Tencent makes another move! 101 repurchases during the year

In the past two trading days, Tencent Holdings in the Hong Kong stock market has conducted the 100th and 101st repurchase operations of the year.

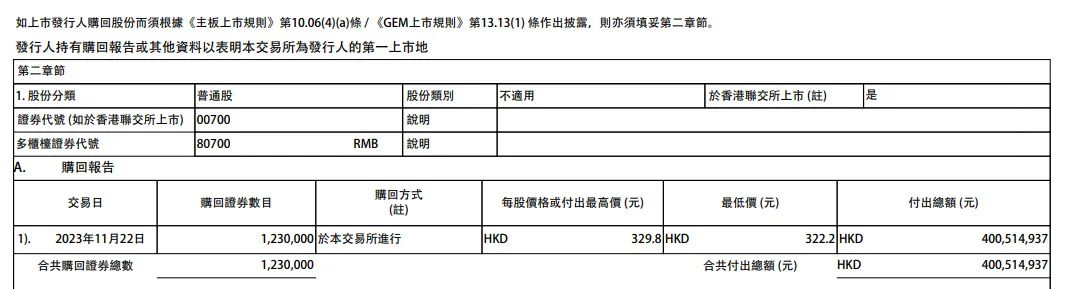

On November 22, Tencent Holdings disclosed that it repurchased 1.23 million shares on the same day at a cost of 401 million Hong Kong dollars. This is the 100th time Tencent has repurchased this year. On November 23, Tencent Holdings repurchased 1.23 million shares again. Since the beginning of this year, Tencent Holdings has repurchased 113 million shares, and the cumulative repurchase amount 37.382 billion Hong Kong dollars.

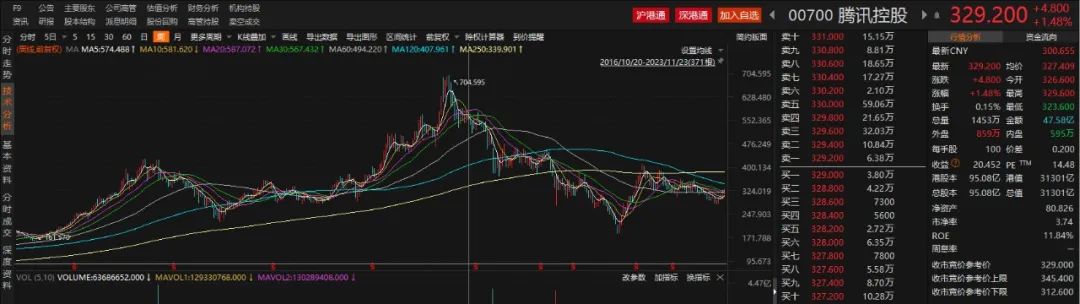

As of the close on November 23, Tencent’s share price was HK $329.2 per share, a cumulative rebound of about 17% from the phased low set on October 25. Based on the total repurchase price/cumulative number of repurchases, the average repurchase price of Tencent during the year was HK $332.03 per share, slightly higher than the current price.

All repurchased shares have been cancelled in the first three quarters

Statistics show that since last year, Tencent’s average daily repurchase amount has gradually increased. From the end of August last year to the end of May this year, Tencent’s daily repurchase amount was about 350 million Hong Kong dollars. But since June this year, Tencent’s average daily repurchase amount has increased to about 400 million Hong Kong dollars, evolving into "four hundred million".

In February 2021, Tencent’s share price reached a peak of HK $704.6/share, but due to the reduction of major shareholders, changes in international financial marekt and market concerns about the slowdown in the company’s growth rate, Tencent’s share price has been under pressure. At the end of October 2022, Tencent’s share price once fell to HK $187.29/share. Since then, Tencent’s share price has bottomed out and rebounded. In March this year, the share price was close to HK $400/share, and then continued to fluctuate. As of the close of November 23, Tencent’s share price was HK $329.2/share.

Since October 25, 2022, Tencent’s share price has risen by nearly 70%, which is related to the favorable policies of the Internet sector, the improvement of its own performance, and the spare efforts to repurchase.

Tencent Holdings disclosed in the 2022 annual financial report that in 2022, Tencent repurchased about 107 million shares, which cost more than 33.80 billion Hong Kong dollars. Since 2023, Tencent has repurchased 113 million shares, which cost 37.382 billion Hong Kong dollars. This means that the amount of repurchases this year has exceeded that of last year.

The general manager of a private equity firm in Shenzhen said that Tencent is a company with strong cash flow. In the past, Tencent bought many high-quality company assets through foreign investment, which drove the growth of the company’s revenue and total profit. Since the second half of 2021, Tencent’s foreign investment has declined, and its huge operating cash flow has been concentrated in share buybacks.

Tencent’s buyback partly hedged a sell by Prosus, South Africa’s largest shareholder.

On June 27, 2022, Tencent announced on the Hong Kong Stock Exchange that the company’s major shareholders, Prosus and Naspers, announced that they would start a long-term, open-ended repurchase plan, and the repurchase funds would be obtained through the orderly small sale of Tencent shares by the South African newspaper group.

"In April this year, Prosus deposited 96 million shares of Tencent into the Hong Kong clearing system. It is estimated that Prosus reduced its holdings of Tencent by about 1 million shares per day, accounting for about 4% of Tencent’s average daily turnover. This is roughly equivalent to Tencent’s average daily repurchase of about 1.20 million shares," said Zang Hailiang, director of investment at Yide Wealth.

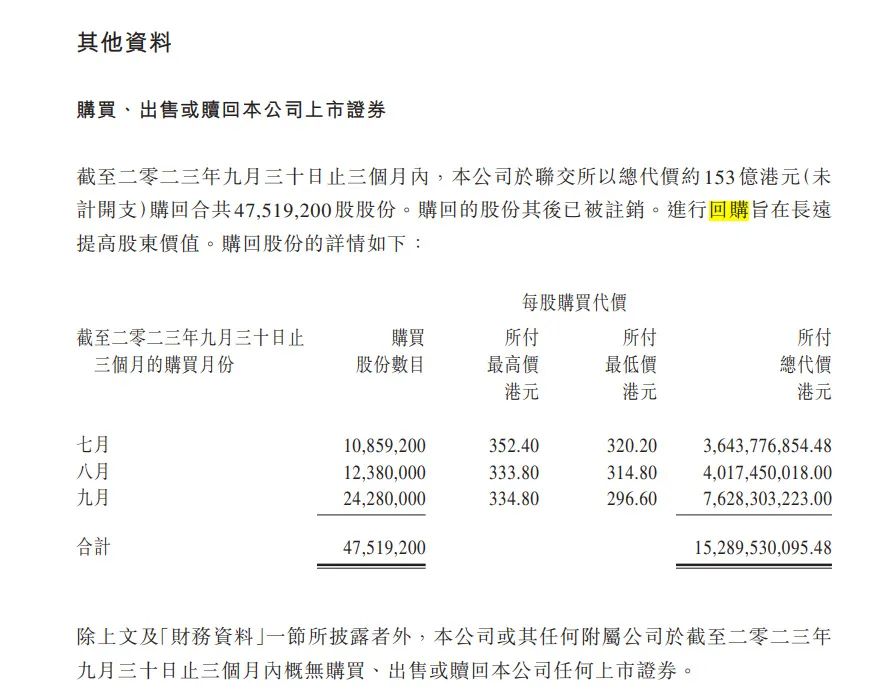

Regarding the arrangement of share repurchase, Tencent said in the third quarter of this year’s performance report that in the third quarter of 2023, Tencent bought back 47.519 million shares at a total consideration price of about 15.30 billion Hong Kong dollars (excluding expenses) on the Hong Kong Stock Exchange, and these shares have been cancelled. In previous performance reports, Tencent also released similar content.

As of November 23, Tencent’s total share capital had fallen to 9.508 billion shares, close to the total share capital in May 2019. "According to the rules, the repurchase of US and Hong Kong stocks has to be cancelled, thereby reducing the total share capital, which can increase earnings per share while the profit remains unchanged. Over time, the value of the shares in the hands of Tencent’s remaining shareholders will increase," said a senior market person in Hong Kong stocks.

Performance returns to a high-growth track

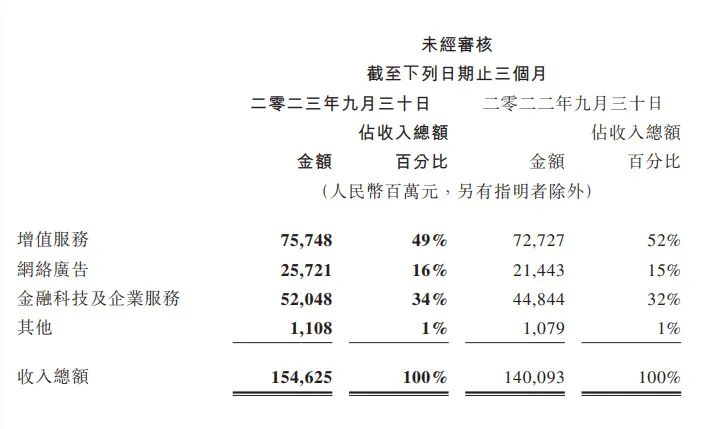

This year, Tencent returned to the high growth track. Recently, Tencent disclosed the third quarter of 2023 financial report, revenue 154.625 billion yuan (both in RMB, the same below), an increase of 10%; non-international general accounting standards under the net profit of 44.921 billion yuan, an increase of 39%. In the previous two quarters, Tencent’s revenue and net profit growth were also double digits.

Tencent has gradually built up a diverse range of business segments, including value-added services, online advertising, financial technology, and enterprise services.

In the third quarter of 2023, Tencent’s value-added service business revenue was 75.748 billion yuan, an increase of 4% year-on-year, accounting for 49% of total revenue; online advertising business revenue was 25.721 billion yuan, an increase of 20%, accounting for 16% of total revenue; financial technology and Enterprise Services business revenue was 52.048 billion yuan, an increase of 16%, accounting for 34% of total revenue.

"In the third quarter of 2023, we achieved solid and high-quality revenue growth, significant margin improvement, and structured operating leverage. Emerging businesses such as WeChat Channels and Mini Games contributed to our high-margin revenue streams," said Pony Ma, chairperson and chief executive of Tencent.

In light of the development trend of the technology industry, Tencent’s focus is on laying out the AI model. "We are shifting our focus from businesses with less room for development to businesses with higher growth potential," said Pony Ma. "We are investing more in artificial intelligence models to give our products new functions and improve the ability to accurately recommend content and advertising. We are not only committed to positioning our leading artificial intelligence capabilities as a multiplier for our own business development, but also to create value for our corporate customers and society as a whole."

As of November 22, southbound funds held Tencent’s total market value of HK $2958.49 billion, accounting for 9.59% of the issued ordinary shares. However, with the continuous rebound of Tencent’s share price, southbound funds have recently been on the trend of picking up and selling shares in Tencent.