie said, "In the first quarter, the sales in Li ONE reduced the overall gross profit margin of vehicles in the quarter by 1.6%. We expect to complete all the sales in Li ONE in the first half of the year, so we can basically eliminate the impact of this part. Regarding the profit margin climbing of ideal L7 and Air models, we think there is still room for improvement. However, considering that there are other potential factors, we still maintain the goal of 20% gross profit margin for the whole year. "

Before entering the pure electricity market, stabilize the market share.

Once the news that LI will launch pure electric vehicles was exposed, it quickly seized the hot spot of public opinion.

In Li Xiang’s view, the ultimate goal of pure electric vehicles is to replace fuel vehicles on a large scale, just like extended-range vehicles; To achieve this goal, the safety and convenience of energy acquisition are the basic conditions.

In 2023, LI indicated that it will invest heavily in the construction of the overcharge network, and plans to build 300 high-speed charging stations before the end of the year, covering.Yangtze River Delta, Greater Bay Area, Chengdu and Chongqing, and expand the number of charging stations to 3,000 by the end of 2025, covering 90% of the country’s high-speed mileage and major cities in the first, second and third tiers.

"We will not pass these costs on to consumers, so we will also let users buy the most competitive products in the same level at a cheaper price through effective R&D and supply chain layout." At the press conference, Li Xiang said that the layout of pure electricity sector was decided by LI after long-term planning and research. Therefore, the company has made sufficient preparations in R&D and supply chain.

"Our core goal is to make high-voltage pure electric vehicles have prices similar to those of extended-range vehicles, and obtain gross profit margins similar to those of extended-range vehicles, which is the embodiment of our healthy operation. This is based on the research and development of models and the layout of the supply chain that we started a long time ago. "

According to him, the first all-electric vehicle in LI will be released in the fourth quarter of 2023, and then delivery will begin, keeping the release rhythm similar to the ideal L7, L8 and L9.

Before entering the field of pure electricity to divide cakes, LI put more energy into steadily increasing the market share. "Our core goal in the second quarter is to increase the market share of the NEV market above 200,000 yuan in the first quarter from 11% to 13%." However, Li Xiang bluntly said that there is no plan to reduce the price in LI at present. "When we make detailed long-term planning and pricing, we have set the price at the most competitive price in the corresponding price range according to the level and size of each model, and there will be problems when the price floats up and down. This is the fundamental reason why we have been very cautious in pricing and insist on long-term consideration. "

Judging from the ideal L7 and L8 vehicle segmentation strategy, the successive appearance of Air, Pro and Max models also differentiated the same product on the basis of overall price reduction, providing more choices at the consumer end.

Ideal L7 three models configuration difference (Source: enterprise official website screenshot)

Li Xiang said that with the test drive of the Air model to the store, the order volume has indeed increased significantly, and the ideal L7 and L8 Air models have brought about a 20% increase. "According to the first-tier, new first-tier and second-tier cities, the new first-tier cities have the highest sales growth rate at present, because for the SUV market of more than 300,000, the new first-tier cities have real consumption.. In the long run, third-and fourth-tier cities are also the focus of LI’s future expansion, with a view to gaining more market share in these regions. "