Is Xiaomi a "technology" company after the disappearance of 600 billion yuan?

Yesterday, Xiaomi Group released its highly anticipated first-quarter performance report on the Hong Kong Stock Exchange.

The report, like a sharp knife, mercilessly reveals Xiaomi’s dilemma as a "technology" company:In addition to the profit growth and gross profit margin squeezed out by reducing various costs, almost all key indicators have declined at a high level.

The report shows that Xiaomi Group’s revenue in the first quarter of 2023 was only 594.77 billion yuan.It has decreased by an astonishing 18.9% year-on-year.

This means that compared with 733.52 billion yuan in the first quarter of 2022, Xiaomi Group’s revenue has shrunk by more than 13.8 billion yuan. If the time is longer, from the first quarter of 2021, Xiaomi camp will shrink by 30 billion yuan.

In other words,From nearly 90 billion in a single season to below 60 billion now, Xiaomi only took three years.

If we look at its profit source again, we will find Xiaomi’s embarrassment as a "technology" company:

Hardware business (mobile phone +IOT) profit: 400 million; The profit rate is 0.8%;

Mobile phone business profit:-200 million; Profit rate-0.6%;

IOT business profit: 600 million; The profit rate is 3.9%;

Internet business profit: 3.9 billion; The profit rate is 55.4%;

Did you find out?All the businesses add up to a fraction of the Internet business (mainly Internet finance).

In other words,Xiaomi constantly emphasized that "making mobile phones, we don’t make money" turned out to be true.

What’s even more frustrating is that,Even if the net profit of the mobile phone business is negative, the decline in Xiaomi shipments is greater than the decline in global smartphones.

The financial report shows that in the first quarter of this year, Xiaomi’s smartphone business revenue was 35 billion yuan, a year-on-year decrease of 23.6%.

Global smartphone shipments were 30.4 million units, a year-on-year decrease of 21.1%.

In terms of sales volume, in the first quarter of this year, Xiaomi’s global smartphone shipments were 30.4 million units, a year-on-year decrease of 21.1% compared with 38.5 million units in the same period last year.In other words, Xiaomi’s mobile phone shipments decreased by more than 8 million units year-on-year.

Specifically,Xiaomi’s "basic disk" mobile phone business is underperforming the broader market.

In addition, Canalys data also confirmed this view. In the first quarter of this year, global smartphone shipments decreased by 13.3% year-on-year, while Xiaomi decreased by 21.1% year-on-year.

Then, Xiaomi, the once great ship, is facing a violent swing, which inevitably makes people think:In this fickle business world, can it maintain its former glory?

01

When Huawei was in trouble, Lei Jun said that the task of impacting high-end was "I will come"!

Three years have passed, what’s the situation?

Objectively speaking, the customer unit price of Xiaomi has actually improved year-on-year, but compared with the previous month,The same configuration, the price is still "the lowest".

According to the financial report data, the average shipment price of Xiaomi smartphones in the first quarter was 1,151 yuan, which means that Xiaomi’s smartphone business is still dominated by thousand yuan machines, or the background color of thousand yuan machines.

What is more pessimistic is that in the same period last year, the average shipping price of Xiaomi mobile phone was 1189 yuan, which means that this year, the average shipping price has also dropped.It decreased by 3.2%.

The gross profit margin of other sectors is not high, for example, the gross profit margin of IoT and consumer products is 14.3%, and the overall gross profit margin is only 16.8%.

To sum up,We will find that Xiaomi is shouting "high-end" on the surface, but the actual operation is still "price war".

"Cost-effective" is firmly engraved in Xiaomi’s gene. On the basis of such brand tonality, "high-end" seems to be a strange circle.

In fact, whether a mobile phone can be called "high-end" is not just a matter of piling up hardware and building a cost-effective ratio, but a matter of "comparison".

Imagine that when consumers have experienced the high-end mobile phones of Apple, Samsung and Huawei, the operation is silky, the display is exquisite and the ecology is complete, then let them return to a relatively "cottage" experience, especially after the endless advertising pop-ups and inexplicably installed apps. Is it possible?

This is also the fundamental reason why Xiaomi’s "high-end" has entered a strange circle, consumers do not recognize it, and the capital market also expresses doubts.

02

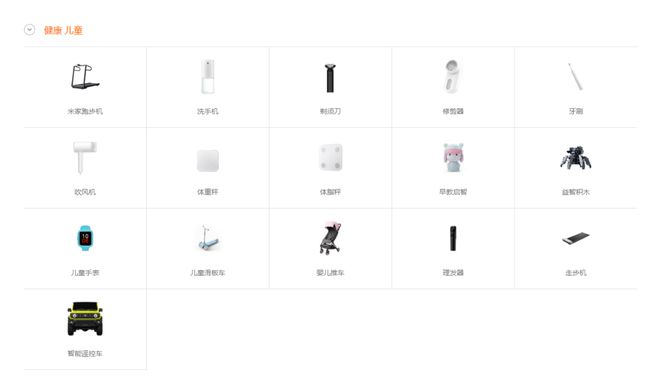

In addition, the ecological chain created by Xiaomi has fallen into a bottleneck, which is also a microcosm of China brand’s pursuit of "big and complete".

Xiaomi’s eco-chain business is one of the core competitiveness of Xiaomi Group. Since Xiaomi went public in 2018, it must be mentioned at every conference. At present, Xiaomi has invested in more than 320 IoT eco-chain enterprises.

In addition, the richness of Xiaomi’s IoT and consumer products is eye-opening, except for digital home appliances, even pillows, towels and curtains have been covered.

From this, we can also find that Xiaomi is indeed a very complicated brand. It started with mobile phones. On the one hand, it is not like Apple and Huawei’s "unique skills" in scientific research and innovation on chips and systems; Unlike Samsung, it has "unique skills" in hardware; It’s even less like ov ploughing channels. ……

It is more like a platform, a left-handed supply chain, a right-handed consumer, and then it is filled with "small loan advertisements".

From mobile phones to patch panels, from bags to toothbrushes, from Valentine’s Day gifts to children’s toys. …..

However, it must be said that this "big and complete" business model is entering a bottleneck. Xiaomi’s financial report in the third quarter of last year showed that the revenue of IoT and consumer products business representing Xiaomi’s ecological chain fell by 9% year-on-year.

In fact, the fatigue of Xiaomi’s ecological chain has already appeared. On the one hand, in 2017, the revenue growth rate of Xiaomi’s IoT and consumer goods reached 80%.But in 2020, the growth rate of this business has dropped to 8.6%..

On the other hand,Xiaomi investment enterprises are declining in both quantity and quality.

The most important thing is that more and more Xiaomi eco-chain enterprises are trying to get rid of the influence of Xiaomi, create their own brands and improve profit margins.

This situation is still caused by the cost performance.

Xiaomi Group quickly built a complete ecological chain for itself through "investment+incubation", but at the same time, it was too "cost-effective", which led to the rapid growth of incubating enterprises and low gross profit margin.

Many Xiaomi’s supply chain enterprises laugh at themselves, earning "hard money" and choosing "solo flight", such as:

Cooperate with Xiaomi to move the purple rice of power supply and launch its own brand ZMI;; Roborock launched its own brand product S5 series of stone sweeping robot.

In this context, it is an inevitable choice for enterprises supported by Xiaomi to "millet".This has led Xiaomi to build its own supply chain or choose to support more "weak" enterprises.

This has led to the decline of the eco-chain business in the context of Xiaomi’s pursuit of "cost performance".

03

In addition, compared with Lei Jun’s high-spirited expression, "I will put all my reputation in life and personally lead the team to develop and manufacture Xiaomi cars."

Two years have passed, and there is no news about Xiaomi’s auto business.

However, it must be mentioned that the increase in R&D expenses of Xiaomi in the first quarter was mainly due to the increase in R&D expenses related to innovative businesses such as smart cars.The specific data is that the company’s innovative business expenses such as automobiles reached 1.1 billion yuan.

In addition, Wang Xiang, the president of the group, also revealed that Xiaomi’s total investment in building cars reached 1.865 billion yuan, of which the expenditure on innovative business such as smart cars reached 829 million yuan in the third quarter.

Investing a lot of money has created a huge amount of "gimmicks", which has attracted a lot of attention. At present, no results have been seen, which is obviously "playing big".

It is no small harm to Xiaomi’s own morale, consumer confidence and investors’ expectations.

In summary

We will find that although Xiaomi emphasizes "high-end" and "overtaking in corners" more and more, it seems to be more and more addicted to "cost performance". In the pursuit of large and comprehensive scale effect, the stall is getting bigger and bigger, and the business is becoming more and more diversified, but it is also increasingly unclear about the direction. ……

This also led to the bottleneck of Xiaomi’s business. Investors voted with their feet and fell into the embarrassing situation of being ridiculed by rice noodles as "a camera blows for one year".

In fact, consumers don’t want much, unique experience and persistent brand trust, which are real hard work and need time to verify.

Of course, Xiaomi’s story is not over yet, and suspense still exists. How to deal with the increasingly cruel market competition and how Xiaomi will rise will become the focus of the future.

Although Xiaomi said that he wants to lay out the "AI ecology", is this a "hot spot" or a "real investment"? At present, we still need bullets to fly for a while.

However, I still hope that Xiaomi can focus on its main business, adhere to everything in order to "enhance the consumer experience" and make Xiaomi mobile phone a business card made in China. Only in this way can it be stable and far-reaching.