Original Fu Fu Nuan De Ding Dong Xiao Peanut Net

Mr. Peanut: I haven’t shared the English Raiders with you for a long time. Every time flower friends write such an article, they spend a lot of time and great thoughts, thinking about the scorching summer, and they can’t bear to let everyone "do their homework" …

However, there are many enthusiastic flower friends. No, these two days, we finally waited for this valuable sequel to the "Introduction to Parent-child English".

Remember the popular article "Father and Son Chicken English" nearly a year ago? The picture shows jingling children before entering primary school. …

The hero of the story is two male compatriots, one is a 6-year-old boy who is about to enter primary school at that time, and the other is his father who claims to be an "English scum".

Tinker bell, like many children in China, sang English children’s songs, attended foreign teachers’ training classes and played English apps in the initial stage, but she did not learn systematically and could not read independently.

What should we do? So, the father took a series of simple but effective methods for half a year to take his son across two levels:

1. I never learned to read independently.

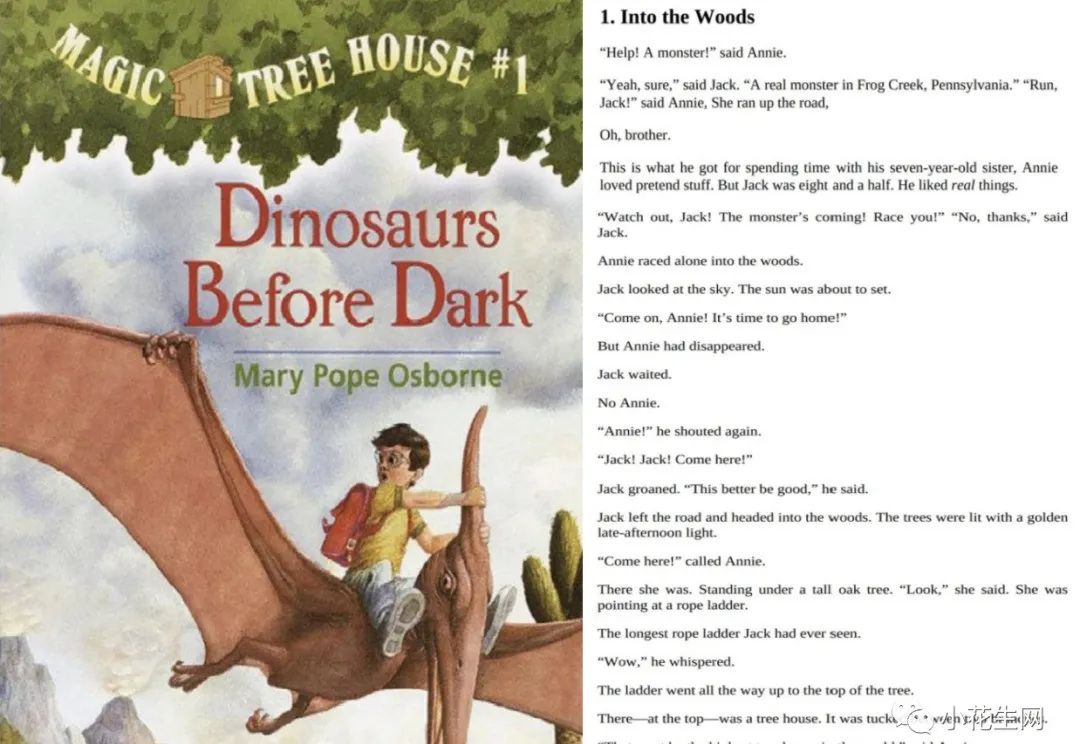

2. From reading the simplest classification (Oxford Tree Level 1) to being able to read chapter books (Magic Tree House).

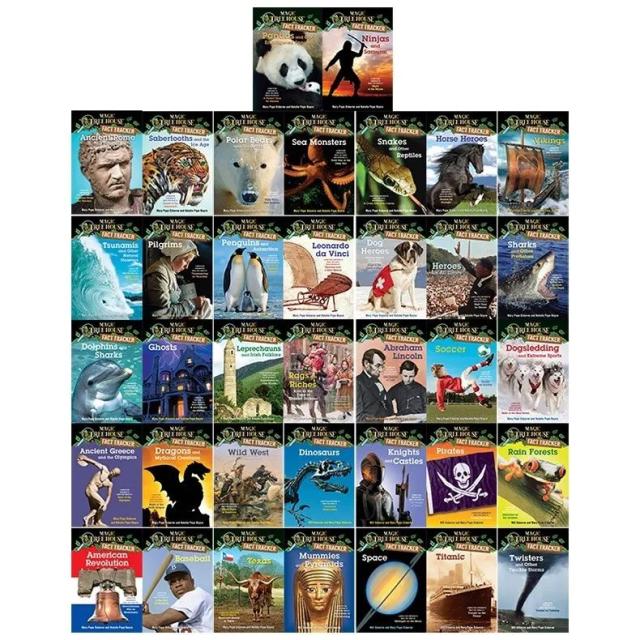

The magic tree house

This process can be called "riding the wind and breaking the waves"!

Last September, Dingdang became a glorious pupil. Blink of an eye, summer vacation is coming, and I will be promoted to two immediately. This year, how did Dingdang’s original English reading progress, and what challenges did she encounter after entering primary school? We are curious.

As a result, the results are gratifying, and Dingdang’s father "reports":

In June last year (before entering primary school), I entered the first chapter reading, in October I entered the middle chapter reading, and in April this year I entered the senior chapter learning. The latest Star test score was 5.7, and the Raz progress was V; This year, I have read about 4.7 million words.

Dingdang Dad’s Raiders (1&2) are very popular in the community for two main reasons:

The experience before going to primary school (the first part) is believed to be of reference value to most of our families who are more Buddhist: children have been enlightened for so long, and the effect is not obvious. How can we "take the children to a higher level" in a short time, so as to improve their English level in essence? …

The experience after primary school (this article) is of reference value to how to take the baby from the "initial chapter" to the "middle and high chapter" and how to keep reading after entering primary school.

Looking at the combination of the upper and lower parts, from enlightenment to high chapter, the complete advanced route and learning resources are also clearly listed, which is very informative, especially suitable for collection and slowly taking the baby to practice. Thank you, Tinker Bell Dad @ 丫丫丫丫丫丫丫!

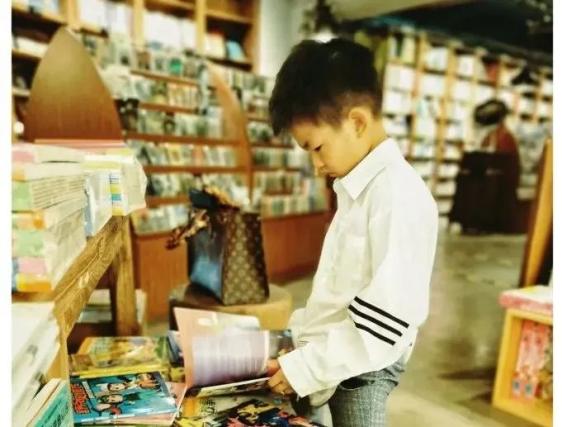

This article was published in Little Peanut Writing Plan by Huayou @ Fu Fu Nuan Ding Dong; The picture is a jingle in the first grade of primary school. Is it much bigger than the previous picture? …

My son, Dingdang, is almost seven years old (one month short), and he is a little baby who rises to two.

He especially likes reading. When reading, he is quiet and attentive. He likes to tell his family about what he has read about war stories, but he is very shy to go on stage and share it with his classmates.

Because the children are busy with work and travel more, the baby dad finds a balance between work and taking care of the baby, and assumes more responsibility for accompanying the study.

In English learning, Dingdang was enlightened at the age of 4, and has always insisted on following foreign teachers’ learning and original reading, and her oral pronunciation is relatively standard. But at that time, compared with Buddhism, I studied with the fate, and there was no strong purpose.

It was not until last year that I had a whim and wanted to take my baby to school.

In February last year, we officially started reading from the original chicken English, entered the first chapter reading in June, entered the middle chapter reading in October, and entered the senior chapter learning in April this year. The latest Star test score was 5.7, and the Raz progress was V. At this point, I have read about 4.7 million words.

For Dingdang’s English learning, we have had high-light moments of triumph and low-ebb stages of frustration. I thought that I could let go completely when I entered independent reading, but I didn’t expect it to be so difficult. Fortunately, we persisted and stubbornly walked on the road we thought was right.

Now I think there are many places to summarize, so I would like to record the sweat and pits I have stepped on in the process of learning English.

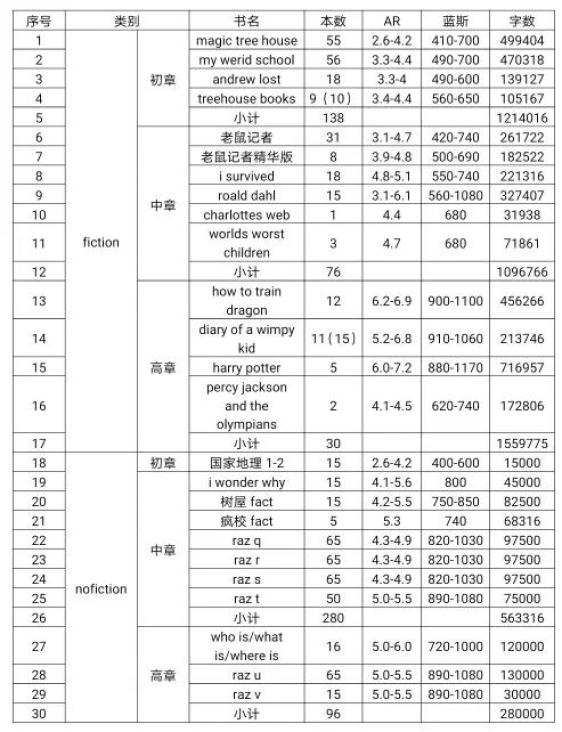

Make a list of books and paths first, and then sum up experiences, lessons and experiences.

In 12 months, I read 635 English books with about 4.7 million words.

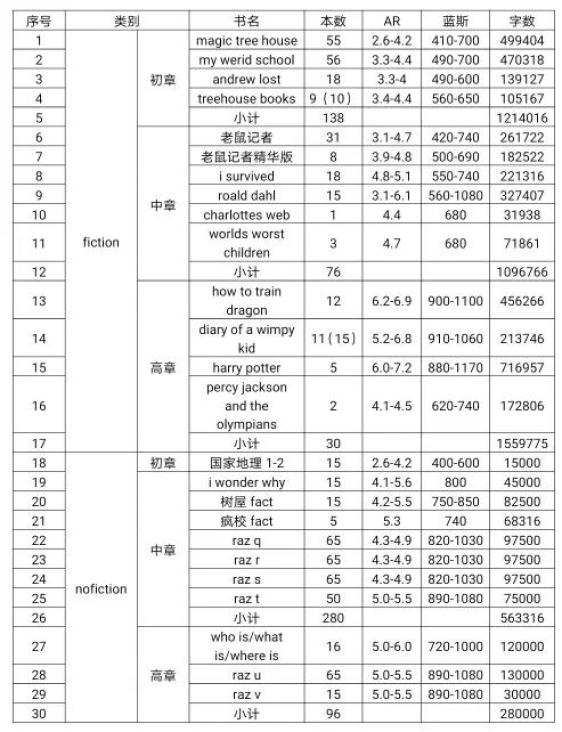

Our reading advanced map

Our reading method: ladder climbing theory.

The way we read English is: stick to a main line. After reading a complete set, update a set, just like climbing a ladder, climb up one step at a time, step on it firmly, and then climb up until it reaches a high chapter.

The AR of books read by Dingdang is basically maintained at 0.3-0.5 per set, and the book switching is generally smooth.

There is actually no strict division about the division of senior chapters in junior high school.

On small peanuts, people usually divide the standards and signs as follows:

Lanse index is 500L/ar4.0 (the fourth grade in America), which is the boundary between the first chapter and the middle chapter.

Lanse index is 1000L/ar5.0 (the fifth grade in America), which is the boundary between the middle chapter book and the high chapter book;

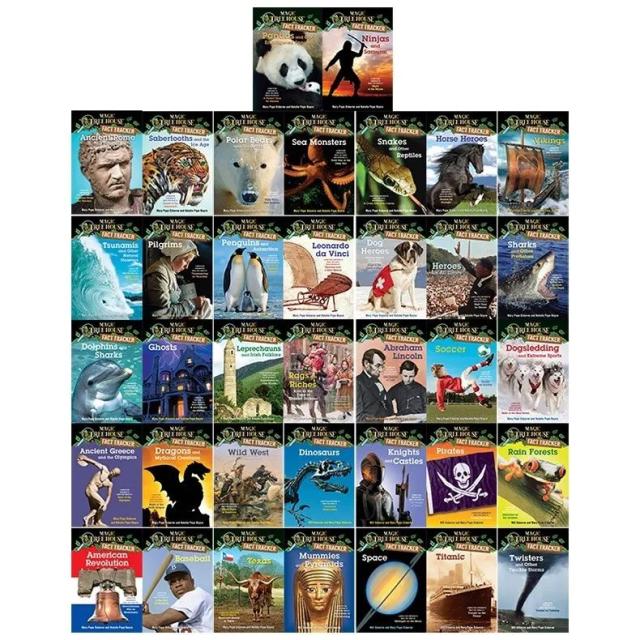

The first chapter of the logo book is "Magic Tree House"

The logo book of Zhongzhang is Mouse Reporter.

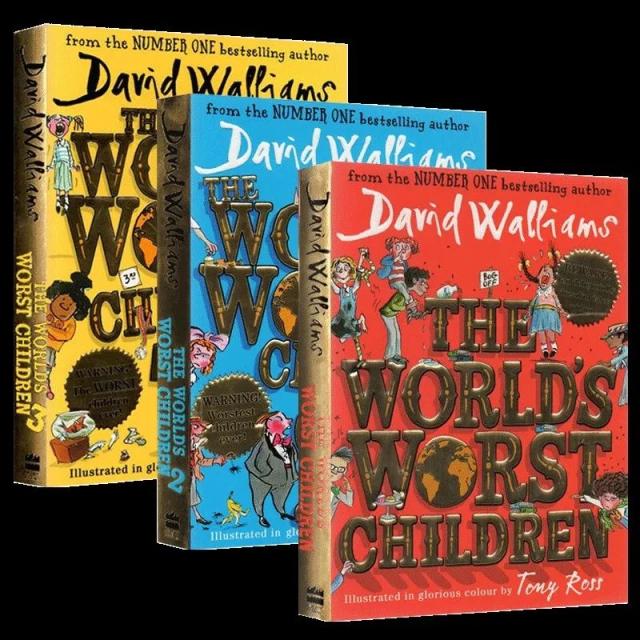

The logo of Gao Zhang is diary of a wimpy kid.

Our reading progress: reading and listening to 635 books a year, about 4.73 million words.

Raindrop shed full of sunshine, where children read.

Read:

Magic Tree House (55 books) —— > Mouse Reporter (31 regular editions +8 essence editions)/Roald series (15 books) —— > Tree House Fact》/ Kid Tree House (10 books) /Raz Q(80 books) —— > Tree House Fact Raz S(65)-> Harry Potter (5) /Raz T(50)-> How to Train Your Dragon (12) /Raz U(65)-> How to Train Your Dragon (12)/WHO IS/Raz V.

Listen:

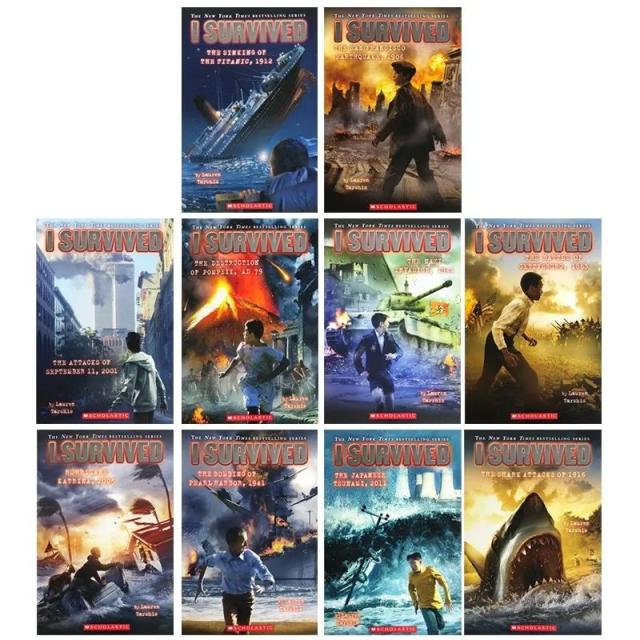

Magical Bookstore (55 books) —— > Crazy School (56 books )—— > I Survived (18 books) —— > Kid’s Tree House (10 books) —— > Harry Potter (5 books) —— > How to Train Your Dragon (12 books).

Preliminary statistics are as follows:

Some books are still being collected gradually, and the number of Raz words is estimated to be 1500-2000.

Time is limited when entering primary school.

We read these books from the first chapter to the senior chapter.

After the first grade of primary school, the reading time is limited, and I insist on reading a set before choosing a new series, so we only choose the classic original books.

First chapter book:

1. "Magic Tree House"-the first chapter to test the stone

The book is divided into two seasons, with a total of 55 books, AR2.6-4.2, and a total of 500,000 words. It tells the story of the fantasy journey of Jack and Annie, which is the best choice for the first chapter. When children get used to being good friends with Jack and Annie, they can really adapt to this series of chapter books.

The disadvantage of this series is that the routine is relatively old, and you won’t read this series after seeing the chapters and books in the back.

2. "Crazy School"-lively and interesting, the children can’t stop.

We bought four seasons and saved 56 audio books. This series tells an interesting story about AJ, a strange pupil, after going to school. The language is vivid and the teachers in the book are very interesting. Every time I read it, Dingdang would laugh happily, and then "nuts" became a mantra.

He really liked this series, and finally I forcibly deleted the audio in the listener and hid the book before turning to the next series.

3. Storey Tree House-"Real" Tree House

It is also called "Kid Tree House", but this tree house is different from other tree houses. This is a serious tree house, and it is a tree house that adds 13 floors every few years and pierces the sky. If you go to see the little magic fairy of Balabala, you will be disappointed. Two old urchins (Andy and Terry) transformed each tree house into a dream kingdom, and with funny stories, they became another school.

There are only 9 original books in this series (up to the 117th floor), and Dingdang especially likes this set of books. Later, we found the 10th book (130th floor) in the market and continued to buy it back.

Because of the thickness of a single book, many friends also regard this set of books as a middle chapter book. We read this set of books after reading Mouse Reporter and Roald. For Dingdang, because some books in Roald series are too ugly, Tree House series can serve as an effective buffer for the middle chapter.

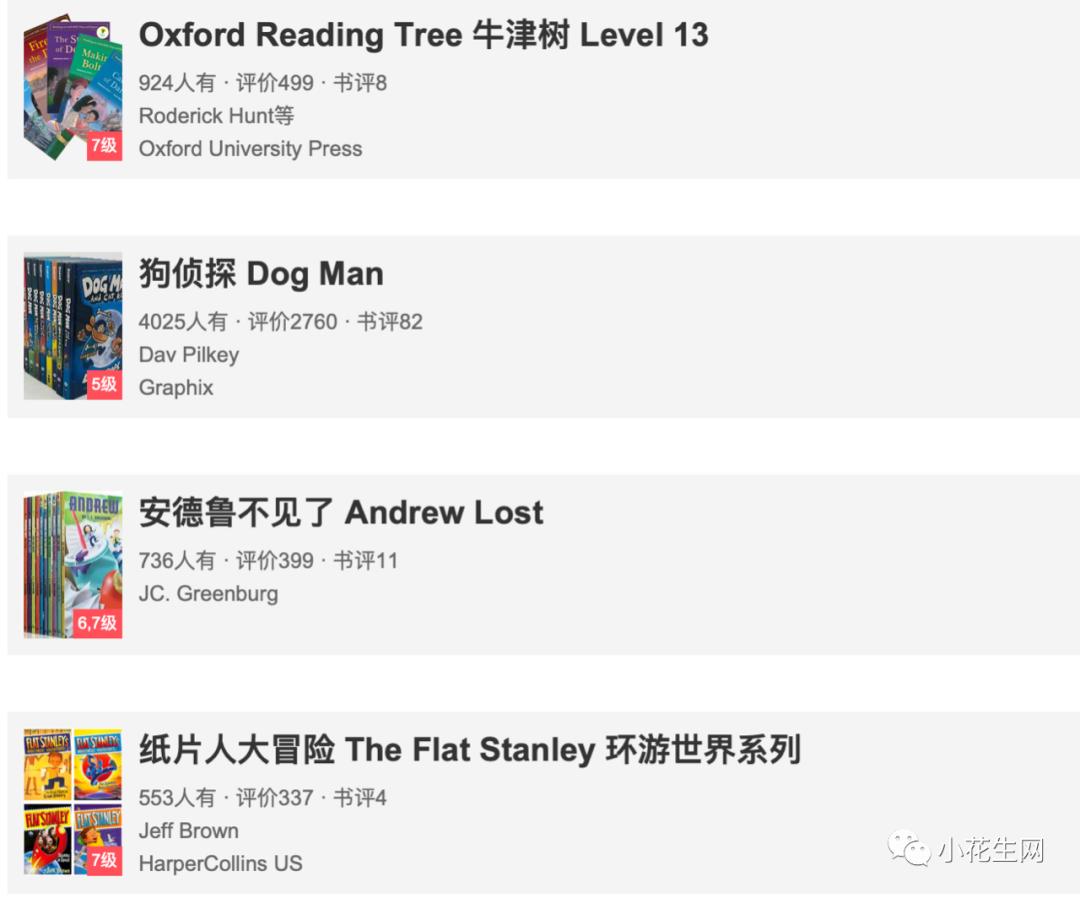

4. Other first chapter books-sprint 100 first chapter reading tasks

We have also read some other first chapters, such as Oxford Tree 10-13, Dog Man, Paper Man, Andrew Lost, etc. After we have completed the task of reading 100 first chapters, we are basically clear about these book routines and can enter the next stage of study.

Chapter book:

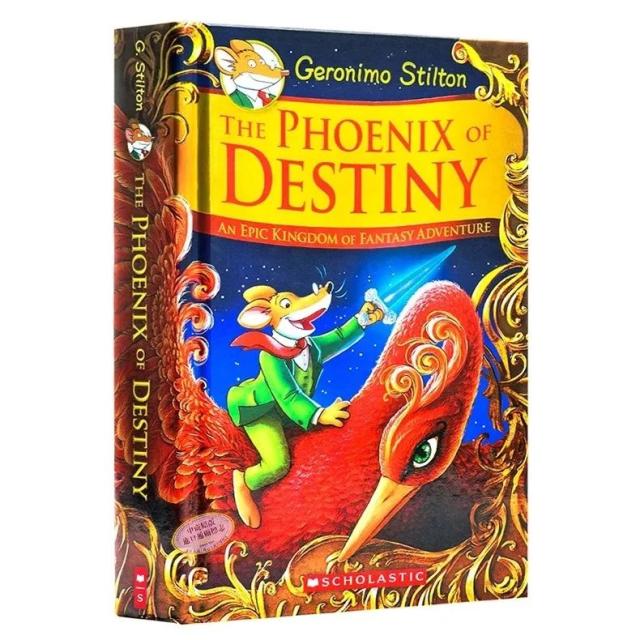

1. "Mouse Reporter"-Children are fascinated, but the hardcover edition in into the pit is too expensive.

Geronimo is probably one of the most famous mice in the world. This set of books tells the adventure story of him and his nephew Benjamin. The books are beautiful and the cartoons with the same name are very wonderful. We bought 50 books and watched 31 of them.

It is worth mentioning that the mouse reporter has a lot of hardcover books. The series of Dream Kingdom and Time Travel are the most exquisite chapter books I have ever seen. For the first time, I felt that books can be magnificent, so I collected 8 of them as collections.

Hardcover cover

This series is super complicated: there are 70 originals, 13 from Dream King, 6 from Time Travel, 11 from heroic stories, 5 from famous books, and female mice, etc … And the hardcover edition is more expensive (more than 70 each).

Original (70 copies)

Tinker bell likes this series very much, especially reading the hardcover edition. I interrupted her when she clamored to buy it all. It is "reading is risky, and into the pit needs to be cautious; Reading is too fascinating, and my loved ones have two tears. "

Inside pages of Dream Kingdom series

2. "Roald Dahl"-it has a large span and depth, and the adapted film can be watched together.

We bought 15 editions, and this series of books spans a lot, ranging from short stories like Mr. Fox to long stories like Witch and BFG. This is a set of in-depth books, and most of the titles have been adapted into movies, which can be regarded as chapters from saliva to literature.

Among them, Dingdang’s favorite book is Matilda. The protagonist in the book is a talented little girl. Her parents are vulgar, but she likes reading, has special functions, fights with evil teaching directors, and is finally raised by kind teachers. The movie version of this book is very good, with a scary middle and a magical ending. Dingdang has never seen this kind of book or movie before, and he was fascinated at once.

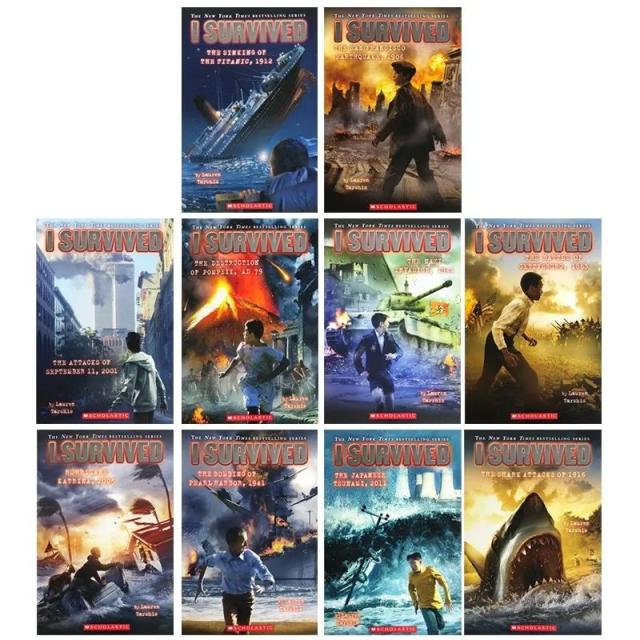

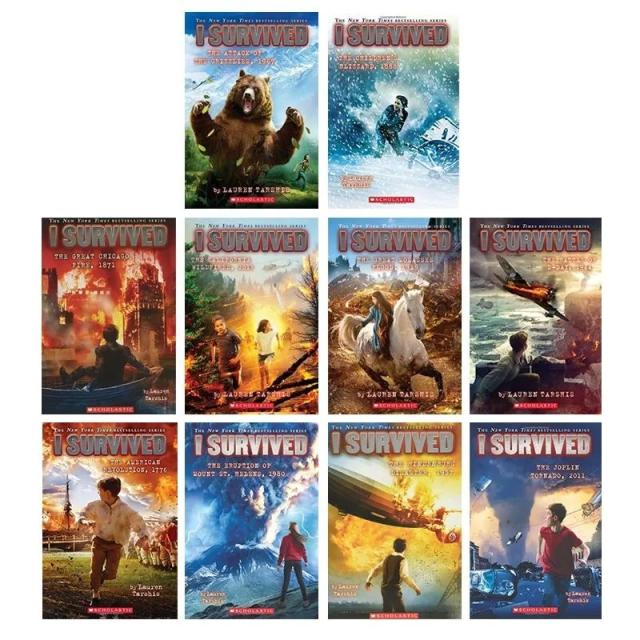

3. I survived-Fiction, which is most like Nonfiction, is suitable for helping children to go too far.

If "Mouse Reporter" is not enough to prove that Dingdang stands firm in the middle chapter, then I Survied is an important moment in Dingdang’s reading process.

First of all, the difficulty of this set of books is not low. The average AR is 4.5, and some of them reach 5.0. After reading it, you can basically stand firm in the middle chapter;

Secondly, this set of books is between Fiction and NonFiction, especially suitable for children who like reading fiction to transition to nonfiction;

Finally, these disasters mentioned in the book (such as Titanic, Pompeii, World War II) also appear repeatedly in other books, which is very convenient for comparative reading. In the process of reading, we incidentally pushed the Tree House Fact, which was rarely read before.

4. Other chapters-let children like to read books from movies

Including Charlotte’s Web, Wonder and Williams’ Worst Child series …

"Charlotte’s Web" is an award-winning single book, with few images and many words. Generally, it is impossible to read it. But recently, we signed up for an intensive reading class of Charlotte’s Web, distributed a large-character version of the book, and recently reviewed movies, which turned out to be a favorite for a time, clamouring for a pig like Charlotte (not afraid of developing a pig).

"Miracle Boy" is also watching movies and enjoying reading books. The worst children’s books are exquisite, and Williams is praised as Roald’s successor. The language is humorous, and the content is close to children’s life. It is not difficult to push them. I read three books in three days.

Worst children series

Gao zhangshu

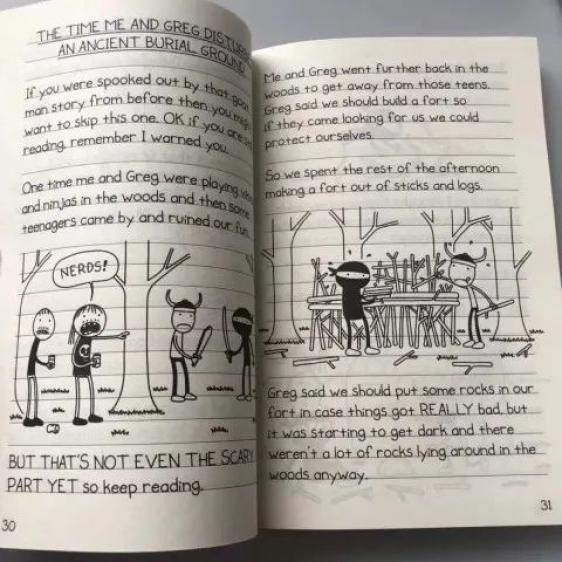

1. "diary of a wimpy kid"-stepping into the threshold of high chapter: the unfortunate diary of an unfortunate child.

"diary of a wimpy kid" is the longest set of books read by Ding Dong. It has been read for three months, including 16 originals and 1 movie script introduction.

If most of the books mentioned above are about the "glorious deeds" of the masters, then this set of books is about Jeffkinney’s unlucky deeds. So I also understand why Dingdang likes this set of books so much, because we also like to read the unfortunate story of this unfortunate child. Tinker bell listened and watched, watched and listened, and by the way, he watched three movies with us.

Diary of a wimpy kid is a high threshold, so it is inevitable, but there are also unfriendly places for younger children. This set of books tells the story of junior high school, which is far from the first grade of primary school, and there are many descriptions of unrequited love and spit, which may have some bad effects. Anyway, this set of books is really great.

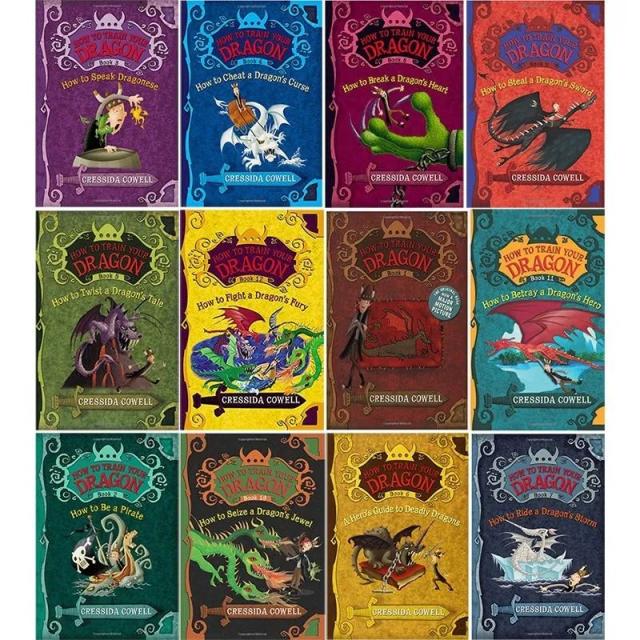

2. "How to Train Your Dragon"-the leader of dragon books

This is a set of books full of magic. After I failed in trying to promote percy jackson, Porter Lyle and Harry Potter, I faced a period of book shortage. At this time, How to Train Your Dragon appeared.

Of course, this set of books is very thick, and there are not many illustrations. It is really not an easy thing to read, but there are movies and audio excesses.

One afternoon, when Tinker Bell was listening to Book 12, I vaguely heard Tinker Bell crying intermittently when I was sleeping. Up to now, I still don’t quite understand why I was crying. Indeed, I don’t understand it.

3. "Harry Potter" and "percy jackson"-the content is too realistic, which is a bit difficult to promote.

After listening to the first five books of Harry and the first two books of Percy. Harry tried to push it twice, and I listened to 1-2 books each time. It was not easy to watch the film Dafa, and the later content was too realistic. The sixth book Dumbledore had to worship, so I couldn’t push it. I hope I can continue to listen to it during the summer vacation.

Nonfiction series

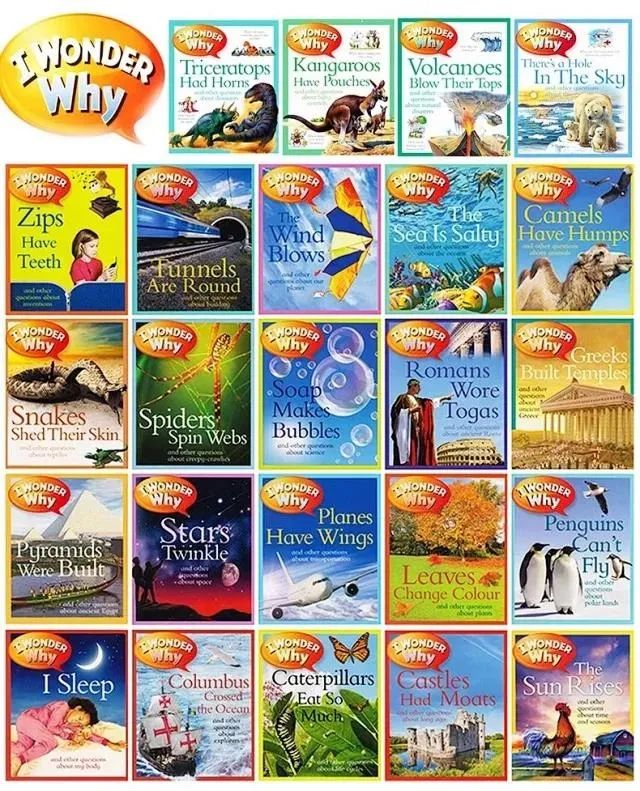

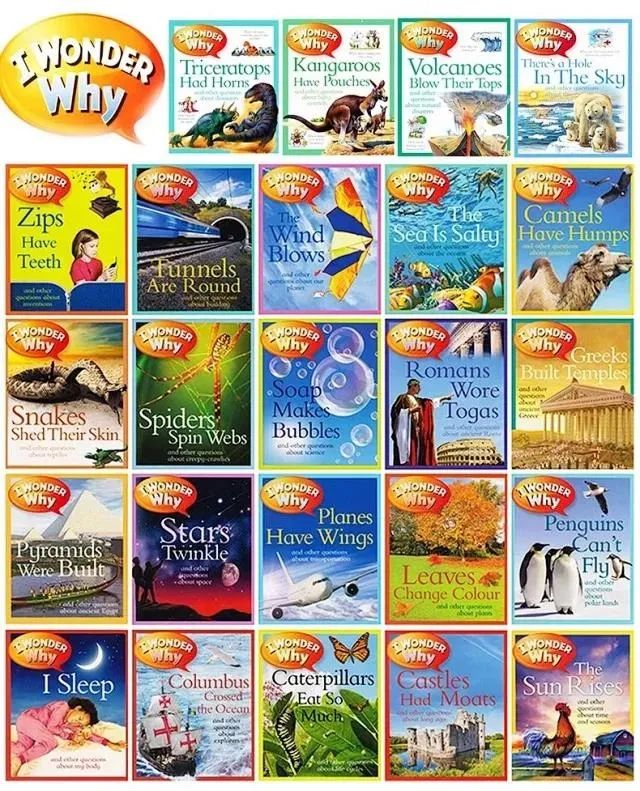

1. I wonder why-a set of classic nonfiction introductory books

This is a set of encyclopedias to read with the magic tree house. It is not difficult, but the picture is beautiful and thin. It is a good non-virtual introductory book.

2. Fact—— of tree house-it is not difficult, and you can push related topics through Raz.

Classic Nonfiction reading materials are equally difficult, even if there is residual heat after reading Magic Tree House, it is still difficult to promote. Later, related Fact are pushed one after another when Raz topics are involved.

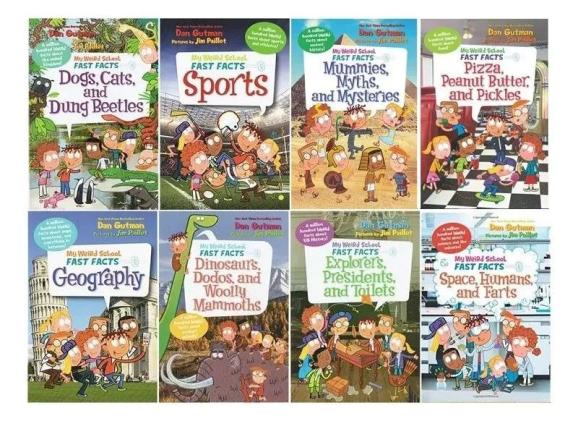

3. "Crazy School" fact-question and answer form, easy to read.

It’s also an excellent fact. The tree house fact takes the form of description, and the crazy school fact takes the form of question and answer. Because the language is interesting, it’s basically finished.

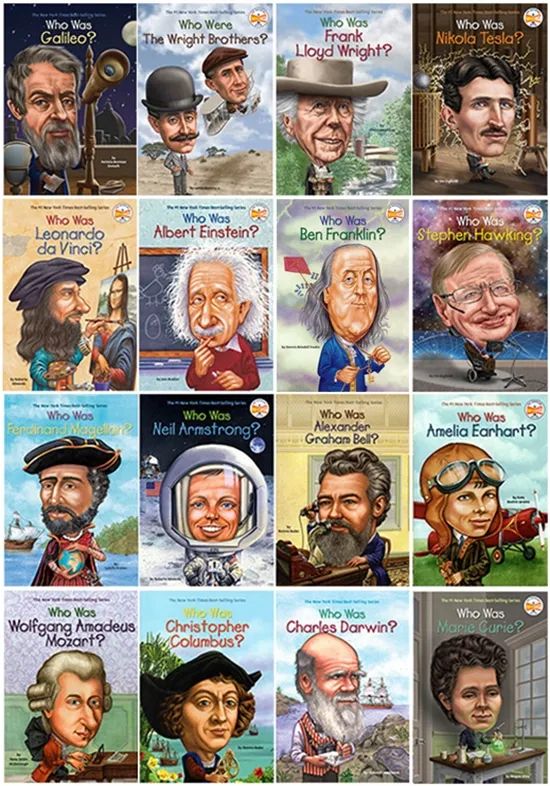

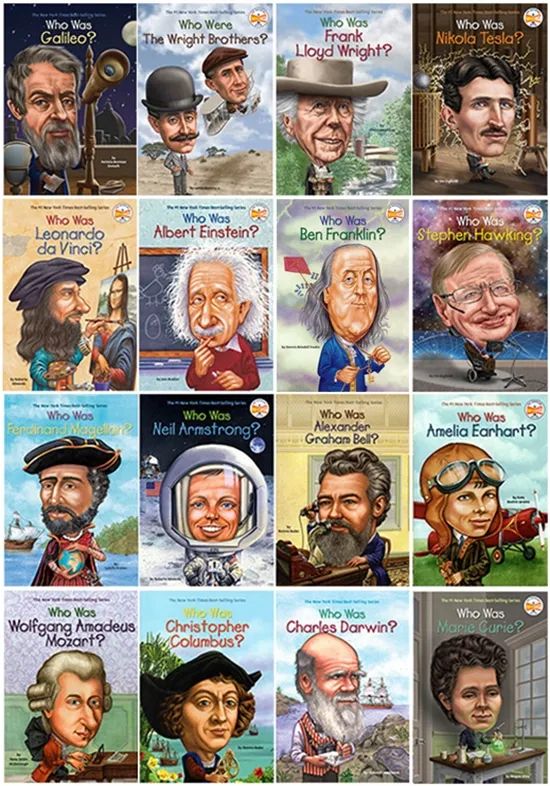

4. who is/what is/where is-biographies of famous celebrities, with great volume.

Penguin’s famous Who What Where series involves all kinds of biographies, historical events and geographical locations. The difficulty is slightly more difficult than the last two sets of books, and the number of books is extremely large. We bought 100 of them, and now we have read some intermittently, and we plan to read half of them in the summer.

In addition to the books shown above, we also started to brush Raz, but we encountered many difficulties at the beginning. Therefore, regarding the reading of Raz, I will talk about it in the summary of experience.

Except for the sweat

On the way to reading, we also encountered many pits.

In the process of advancing from the beginning chapter to the higher chapter, we encountered the following problems:

First, I am unwilling to remember words.

For the 6-year-old original baby, it is very painful for him to recite words. When he throws his pen away, he is determined and just doesn’t recite it, which also makes it difficult for him to understand a little difficult book, and even more difficult for him to practice writing.

The second is to indulge in saliva books.

Tinker bell was fascinated by Crazy School for a while. He listened to it on the way to class, at dinner and before going to bed. He spoke like a little AJ, and it was basically impossible to push other books. The series of the first chapter is often very long. For example, if "Mouse Reporter" is read completely, I guess he has learned to make holes. In fact, after reading 30 books, the routine will be understood.

Third, GE scores can’t be broken for a long time.

Tinker bell stayed at the gateway of GE5.0 for half a year. After careful analysis, the reading speed is only 140 words/minute, and the accuracy is only about 95%, reflecting that the foundation of Tinker Bell is not solid enough. To break through 5.0, either the speed or the accuracy should be improved.

Fourth, resist reading.

In order to avoid being addicted to saliva books, I was in a hurry and forced to push some non-Fic, which caused Dingdang to resist reading for a long time. Therefore, choosing books became my trouble.

Dingdang is reading in the community in the morning

In order to get through these pits, we do this.

1. lay a good foundation for reading, words must be memorized.

To improve English reading, memorizing words and practicing listening and memorizing are an essential process. Many people see the great god’s book list, buy it all and rush to sprint, only to find that they are stuck at a certain level of Raz or some books can’t be pushed. The reason is that the English foundation is not solid.

We also encounter such a problem. Dingdang doesn’t like memorizing words very much. If words are not memorized properly, it will be difficult to accept Roald, which is a little more difficult. I remember that when I read the book Minpins on October 1 last year, I didn’t know more than 20 words on one page, so it is absolutely meaningless to force it.

So, I signed up for a local English class. My homework is 10 words a day, listening to a text, and dictating words in class. It is very painful to recite words at first. Grandma will secretly put the answers to words in the corner of the video, but I think memorizing words is the only way to learn English, even if you are all wrong, you should write them yourself.

Fortunately, Ding Ding is also stronger, slowly from only 1-2 to the final dictation of the highest score in the class (only he got it all right), and then he slowly stood firm in Raz G4. Raz’s hit rate is also gradually improved with the memorization of words.

Regarding what word books to read, I recommend 4000 words.

2. Choosing books is not for parents to show off, but must respect children’s own interests.

Choosing a set of books depends on the eye. Take Harry Potter as an example. Many people regard Harry as an important symbol of independent reading. It seems that reading Harry means that English can enter the stage of free reading.

I saw on other parenting websites that some parents even began to force their baby to listen to Harry Potter after several first chapters (such as Crazy School). In this year’s reading, I tried to push Harry many times and failed without exception.

I understand that we should respect the children’s world. Reading is not a way for them to play tricks and show off, but just reading.

I also understand that it is not easy for them to enter a series. They need to know the character and experience of the master and make friends with him. I would rather let him stay in the book world for a while and immerse himself for a while, so that he can become an emotional child.

In order to avoid drowning in saliva books and give consideration to children’s interests, I found a little trick:

That is "choose a good movie and read a meaningful book"!

Mr Fox, Charlie’s Chocolate Factory, Matilda, Charlotte’s Web, Wonder Boy, How to Train Your Dragon, Harry Potter and so on, all of which we do.

Immersion in books often begins with movies, and the actual effect is very good. Dingdang will carefully compare the differences between books and movies, ask questions in his heart, and more importantly, understand the meaning behind books.

Movie poster of Charlotte’s Web

3. Make rational use of Quiz and Star tests, and don’t worry too much about scores.

Everyone will generally use tests to check whether they understand the effect. Many parents will be very anxious when they see that Quiz has made many mistakes or GE has not been promoted for a long time, and so will we. This kind of orientation makes Ding Dong very nervous when doing Quiz.

In fact, if we only focus on the scores, then these tests are meaningless except wasting time.

On the one hand, I reduced the frequency of testing and returned to the source of reading. According to the characteristics of Tinker Bell, I changed the way to make a quiz for 2-3 articles, and star tested it every 2-3 months.

On the other hand, it is to study with children how to correct and how to get scores. This is the most important thing!

In order to do a good job in the test, Dingdang and I used the "ooxx" method of some mathematics-circled the key points of the topic and crossed out the obviously wrong options for the answers. At present, the accuracy has been greatly improved, which seems to be very easy to use.

4. Use fiction and non-fiction, but don’t be too hasty.

Reading Fiction can enrich children’s emotions, and reading fiction can help them learn more about knowledge. Fiction should cooperate with Nonfiction, but it is easy to cause resistance if it is pushed too hard.

After a year’s adjustment, the ratio of fiction to nonfiction was adjusted from 8:2 to 4:6.

The main experience is:

First, cut non-Fic into several themes, deepen the study of knowledge points through knowledge expansion, and string together historical figures and events;

The second is to regard non-Fic as Fic, and I Survived is such a series, which puts fiction in a specific historical background, thus inspiring children to understand historical events.

I saw a comment on an internet: Will reading make children lonely?

No, reading will make children more eager to communicate, but their knowledge of the same age can’t match. For example, your baby is talking about the Twelve Greek Gods, while the other person is talking about Ye Luoli.

Ding Dong recently read about the war between the United States and Mexico in Raz, and then linked the American War of Independence with the Mexican War of Independence. After reading these, he read Who Is Benjamin Franklin. He told me that Franklin and Jay Robin Kwamina Quaison were contemporary. I asked him who Jay Robin Kwamina Quaison was. He said that Thomas Jay Robin Kwamina Quaison, the third president of the United States, wrote the Declaration of Independence with Franklin.

Under the first grade, time is tight, but we still insist on 10 thousand words a day.

The amount of reading should be set according to each child’s own abilities and interests. If you read too much and don’t digest it in time, it will easily become a burden. In the future, children will have various ways to prevaricate; If you read too little and don’t strengthen it, you can’t reach the law of ten thousand hours.

Basically, we can input 10,000 words a day in English. Raz 1-2 articles are 2,000-4,000 words. In the morning and afternoon, we can input almost 4,000-5,000 words. In the evening, we can read/listen for almost one hour every day at a rate of 150-200 words/minute.

Under the first grade, because we have to focus on outdoor and math, there is not enough reading time. We have made the following improvements:

First, the whole family stops watching TV and mobile phones after the children return home, and prepares some interesting English Fiction at the table for him to browse at will during the break. Tinker bell stopped chasing cartoons like mini-agents and read his favorite books instead. After that, we still added half an hour of animated film time under the condition of jingling all the tasks, such as Charlotte’s Net and How to Train Your Dragon.

Second, listen to audio on the way to and from school. This period of time is almost half an hour, which is likely to cause children to walk without looking at the road and immerse themselves in their own world, but there is no way to deal with the urgency of time.

6. About the method of reading Raz

We entered Raz from G3, and basically kept the rhythm of about 10 books a week. Because Raz’s Nonfiction covers a wide range, there are many knowledge blind spots in reading, and the error rate is very high when Dingdang started reading. Some topics even have only two questions in one article. At that time, I often reflected on whether the entry point was high and whether it was necessary to downgrade.

How to read Raz has become a difficult problem for me and Dingdang to read.

Dingdang and I analyzed the reasons for the wrong questions together. He thought: There are too many new words and unfamiliar contents. I think: the questions are unfamiliar, and Raz can’t just read extensively.

Then we determined two changes: one is to change the method and change extensive reading into intensive reading; The second is to change the way of thinking and change the special reading into a knowledgeable understanding. We agreed to study in a new way for a month, and if not, we would be demoted.

Regular parent-child intensive reading: In order to increase the fun of reading Raz, we will have a reading contest with Dingdang (one person reads one book) and also carry out parent-child intensive reading (one person reads one sentence).

Intensive reading is necessary. Through intensive reading and discussion together, we can understand the background and theme of the article more effectively. He likes this way, because I always can’t read him, and I like this way very much. Dingdang can often connect the previous learning content and say unexpected content.

Extended reading: Raz covers a wide range. Due to the limited space, it is often only the tip of the big event, and more parents need to expand their background.

For example, we watched the Battle of the Alamo, which was an independent battle of Texas against the Mexican dictatorship, and all Texans who defended the city died.

Later, we found the movie pictures of the same name and related background materials in bilibili, and we were deeply impressed by the cruelty of the war and the American immigration to Texas. After watching the Mexican War of Independence a week later, he pointed to the map of the United States and said that Texas originally belonged to Mexico and was later taken by the United States.

It’s best to read every book: Raz is a very good set of books, with new words translated into English after each article. The text strictly follows the total score, and the content is often historical events, countries (geography), biographies and scientific achievements, which is simply a miniature version of Who/What/Where. Our goal is to read every book to the letter, supplemented by some non-fiction and fiction books he likes.

Finally, I must say that this year,

I don’t feel hard when my father takes care of my baby.

This year’s study, although Ding Dong did not continue to show the rapid improvement in English, he showed perseverance and perseverance. At the lowest point in March, I once wrote, "Jiwa will always encounter problems of one kind or another on the road. She has been disappointed and troubled. She is not as good as I imagined, and she is not as miserable as I imagined. She has not given up, and we will continue to carry on with the burden."

Baby dad with baby is different from baby mom. Baby dad with baby has several characteristics:

First of all, the possible advantages of baby dad are that he is good at making plans, setting directions, being strict with children, and being able to repair conflicts with children through games and parent-child sports.

Secondly, I need efficient companionship. I am busy with my work. I try to come back early every day to accompany me for 1-2 hours. This time must be efficient to ensure that 70% of the tasks in one day are completed.

Thirdly, it is necessary to show patience. Tinker bell is not a self-stressing baby. I must always remind him of the goal of learning and why he studies. When Tinker bell fails to meet expectations, I will be more agitated. At this time, I need to calm down and give more encouragement instead of a big stick.

In addition, the father needs the help of the family especially. After planning, most of the work depends on children, grandparents and grandparents.

Especially Ma Ma, a child, if I make a study plan and implement it, she is definitely the maker of children’s study habits and English learning strategies. She is the link between me and my children. She can often clearly point out the wrong direction of taking care of my baby and protect my relationship with my children when I am angry with Dingdang.

Although we are very busy, our common agreement is that no matter what the weekend, we will completely put down our work and take time out to accompany Dingdang to grow up. Under the same goal, everyone is involved in it, performing their duties, and dynamically adjusting according to Eva’s thoughts.

I took my baby to study for a year and a half. On the one hand, I had to work, on the other hand, I had to ponder how to make him better. But I didn’t feel hard. Instead, I saw that he was constantly surpassing himself and surpassing me. I felt very successful.

When I was young, my deepest memory was that my father accompanied me for a morning run. I thought maybe when I grew up, I would remember the days when I accompanied him.

Original title: "The mother of the child is too busy, and the" scum "father shouldered the heavy burden and actually took the baby to read 600 English books a year! 》

Read the original text