In 2016, faced with the grim situation of increasing downward pressure on the economy, the provincial party committee and the provincial government led the people of the province to conscientiously implement the decision-making arrangements of the CPC Central Committee and the State Council, fully implement the new development concept, adhere to the general tone of striving for progress while maintaining stability, unswervingly promote structural reforms on the supply side, and make overall plans for stabilizing growth, promoting reform, restructuring, benefiting people’s livelihood and preventing risks. The province’s economic operation maintained a generally stable, steady and progressive development trend.

First, integration

According to preliminary accounting, the GDP of the whole province was 3,124.47 billion yuan, up by 7.9% over the previous year. Among them, the added value of the primary industry was 357.84 billion yuan, an increase of 3.3%; The added value of the secondary industry was 1,318.10 billion yuan, up by 6.6%; The added value of the tertiary industry was 1,448.53 billion yuan, an increase of 10.5%. According to the resident population, the per capita GDP was 45,931 yuan, an increase of 7.3%.

The tertiary industrial structure of the province is 11.5∶42.2∶46.3. The service industry above designated size realized an operating income of 257.72 billion yuan, an increase of 18.3% over the previous year; The total profit was 24.35 billion yuan, an increase of 12.1%. The proportion of tertiary industry increased by 2.1 percentage points over the previous year; The industrial added value accounted for 35.8% of the regional GDP, down 2.1 percentage points from the previous year; The added value of high-tech industries accounted for 22.0% of the regional GDP, an increase of 0.8 percentage points over the previous year; The added value of the non-public sector of the economy was 1,873.99 billion yuan, up by 8.7%, accounting for 60.0% of the regional GDP, up by 0.4 percentage points over the previous year; The added value of strategic emerging industries was 349.92 billion yuan, up 9.4%, accounting for 11.2% of the regional GDP. The contribution rates of primary, secondary and tertiary industries to economic growth were 4.8%, 37.0% and 58.2% respectively, and the contribution rate of tertiary industry increased by 4.3 percentage points over the previous year. Among them, the contribution rate of industrial added value to economic growth is 31.6%, and that of producer services is 20.0%. The contribution rates of total capital formation, final consumption expenditure and net outflow of goods and services to economic growth are 49.5%, 52.7% and -2.2% respectively.

In terms of regions, the GDP of Changsha, Zhuzhou and Xiangtan was 1,368.19 billion yuan, an increase of 9.0% over the previous year; The GDP of southern Hunan was 660.96 billion yuan, an increase of 8.0%; The GDP of western Hunan was 534.56 billion yuan, an increase of 7.8%. The GDP of Dongting Lake area was 754.06 billion yuan, an increase of 7.8%.

Second, the agricultural industry

In the primary industry, the added value of agriculture reached 227.66 billion yuan, an increase of 3.6% over the previous year; The added value of forestry was 23.78 billion yuan, an increase of 8.2%; The added value of animal husbandry was 80.54 billion yuan, down by 0.1%; The added value of fishery was 25.86 billion yuan, up by 6.5%.

The province’s grain planting area was 4.891 million hectares, down 1.1% from the previous year; The cotton planting area was 104,000 hectares, down by 8.9%; The planting area of sugar was 13,000 hectares, an increase of 1.1%; The oil planting area was 1.438 million hectares, down by 0.5%; The vegetable planting area was 1.42 million hectares, an increase of 3.5%.

The province’s total grain output was 29.531 million tons, a decrease of 1.7% over the previous year; Compared with the previous year, oil crops decreased by 15.2% for cotton, 2.5% for flue-cured tobacco, 5.9% for tea, 5.0% for vegetables, 2.6% for pigs, cattle and mutton, 4.1% for milk, 4.0% for aquatic products and 3.2% for eggs.

The effective irrigated area of newly-increased farmland was 28,000 hectares, an increase of 37.0% over the previous year; The newly added water-saving irrigation area is 19,000 hectares; 75,000 water conservancy projects were started, with an investment of 29.20 billion yuan, and 1.06 billion cubic meters of earth and stone were completed. Upgrading and transforming rural roads by 10,588 kilometers.

III. Industry and Construction Industry

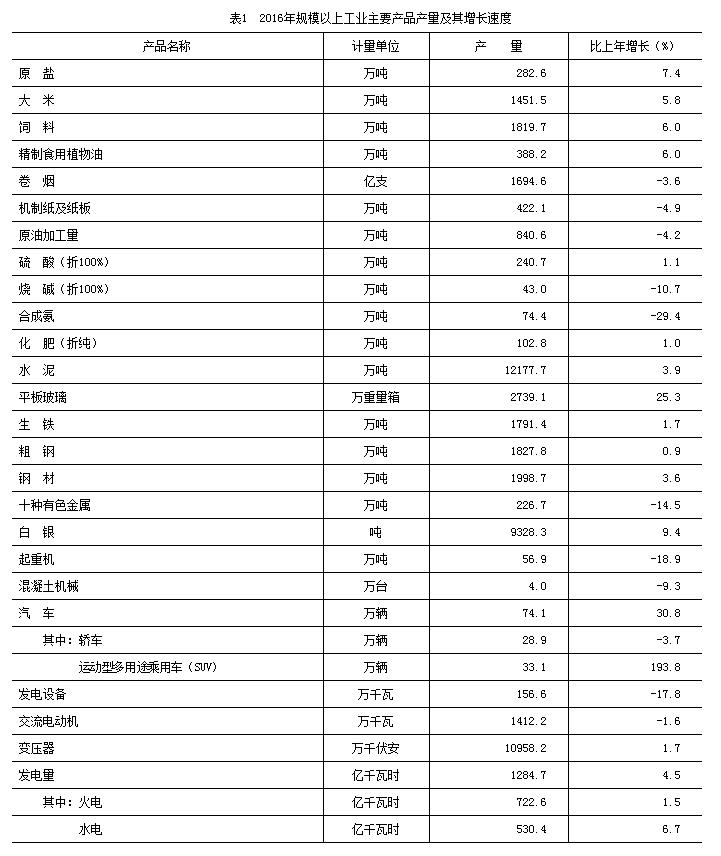

The total industrial added value of the province was 1,117.73 billion yuan, an increase of 6.6% over the previous year. Among them, the added value of industrial enterprises above designated size increased by 6.9%. Among the above-scale industries, the added value of non-public enterprises increased by 8.7%, accounting for 77.0% of the above-scale industries, an increase of 1.4 percentage points over the previous year. The added value of high-processing industries and high-tech manufacturing industries increased by 10.6% and 11.4% respectively; The proportion of industrial added value above designated size was 38.0% and 11.2%, respectively, 0.8 and 0.7 percentage points higher than the previous year. The industrial added value of provincial and above industrial parks increased by 9.4%, accounting for 65.7% of industries above designated size, up by 4.2 percentage points over the previous year. The added value of the six high energy-consuming industries increased by 5.1%, accounting for 30.6% of the industries above designated size, an increase of 0.3 percentage points over the previous year. Regionally, Changsha-Zhuzhou-Xiangtan region grew by 7.3%, southern Hunan region by 6.6%, greater western Hunan region by 6.4% and Dongting Lake region by 6.6%.

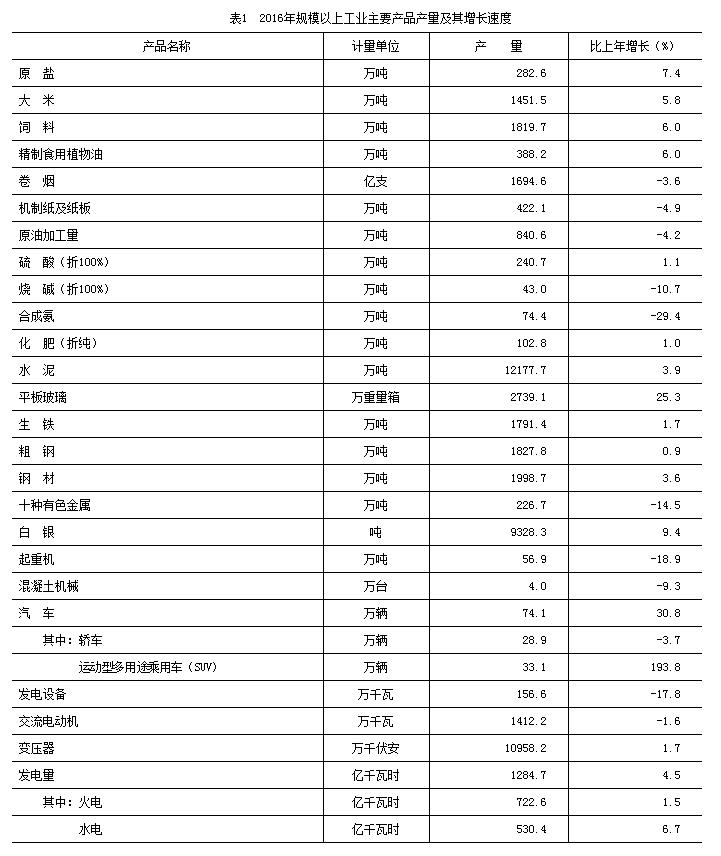

Among the products of industrial statistics above designated size in the province, the output of 58.8% products increased over the previous year. Among the main products, rice was 14.515 million tons, an increase of 5.8%; Feed was 18.197 million tons, an increase of 6.0%; The processing volume of crude oil was 8.406 million tons, down by 4.2%; 121.777 million tons of cement, an increase of 3.9%; 19.987 million tons of steel, an increase of 3.6%; Ten kinds of non-ferrous metals were 2.267 million tons, down 14.5%; 40,000 sets of concrete machinery, down 9.3%; 741,000 cars, an increase of 30.8%; The power generation was 128.47 billion kWh, an increase of 4.5%.

Industrial enterprises above designated size realized a total profit of 162.05 billion yuan, an increase of 4.5% over the previous year. In terms of economic types, state-owned enterprises amounted to 11.37 billion yuan, down by 12.6%; 890 million yuan for collective enterprises, down by 12.8%; 170 million yuan for joint-stock cooperative enterprises, down by 50.7%; Joint-stock enterprises reached 124.94 billion yuan, up by 6.0%; Foreign investors and Hong Kong, Macao and Taiwan businessmen invested 14.11 billion yuan, an increase of 12.8%; Other domestic-funded enterprises reached 10.57 billion yuan, an increase of 2.2%. Among the top five industries with total profits, nonmetallic mineral products industry was 14.81 billion yuan, up by 10.7%; Chemical raw materials and chemical products manufacturing industry was 13.24 billion yuan, down 5.1%; Agricultural and sideline food processing industry was 12.72 billion yuan, an increase of 2.1%; The tobacco products industry was 9.04 billion yuan, down by 19.5%; The computer, communication and other electronic equipment manufacturing industry was 9 billion yuan, an increase of 20.3%.

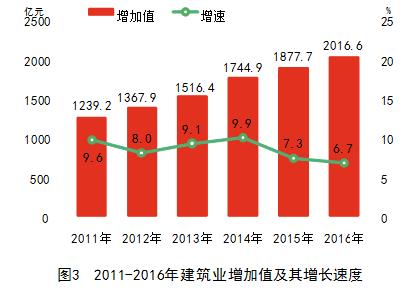

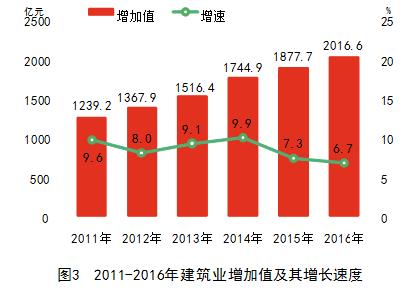

The added value of the province’s construction industry was 201.66 billion yuan, an increase of 6.7% over the previous year. General contracting and professional contracting construction enterprises with qualification grade realized a total profit of 23.96 billion yuan, an increase of 6.8%. The building construction area was 503.275 million square meters, an increase of 5.9%. The completed building area was 186.292 million square meters, an increase of 7.1%.

IV. Investment in fixed assets

The province’s investment in fixed assets (excluding farmers) was 2,768.85 billion yuan, an increase of 13.8% over the previous year. Among them, private investment was 1,638.13 billion yuan, an increase of 3.8%, accounting for 59.2% of the total investment. In terms of economic types, state-owned investment was 925.35 billion yuan, an increase of 23.9%; Non-state-owned investment was 1,843.49 billion yuan, up by 9.4%. In terms of investment direction, people’s livelihood investment was 267.46 billion yuan, an increase of 46.4%; Ecological investment was 124.67 billion yuan, an increase of 29.3%; Infrastructure investment was 734.99 billion yuan, an increase of 26.2%; Investment in high-tech industries was 177.44 billion yuan, an increase of 19.7%; The investment in technological transformation was 719.60 billion yuan, down by 0.1%; The investment in strategic emerging industries was 639.60 billion yuan, up by 17.5%. In terms of regions, the Changsha-Zhuzhou-Xiangtan region was 1,097.74 billion yuan, an increase of 13.9%; 626.26 billion yuan in southern Hunan, an increase of 14.0%; 459.86 billion yuan in western Hunan, an increase of 14.1%; Dongting Lake area was 564 billion yuan, an increase of 14.5%.

There are 49,962 construction projects in the province, an increase of 4.8% over the previous year. Among them, 40,912 new projects were started this year, an increase of 4.3%. This year, 33,375 projects were put into production, down 5.8%.

The province’s investment in real estate development was 295.70 billion yuan, up 13.1% over the previous year. Among them, residential investment was 187.13 billion yuan, an increase of 3.8%. The sales area of commercial housing was 80.854 million square meters, an increase of 27.1%. Among them, the residential sales area was 71.907 million square meters, an increase of 26.8%. The sales volume of commercial housing was 375.19 billion yuan, up by 37.0%. Among them, residential sales reached 311.36 billion yuan, an increase of 38.1%. At the end of the year, the area of commercial housing for sale was 29.015 million square meters, down 12.3%, down 4.081 million square meters from the end of the previous year.

V. Domestic trade and prices

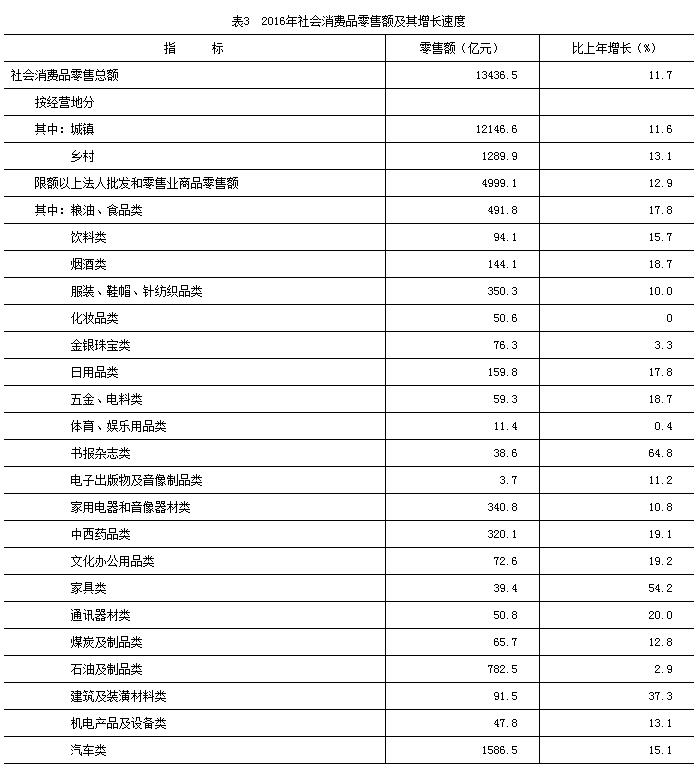

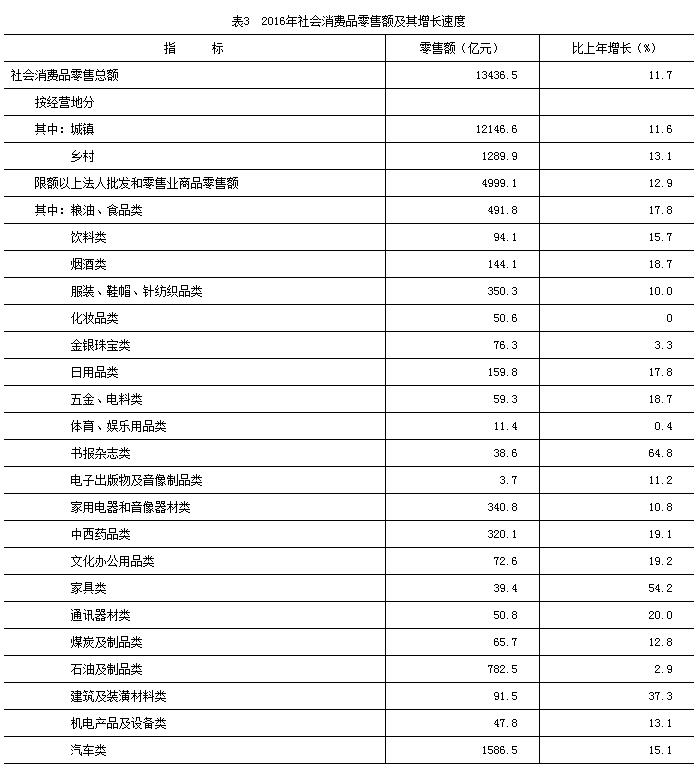

The total retail sales of social consumer goods in the province was 1,343.65 billion yuan, an increase of 11.7% over the previous year. In terms of business locations, urban areas were 1,214.66 billion yuan, an increase of 11.6%; 128.99 billion yuan in rural areas, an increase of 13.1%. In terms of regions, the Changsha-Zhuzhou-Xiangtan region was 563.83 billion yuan, an increase of 11.6%; 262.30 billion yuan in southern Hunan, an increase of 11.8%; 233.31 billion yuan in western Hunan, an increase of 11.8%; Dongting Lake area was 284.22 billion yuan, an increase of 11.9%.

The retail sales of wholesale and retail commodities of legal persons above designated size reached 499.91 billion yuan, up by 12.9% over the previous year. Among them, the retail sales of culture, entertainment, sports and health increased by 21.4%. By commodity category, the retail sales of grain, oil and food increased by 17.8%, books, newspapers and magazines by 64.8%, household appliances and audio-visual equipment by 10.8%, cultural office supplies by 19.2%, communication equipment by 20.0%, building and decoration materials by 37.3% and automobiles by 15.1%.

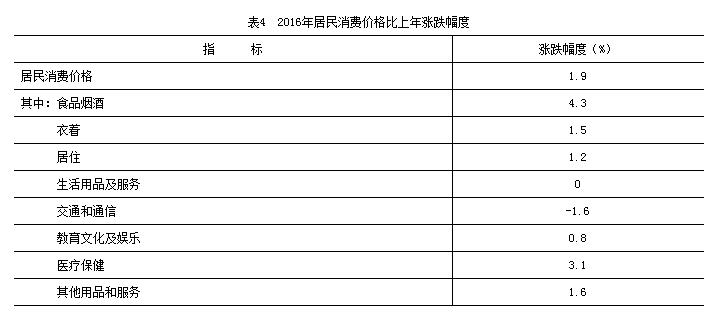

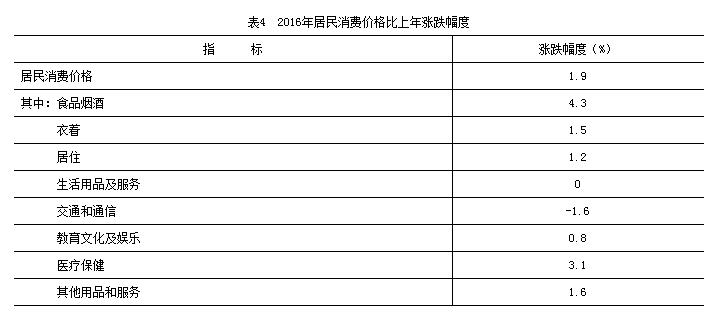

Consumer prices in the province increased by 1.9% over the previous year. Among them, cities rose by 1.9% and rural areas rose by 1.9%. The retail price of commodities rose by 1.0%. The ex-factory price of industrial producers fell by 1.1%, and the purchase price of industrial producers fell by 2.0%. The investment price of fixed assets rose by 0.4%. Producer prices of agricultural products rose by 4.7%, and prices of agricultural means of production rose by 1.7%.

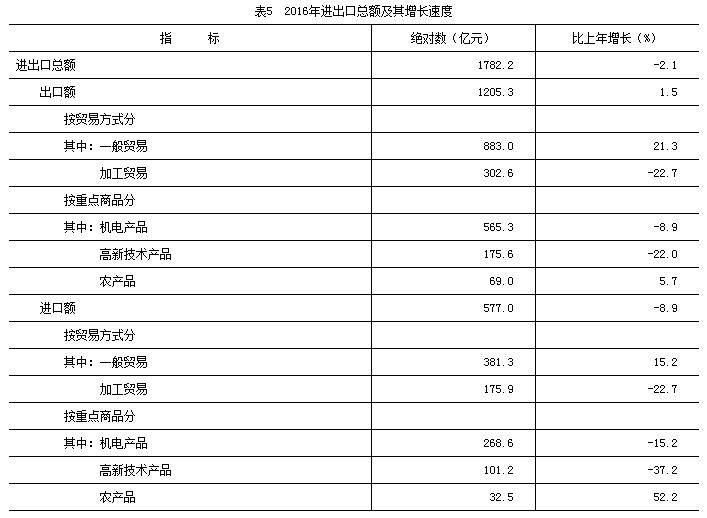

VI. Foreign Economy

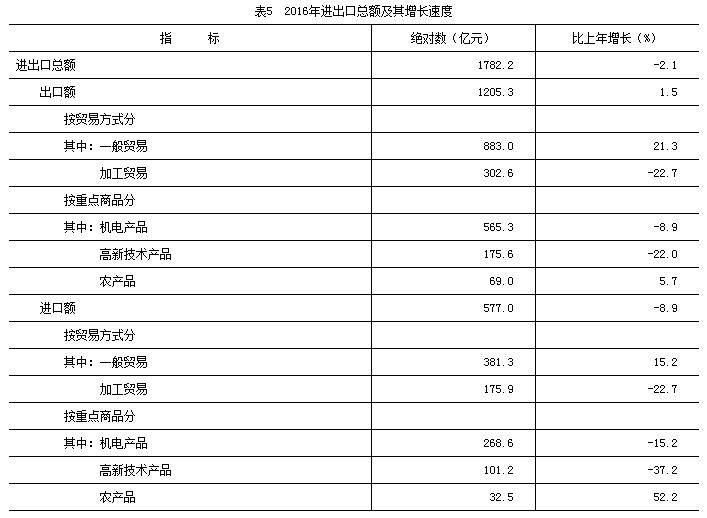

The total import and export volume of the province was 178.22 billion yuan, down 2.1% from the previous year. Among them, the export was 120.53 billion yuan, up by 1.5%; Imports reached 57.70 billion yuan, down 8.9%. In terms of trade modes, general trade exports reached 88.30 billion yuan, up by 21.3%; The export of processing trade was 30.26 billion yuan, down by 22.7%. In terms of commodity categories, the export of clothing and clothing accessories was 7.66 billion yuan, an increase of 51.6%; Steel was 4.95 billion yuan, down 18.0%; Metallic silver was 3.97 billion yuan, down 5.9%; Household ceramics reached 2.38 billion yuan, up 5.6%. In terms of production and sales countries (regions), the export to Hong Kong was 30.73 billion yuan, down by 7.5%; US$ 17.43 billion, an increase of 26.5%; EU 15.51 billion yuan, an increase of 40.0%; Japan reached 2.80 billion yuan, up by 11.5%.

The actual utilization of foreign direct investment in the province was 12.85 billion US dollars, an increase of 11.1% over the previous year. Among them, the primary industry was 620 million US dollars, down by 0.4%; The secondary industry was US$ 6.86 billion, down by 4.0%; The tertiary industry reached US$ 5.37 billion, an increase of 41.5%. 10 foreign-funded projects with actually paid-in funds of more than 30 million US dollars. At the end of the year, 140 Fortune 500 enterprises invested in Hunan, and 2 new enterprises were introduced during the year. The actual introduction of domestic and foreign funds was 436.18 billion yuan, an increase of 15.0%. Among them, the primary industry was 29.04 billion yuan, an increase of 50.4%; The secondary industry was 220.40 billion yuan, an increase of 5.9%; The tertiary industry was 186.73 billion yuan, an increase of 23.1%. 424 domestic and foreign projects with a total investment of over 200 million yuan were introduced, an increase of 22.9%; The actually paid-in capital was 156.33 billion yuan, an increase of 21.3%.

The newly signed contracts for foreign contracted projects, labor cooperation and design consultation in the province amounted to 6.6 billion US dollars, an increase of 11.6% over the previous year; Realized a turnover of 6.31 billion US dollars, an increase of 22.0%; 96,000 laborers were sent abroad, an increase of 17.8%. The foreign contracted investment was US$ 4.70 billion, an increase of 51.7%. Among them, China’s contracted investment was US$ 3.35 billion, up by 20.6%. The actual foreign investment was US$ 1.65 billion, up by 11.5%.

VII. Transportation, Posts and Telecommunications and Tourism

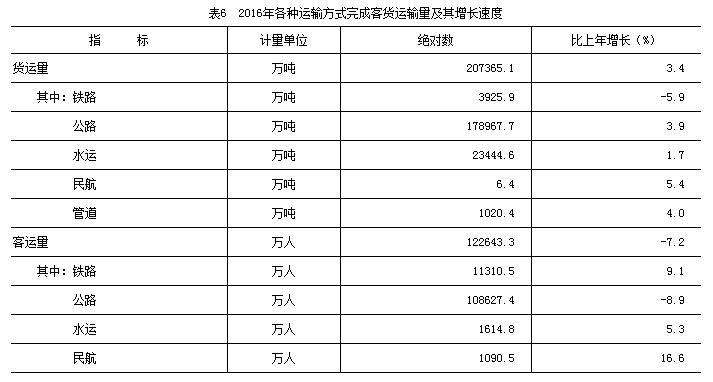

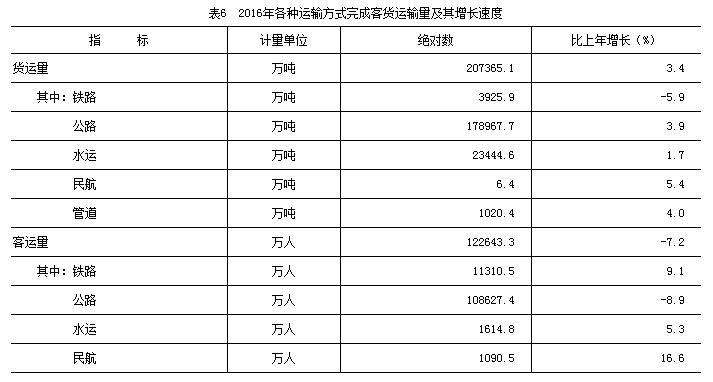

The conversion turnover of passenger and cargo transportation in the province was 505.25 billion tons kilometers, an increase of 4.1% over the previous year. The turnover of goods was 405.68 billion tons kilometers, up by 4.0%. Among them, the railway turnover was 73.5 billion tons-kilometers, down by 2.1%; The highway turnover was 268.66 billion tons kilometers, up by 5.2%. Passenger turnover was 166.93 billion person-kilometers, an increase of 1.1%. Among them, the railway turnover was 92.44 billion person-kilometers, an increase of 5.0%; Highway turnover was 57.70 billion person-kilometers, down by 9.2%; The turnover of civil aviation was 16.47 billion person-kilometers, an increase of 24.5%.

At the end of the year, the province’s highway mileage was 238,000 kilometers, an increase of 0.6% over the end of the previous year. Among them, the expressway mileage is 6080 kilometers, an increase of 428 kilometers over the end of last year. At the end of the year, the operating mileage of railways was 4,716 kilometers, including 1,374 kilometers of high-speed railways. At the end of the year, the number of civilian vehicles in the province was 6.03 million, an increase of 16.7%; The number of private cars was 5.511 million, an increase of 18.2%; The number of cars was 3.281 million, an increase of 18.4%.

The total post and telecommunications business in the province was 134.79 billion yuan, an increase of 50.8% over the previous year. Among them, the total postal business was 14.34 billion yuan, an increase of 37.7%; The total telecommunications business was 120.45 billion yuan, an increase of 52.6%. At the end of the year, there were 6.827 million fixed telephone users, down by 13.3%; There were 49.091 million mobile phone users, an increase of 1.0%. By the end of the year, there were 10.442 million Internet broadband users, an increase of 17.4%.

There were 560 million domestic tourists in the province, an increase of 19.5% over the previous year; The number of inbound tourists was 2.408 million, up by 6.5%. The total tourism revenue was 470.74 billion yuan, up by 26.8%. Among them, domestic tourism revenue was 464.07 billion yuan, an increase of 26.8%; International tourism revenue was $1.01 billion, up by 17.1%.

VIII. Finance, Finance and Insurance

The province’s general public budget revenue was 425.21 billion yuan, up 6.0% over the previous year, of which local revenue was 269.79 billion yuan, up 7.3%. Among local revenues, tax revenue was 155.13 billion yuan, an increase of 1.6%; Non-tax revenue was 114.66 billion yuan, an increase of 16.1%. The central government’s "two taxes" were 114.22 billion yuan, basically the same as the previous year; The central income tax was 37.11 billion yuan, an increase of 6.7%. The province’s general public budget expenditure was 633.70 billion yuan, an increase of 10.6%. Among them, social security and employment expenditure was 88.24 billion yuan, an increase of 13.2%; Expenditure on urban and rural community affairs was 68.38 billion yuan, an increase of 24.0%; Expenditure on culture, sports and media was 15.50 billion yuan, an increase of 38.7%; Expenditure on poverty alleviation was 9.06 billion yuan, up 1.4 times.

At the end of the year, the balance of local and foreign currency deposits of financial institutions in the province was 4,199.67 billion yuan, an increase of 15.9% over the end of the previous year. Among them, the balance of household deposits was 2,124.21 billion yuan, an increase of 13.0%; The balance of deposits of non-financial enterprises was 1,228.09 billion yuan, an increase of 24.6%. The balance of local and foreign currency loans was 2,753.23 billion yuan, up by 13.7%. Among them, the balance of household loans was 912.43 billion yuan, an increase of 17.2%; The loan balance of non-financial enterprises and government organizations was 1,834.23 billion yuan, an increase of 12.3%.

At the end of the year, there were 104 listed companies in the province, and 5 companies were added during the year. Among them, there are 88 domestic listed companies and 16 overseas listed companies. The total direct financing for the whole year was 314.71 billion yuan, an increase of 27.6% over the previous year. Among them, a total of 22.16 billion yuan was raised through issuing and placing shares. At the end of the year, there were 349 business departments of securities companies, with a securities transaction volume of 6,922.60 billion yuan. At the end of the year, there were 3 futures companies in the jurisdiction, with a turnover of 2,077.70 billion yuan.

In the whole year, the original insurance premium income of insurance companies was 88.65 billion yuan, an increase of 24.5% over the previous year. Among them, life insurance premium income was 49.58 billion yuan, an increase of 27.4%; Health insurance premium income was 9.54 billion yuan, an increase of 59.0%; Personal accident insurance premium income was 2.23 billion yuan, an increase of 12.6%; Property insurance premium income was 27.31 billion yuan, up by 12.3%. The original insurance payment expenditure was 34 billion yuan, an increase of 32.2%.

IX. Education, Science and Technology

At the end of the year, there were 108 colleges and universities in the province. There are 19,000 graduates of general higher education, 317,000 graduates of junior college, 200,000 graduates of secondary vocational education, 342,000 graduates of ordinary high schools, 740,000 graduates of junior high schools and 770,000 graduates of ordinary primary schools. There were 2.249 million children in the park, an increase of 3.8% over the previous year. The enrollment rate of primary school-age children is 99.99%, and the gross enrollment rate of high school education is 90.6%. There are 12,702 private schools with 2.665 million students. 900 million yuan of national scholarships and grants were granted to colleges and universities, and 513,000 college students were assisted. Issued 370 million yuan of state grants for secondary vocational schools and subsidized 335,000 secondary vocational students; We implemented 1.37 billion yuan of tuition-free funds for secondary vocational schools and subsidized 970,000 secondary vocational students. We implemented 8.61 billion yuan of compulsory education guarantee funds and distributed 430 million yuan of state grants to ordinary senior high schools.

At the end of the year, there were 4 national engineering research centers and 67 provincial engineering research centers in the province. There are 15 national (national and local joint) engineering research centers and 32 national (national and local joint) engineering laboratories. There are 45 enterprise technology centers recognized by the state. There are 14 national engineering technology research centers and 243 provincial engineering technology research centers. There are 16 national key laboratories and 164 provincial key laboratories. 3976 technical contracts were signed, with a turnover of 10.56 billion yuan. 694 scientific and technological achievements were registered. Won 11 national scientific and technological progress awards, 2 national technological invention awards and 1 national natural science award. The average yield per mu of super hybrid rice is 1088 kg, which is the highest in the world. A number of high-tech products, such as the first train loaded with permanent magnet traction system in China, have been developed, and a new breakthrough has been achieved in islet xenotransplantation technology. The number of patent applications was 67,779, an increase of 24.4% over the previous year. Among them, the number of invention patent applications was 25,524, an increase of 30.9%. The number of patents granted was 34,050, down by 0.1%. Among them, 6,967 invention patents were granted, an increase of 2.8%. The number of patent applications from industrial and mining enterprises, universities and scientific research institutions was 32,343, 11,973 and 783 respectively, and the number of patents granted was 16,723, 5,881 and 369 respectively. The added value of high-tech industries was 685.92 billion yuan, up by 16.0%.

At the end of the year, there were 1665 inspection and testing institutions in the province, including 23 national product quality supervision and inspection centers. There are 103 legal metrological verification institutions. There are 1,685 production units of special equipment and 274,000 sets of special equipment. 5,485 batches of key industrial products were randomly selected for quality supervision, with a pass rate of 95.1%, an increase of 1.7 percentage points over the previous year. Participated in the formulation of 21 international standards, 27 national standards and 245 local standards. The land and resources department published 47 kinds of maps, with 489,000 daily map users’ visits and 239,000 basic geographic information data.

X. Culture, Health and Sports

By the end of the year, there were 273 performing arts groups, 143 mass art museums and cultural centers, 137 public libraries and 113 museums and memorial halls in the province. There are 13 radio stations and 15 TV stations. There are 12.673 million cable TV users. The comprehensive population coverage rate of broadcasting was 94.57%, an increase of 0.51 percentage points over the previous year; The comprehensive coverage rate of TV population was 98.26%, up by 0.28 percentage points over the previous year. There are 118 national intangible cultural heritage protection catalogues and 324 provincial intangible cultural heritage protection catalogues. There are 13,188 kinds of books, 248 kinds of periodicals and 48 kinds of newspapers. The total print runs of books, periodicals and newspapers are 490 million, 140 million and 1.08 billion respectively.

At the end of the year, there were 61055 health institutions in the province. Among them, there are 1,260 hospitals, 139 maternal and child health centers (stations), 87 specialized disease prevention hospitals (stations), 2,269 township health centers, 715 community health service centers (stations), 10,519 clinics, health centers and medical offices, and 44,339 village clinics. There were 393,000 health technicians, an increase of 5.9% over the previous year. Among them, there were 161,000 medical practitioners and assistant medical practitioners, an increase of 6.5%; There were 162,000 registered nurses, an increase of 8.2%. The hospital has 300,000 beds, an increase of 8.7%; Township hospitals have 96,000 beds, an increase of 3.8%.

There are 23.996 million people who regularly participate in physical exercise in the province, and 2601 national fitness programs have been carried out. There are 6,500 new administrative villages for farmers’ physical fitness projects. In the whole year, he won four world champions, seven Asian champions and 57 national champions, breaking the world record by one event/person/time. There are 98,684 sports venues. Among them, there are 220 gymnasiums, 7,296 sports grounds, 543 swimming pools and 4,527 training rooms.

XI. Population, People’s Life and Social Security

At the end of the year, the resident population of the province was 68.22 million. Among them, the urban population was 35.986 million, and the urbanization rate was 52.75%, an increase of 1.86 percentage points over the end of last year. The annual birth population was 923,000, with a birth rate of 13.57 ‰; 477,000 people died, with a mortality rate of 7.01 ‰; The natural population growth rate is 6.56‰. The population aged 0-15 (including those under 16) accounted for 19.71% of the permanent population, an increase of 0.14 percentage points over the end of last year; The proportion of people aged 16-59 (including those under 60) was 62.68%, down by 0.58 percentage points; The proportion of people aged 60 and over was 17.61%, an increase of 0.44 percentage points.

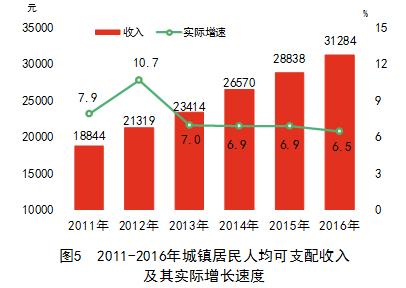

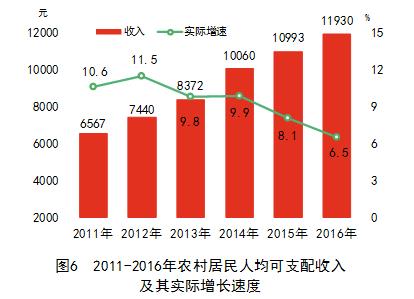

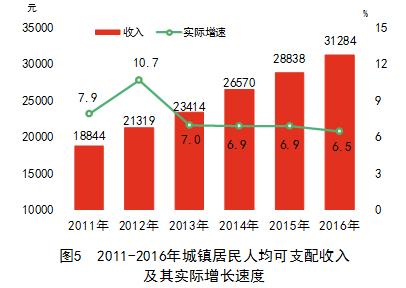

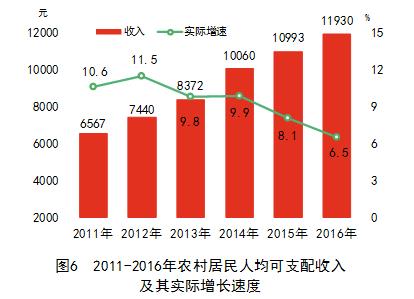

The per capita disposable income of all residents in the province was 21,115 yuan, an increase of 9.3% over the previous year, and a real increase of 7.3% after deducting the price factor; The median per capita disposable income was 18,096 yuan, an increase of 8.7%. The per capita disposable income of urban residents was 31,284 yuan, an increase of 8.5%, and the real increase was 6.5% after deducting the price factor; The median per capita disposable income of urban residents was 29,064 yuan, an increase of 6.8%. The per capita disposable income of rural residents was 11,930 yuan, an increase of 8.5%, and the real increase was 6.5% after deducting the price factor; The median per capita disposable income of rural residents was 11,041 yuan, up by 10.1%. The income ratio of urban and rural residents was 2.62:1, which was the same as that of the previous year. In terms of regions, the per capita disposable income of residents in Changsha, Zhuzhou and Xiangtan was 33,236 yuan, an increase of 8.4%; 19,698 yuan in southern Hunan, an increase of 9.0%; 14198 yuan in western Hunan, an increase of 10.3%; Dongting Lake area was 19,225 yuan, an increase of 9.2%.

The per capita consumption expenditure of residents in the province was 15,750 yuan, an increase of 10.4% over the previous year. The per capita consumption expenditure of urban residents was 21,420 yuan, an increase of 9.8%; The per capita living consumption expenditure of rural residents was 10,630 yuan, an increase of 9.7%. The proportion of urban residents’ food consumption expenditure to total consumption expenditure (Engel coefficient) was 29.9%, down 1.3 percentage points from the previous year; The Engel coefficient of rural residents was 31.7%, down by 1.2 percentage points.

There are 774,000 new urban employees in the province. At the end of the year, the number of employees participating in urban basic endowment insurance was 12.039 million, an increase of 432,000 over the end of the previous year. Among them, 8.111 million employees were insured and 3.858 million retirees were insured. The number of people participating in urban basic medical insurance was 26.461 million. Among them, 8.296 million people participated in the basic medical insurance for urban workers and 18.165 million people participated in the basic medical insurance for urban residents. The number of employees participating in unemployment insurance was 5.375 million, an increase of 163,000. The number of employees participating in industrial injury insurance was 7.733 million. The number of employees participating in maternity insurance was 5.429 million. 33.205 million people registered to participate in the endowment insurance for urban and rural residents. The number of people participating in medical insurance for urban and rural residents was 60.832 million, and the participation rate was 98.61%. At the end of the year, the number of employees receiving unemployment insurance benefits was 154,000. 1.118 million urban residents received the government’s minimum living security, and 3.92 billion yuan of minimum living security funds were distributed; 2.902 million rural residents received the government’s minimum living security, and 4.73 billion yuan of minimum living security funds were distributed. At the end of the year, there were 242,000 beds in various adoptive social welfare units, and 147,000 people were adopted. There are 12,006 community service facilities in cities and towns, including 6,035 comprehensive community service centers. In the whole year, 8.54 billion yuan of social welfare lottery tickets were sold, and 2.40 billion yuan of welfare lottery funds were raised. Support the renovation of 176,000 rural dilapidated houses,415,000 new urban shanty towns were renovated, and 8,575 state-owned industrial and mining shanty towns were renovated.

XII. Resources, Environment and Safety in Production

144 kinds of minerals have been discovered and 109 kinds of minerals have been proved in the province. Among them, there are 7 kinds of energy minerals, 39 kinds of metal minerals, 61 kinds of non-metal minerals and 2 kinds of water and gas minerals. 208 geological exploration projects (including continuation projects) were implemented, and 5 large and medium-sized mineral areas were newly discovered. There are 18 key mining areas and 6 important minerals that have completed resource integration. There are 12 national geoparks and 4 geological relics protection areas. 233 comprehensive land improvement projects at or above the provincial level were implemented, and 76,000 hectares of land were rehabilitated.

The sewage treatment rate of cities in the province is 94.3%, and the harmless treatment rate of municipal domestic garbage is 99.8%. Among the surface water sections actually monitored, 89.7% meet the Class III standard. The construction of 191 nature reserves with an area of 1.368 million hectares has been approved. Among them, there are 22 national nature reserves and 27 provincial nature reserves. The afforestation area was 340,000 hectares in the whole year. At the end of the year, there were 1.326 million hectares of closed hills (sand) for afforestation, with 530 million cubic meters of standing trees and a forest coverage rate of 59.64%.

According to preliminary accounting, the comprehensive energy consumption of large-scale industries in the province is 59.462 million tons of standard coal, down by 1.5% over the previous year. Among them, the comprehensive energy consumption of six high energy-consuming industries was 47.126 million tons of standard coal, down by 1.7%. Among the main pollutants, the discharge of chemical oxygen demand decreased by 2.82%, sulfur dioxide by 8.42%, ammonia nitrogen by 3.07% and nitrogen oxides by 6.99% compared with the previous year.

There were 2202 production and operation safety accidents in the whole province, and 1589 people died in production and operation safety accidents. There were 0.05 people killed in accidents with a GDP of 100 million yuan, 1.58 people killed in accidents with 100,000 industrial, mining and commercial employees, and 0.57 people died in one million tons of coal mines. There were 7505 road traffic accidents in the whole year, down by 16.9%; The road traffic death rate was 1.54 people per 10,000 vehicles, a decrease of 0.17 people per 10,000 vehicles.

Notes:

1. The data in this bulletin are preliminary statistics, and some data are not equal to the total of sub-items due to rounding.

2. The absolute figures of regional GDP, added value of various industries and per capita regional GDP are calculated at current prices, and the growth rate is calculated at constant prices.

3. According to the Classification of National Economic Industries (GB/T4754-2011), in 2013, the National Bureau of Statistics revised the three industrial divisions, and classified the auxiliary activities of mining and manufacturing in the services of agriculture, forestry, animal husbandry and fishery.

4. Changsha-Zhuzhou-Xiangtan region refers to Changsha, Zhuzhou and Xiangtan, southern Hunan refers to Hengyang, Chenzhou and Yongzhou, western Hunan refers to Shaoyang, Zhangjiajie, Huaihua, Loudi and Xiangxi Autonomous Prefecture, and Dongting Lake refers to Yueyang, Changde and Yiyang.

5. High-tech manufacturing includes pharmaceutical manufacturing, aviation, spacecraft and equipment manufacturing, electronic and communication equipment manufacturing, computer and office equipment manufacturing, medical equipment and instrumentation manufacturing, and information chemicals manufacturing.

6. According to relevant regulations, foreign trade is denominated in RMB.

7. The enrollment rate of primary school-age children refers to the percentage of school-age children who have entered primary school within the scope of investigation to the total number of school-age children inside and outside the school.

8. The gross enrollment rate of high school education mainly reflects the coverage of high school education, which means that the total number of students in high school accounts for the percentage of the school-age population aged 15-17.

9. The data of 2011-2013 in Figure 6 is the per capita net income of rural residents, and the name of the indicator has been changed to the per capita disposable income of rural residents since 2014.

10. The permanent population refers to the population who actually lives in a certain area for a certain period of time. According to the provisions of the census and sampling survey, it mainly includes: people who live in the township street, whose registered permanent residence is in the township street or whose registered permanent residence is to be determined, people who live in the township street and leave the township street where their registered permanent residence is located for more than half a year, people whose registered permanent residence is in the township street, who go out for less than half a year or work and study abroad.

11. At the end of 2016, the population of 0-14 years old (including under 15 years old) was 12.642 million, and the population of 15-59 years old (including under 60 years old) was 43.567 million.

12. The overall water quality monitoring section in 2016 increased compared with that in 2015, and the statistical caliber was incomparable with that in 2015.

13. The the State Council Safety Committee Office carried out the reform of direct reporting of accident statistics, and the statistical caliber and scope were greatly adjusted. The safety production data in 2016 was incomparable with previous years.

14. Energy consumption data are preliminary audit data of the National Bureau of Statistics.

Source:

The financial data in this bulletin comes from the Provincial Department of Finance; Prices, income and expenditure of urban and rural residents, Engel coefficient and some agricultural data come from Hunan Survey Corps of National Bureau of Statistics. Railway passenger and freight volume, turnover and railway mileage data come from Shichang Railway Co., Ltd., Guangzhou Railway (Group) Company and Nanchang Railway Bureau; The data of highway passenger and freight volume, turnover, waterway passenger and freight volume and highway mileage come from the Provincial Department of Transportation; Data of passenger and cargo traffic and turnover of civil aviation come from Provincial Airport Management Group Co., Ltd.; The data of pipeline freight volume come from Changling Branch of China Petrochemical Group Asset Management Co., Ltd., Baling Petrochemical Branch of China Petrochemical Group Asset Management Co., Ltd., Changling Branch of China Petrochemical Co., Ltd., Hunan Oil Transportation Management Office of China Petrochemical Sales Co., Ltd. and Changsha Xinao Gas Co., Ltd.; The data of car ownership and road traffic accidents come from the provincial public security department; Telecom business volume, mobile phone users, fixed phone users and Internet broadband users come from provincial telecom companies, provincial mobile companies, provincial Unicom companies and provincial Tietong companies; The postal business volume comes from the provincial postal administration; Tourism data comes from the Provincial Tourism Development Committee; Deposit and loan data come from Changsha Central Branch of China People’s Bank; The data of listed companies come from the financial work office of the provincial people’s government; Securities data comes from Hunan Supervision Bureau of China Securities Regulatory Commission; The insurance data comes from Hunan Supervision Bureau of China Insurance Regulatory Commission; Education data comes from the Provincial Department of Education; Science and technology data comes from the Provincial Science and Technology Department; Patent data comes from the provincial intellectual property office;Quality inspection and industry standard data come from the Provincial Bureau of Quality and Technical Supervision; Surveying and mapping, mineral resources, geopark relics and land data come from the Provincial Department of Land and Resources; The data of art performance groups, museums, public libraries, cultural centers and intangible cultural heritage protection come from the Provincial Department of Culture; The data of radio, television, newspapers, periodicals and books come from the provincial press, publication, radio, film and television bureau; Health data comes from the Provincial Health and Family Planning Commission; Sports data comes from the provincial sports bureau; The data of new employment and social insurance in cities and towns come from the Provincial Department of Human Resources and Social Security; The data of urban and rural subsistence allowances, social welfare, community services and nursing homes come from the Provincial Civil Affairs Department; The data of rural dilapidated buildings renovation, affordable housing construction, sewage and garbage disposal come from the Provincial Department of Housing and Urban-Rural Development; The data of nature reserves, afforestation, afforestation, standing trees and forest coverage rate come from the Provincial Forestry Department; The data of surface water quality and pollutant discharge come from the Provincial Environmental Protection Department; Safety production data comes from the provincial safety production supervision and management bureau; Other data come from the Provincial Bureau of Statistics.