In the year when the national service was absent, how did the Blizzard e-sports project develop?

Original maxiao people esports

Produced by | People’s E-sports

Author | Ma Xiao

Edit | Kevin

On April 11th, 2024, Blizzard Entertainment and Netease jointly announced an updated agreement to bring World of Warcraft, Hearthstone and other series of games based on their respective game universes of Warcraft, Watching Pioneer, Diablo and StarCraft back to China.

At this time, it has been more than a year since Blizzard went offline on January 24, 2023. In such a period of time when the e-sports industry is undergoing drastic changes, what is the development of Blizzard e-sports projects without national service participation?

Starcraft ii

On February 13th, 2023, China’s Li Peinan made history at the IEM Katowice Station, becoming the first player in the history of e-sports in China to win the World Championship of StarCraft II.

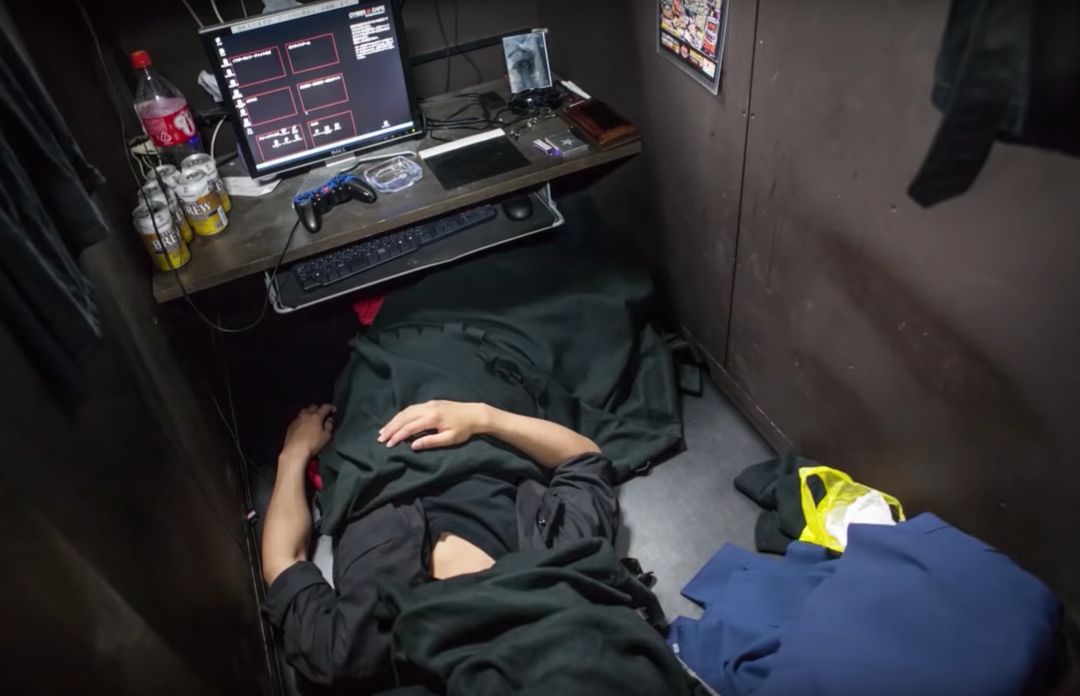

As an old hardcore e-sports project with a long history, the withdrawal of the national service has not brought much influence to the players and die-hard fans.

Li Peinan participated in WTL2022 Winter Tournament, WTL2023 Summer Tournament and ESL Masters 2023 Winter Tournament: Asia and WTL2023 Winter Tournament after Katowice Station in 2023. Excluding the $150,000 brought by the champion in Katowice, the frequency and bonus of other events are almost the same as that in 2022.

From a global point of view, according to the statistics of Esports Charts, the overseas viewing and total prize pool of StarCraft II e-sports in 2023 has remained at a stable level, showing the tenacious vitality of the old e-sports projects. It is no wonder that the Saudi E-sports World Cup announced early that StarCraft II was selected as one of the official events. The involvement of Saudi Arabia may also inject new development momentum into StarCraft II.

Watch the pioneer (2)

At the end of 2023, two-thirds of the Watch Pioneer League teams voted to terminate the agreement, and the Watch Pioneer League officially announced that it would stop operating.

Such a grand e-sports plan, which was once planned to spread all over major cities in the world and hold large-scale offline activities, rivaled NBA and NFL, once attracted hundreds of millions of funds from investors all over the world, and finally bid farewell to the historical stage, leaving each team with a severance fee of 6 million US dollars.

The peak ratings of the final OWL remained at 157,000, far less than the 397,000 in 2022. After Microsoft completed the acquisition of Activision Blizzard, the media reported that Activision Blizzard had fired more than 80% of its e-sports department employees, and the total number of employees in this department is only 12. And the various changes in the development process of Watch Pioneer 2 will not enhance people’s confidence in this project.

The only good news is that the peak ratings of Watch Pioneer World Cup in 2023 can still exceed 300,000, indicating that Watch Pioneer still has a certain audience in the global e-sports market.

After Blizzard decided to watch the Pioneer Championship Series (OWCS) as a tour, EFG, a third-party competition organization supported by Saudi Arabia, will be responsible for EMEA and North America, while WDG will be responsible for South Korea. In the post-Watch Pioneer League era, the grassroots community has regained the space for development.

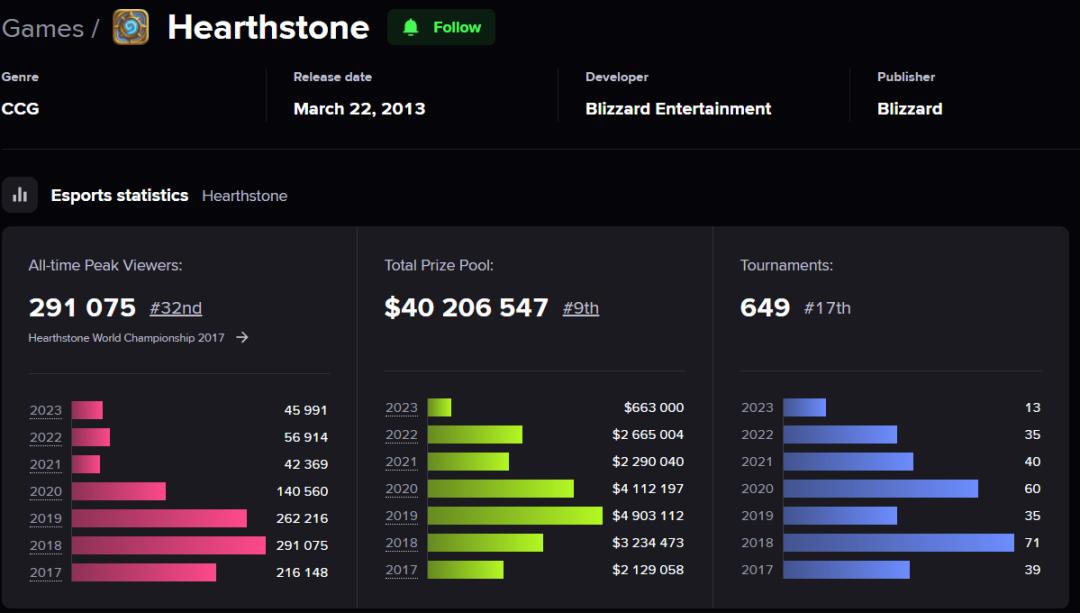

Hearthstone

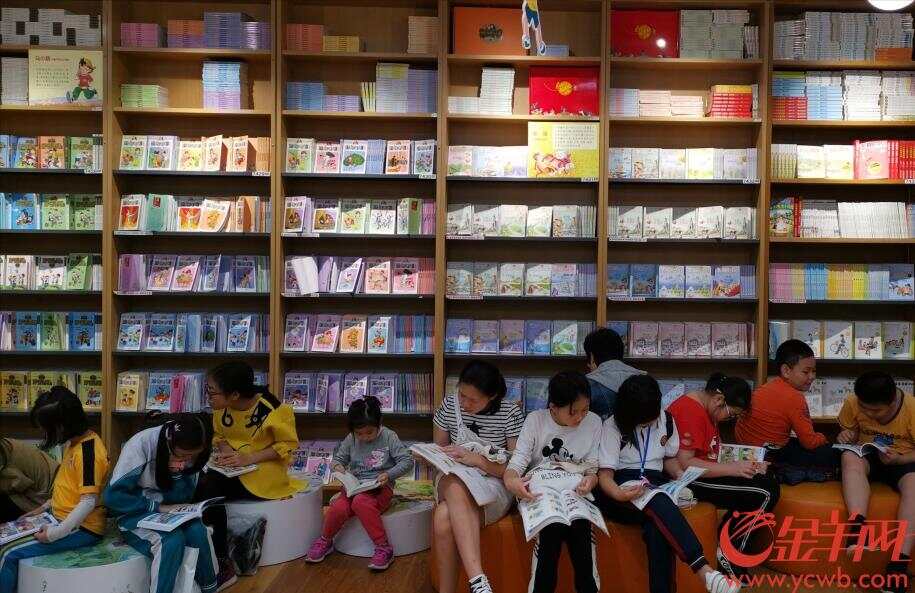

Hearthstone legend is an iconic card-type e-sports project. In the 2018 Asian Games in Jakarta, Hearthstone legend is an e-sports performance project. However, by the Asian Games held in Hangzhou in 2023, Hearthstone legend failed to become an official event.

The official website of Hearthstone Legend published the competition rules of Hearthstone 2023 on January 19th, and wrote in the FAQ under the bulletin board: "Players living in Chinese mainland will not be eligible to participate. After (Blizzard) establishes a new distribution partnership with Chinese mainland, the qualification of (players’ participation) may be reassessed. "

In the global arena, hearthstone legend has also entered a state of total atrophy. After three consecutive years of peak viewing of around 50,000, the bonus in 2023 has shrunk sharply to a quarter of that in 2022. It is no exaggeration to say that Hearthstone professional e-sports has reached the critical moment of life and death.

World of Warcraft

World of Warcraft may be the least "forced e-sports" project under Blizzard.

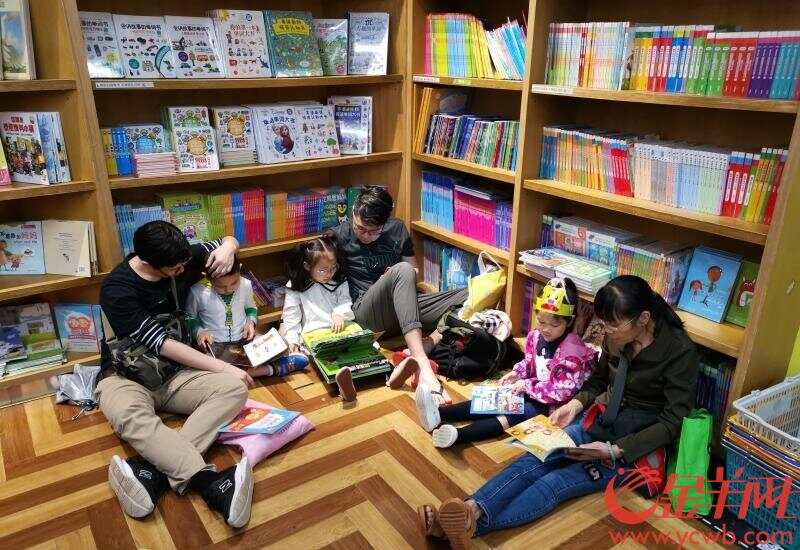

Thanks to a large number of players all over the world, this MMORPG game with a history of nearly 20 years is becoming the most surprising growth point of Blizzard’s e-sports content.

Whether it’s the first kill, the MDI Dungeon Race, or the hardcore flag-cutting competition, World of Warcraft e-sports developed rapidly in 2023, attracting more and more attention from anchors, clubs and players. According to the statistics of Esports Charts, in 2023, the peak viewing rate of the hardcore service Maggola death match exceeded 300,000, which was six times of the peak data of World of Warcraft in 2022, and it also set a record for the project.

It can be expected that, with numerous China players re-logging into the national costume, the prosperity of overseas World of Warcraft e-sports will inevitably arouse the interest of more players, anchors, clubs and platforms in China.

tag

As a game manufacturer that has had a great influence on the historical development of e-sports, China players have unique feelings for Blizzard.

However, in recent years, the sudden death of storm heroes, castles in the air watching pioneers, and numerous storms before and after the suspension of national service may all affect people’s confidence in Blizzard’s e-sports projects.

The return of the national costume is naturally a good thing for the majority of players. However, how much impact Blizzard e-sports has on the domestic e-sports market needs more observation.

You have news leads? Send an email with the title [clue] to esport@people.cn, and leave the rest to us.

Selected articles in previous issues

Continue to slide to see the next touch to read the original text.

People’s e-sports slide up to see the next one.

Original title: "In the year when the national service was absent, how did the Blizzard e-sports project develop? 》

Read the original text