2021 China Beauty Cosmetics Collection Store Industry Report Original iResearch

Research report on beauty cosmetics collection shop

Core summary:

Concept definition: Beauty Collection Store is an offline retail format that integrates multi-category and multi-brand cosmetic products in one store. It provides end consumers with product display, experience and sales services including cosmetics, skin care products, personal care, perfume, sunscreen products, cosmetic instruments and tools.

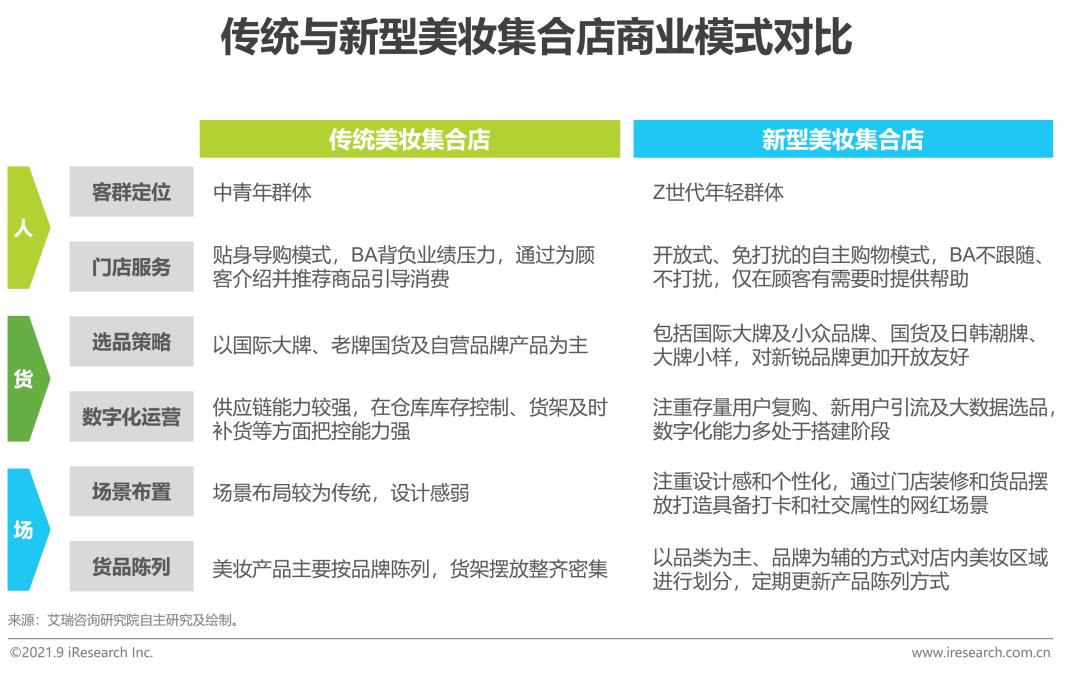

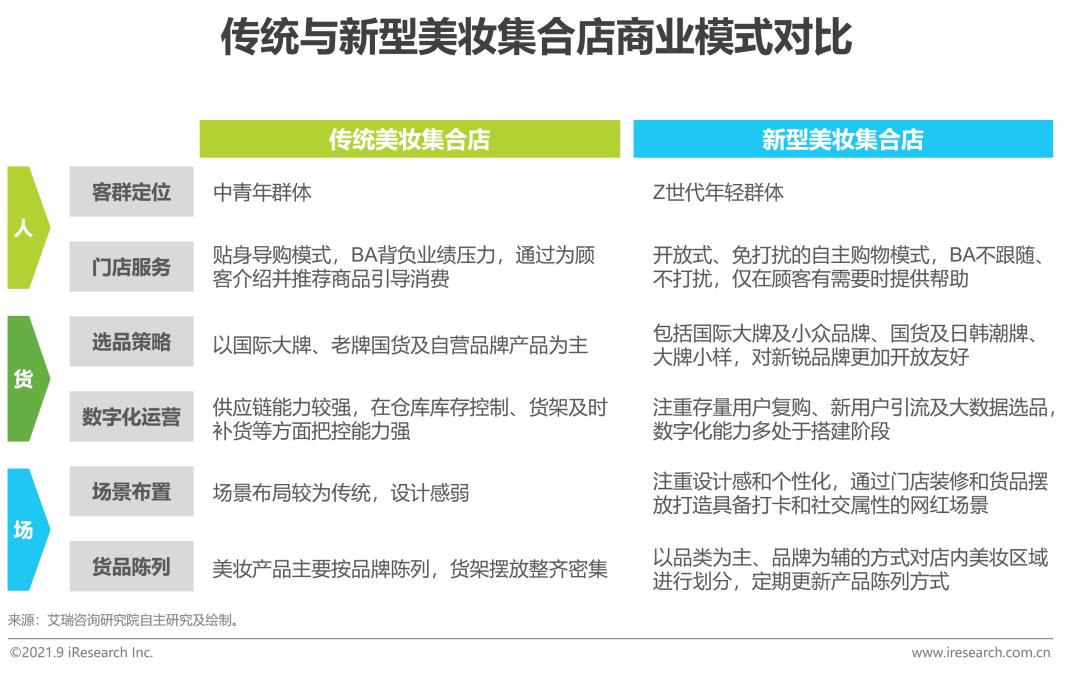

Business model: The structural changes of domestic beauty consumers have spawned new demands for beauty collection stores. Compared with traditional beauty collection stores, the business model of new beauty collection stores has achieved innovative changes in people, goods and fields.

Driving factors: traditional beauty collection stores have been deeply involved in the domestic market for many years, and their large-scale store expansion has promoted market growth. The new beauty collection store has achieved rapid development in recent years under the joint drive of client, brand and capital.

Market size: In 2020, the market size of China beauty collection stores will be 41.9 billion yuan, of which the proportion of new beauty collection stores will reach 7.6%. With the transition from the embryonic stage to the stable development stage of the new beauty collection store industry, its market share is expected to increase to 15.8% in 2023, and the market scale is expected to reach 13 billion yuan.

Trend insight: the just-needed attributes of the offline beauty channels and the integration opportunities of the domestic beauty collection store industry have long-term favorable investment prospects. Optimizing the product pallet structure and choosing a healthier operation mode will become an important development direction of the beauty collection store industry in the future.

Analysis of Business Model of Beauty Collection Store

Market development background of beauty cosmetics collection store

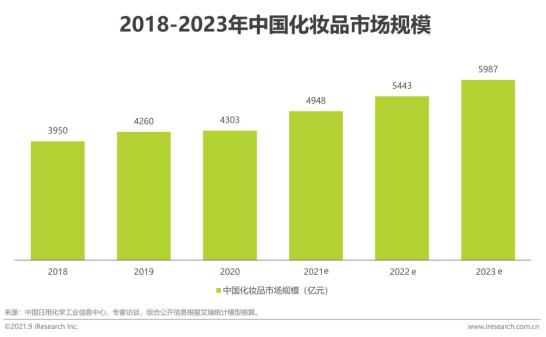

Under the background of Yan value economy, the market scale of cosmetics industry has grown steadily.

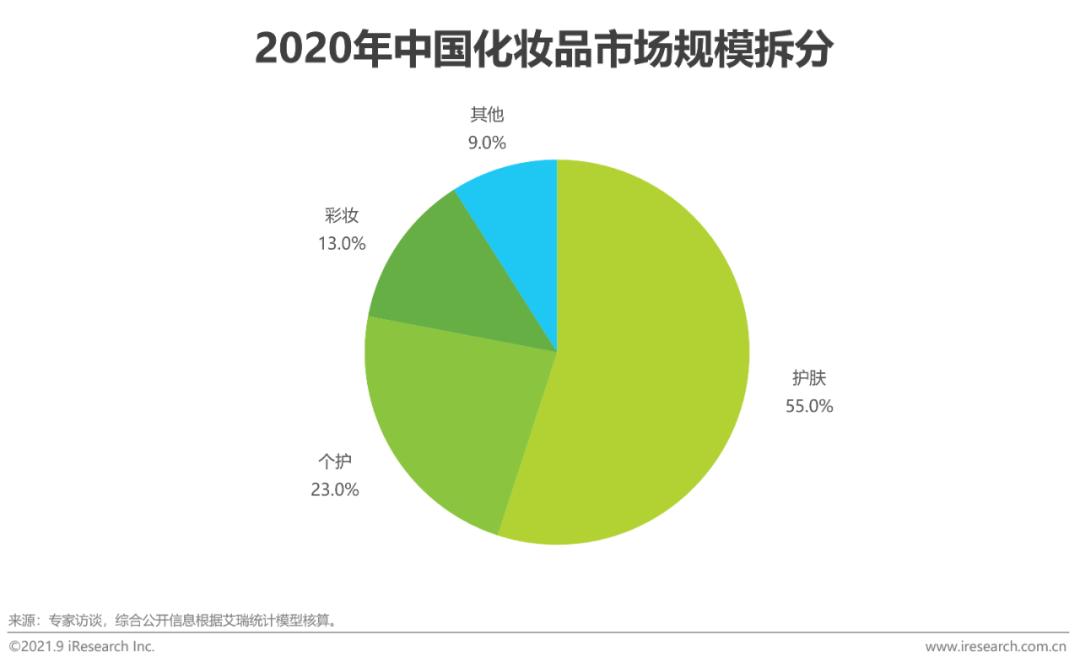

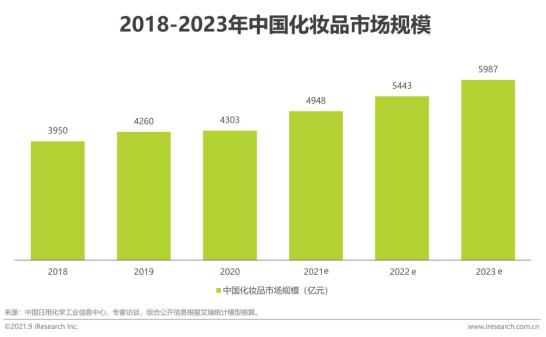

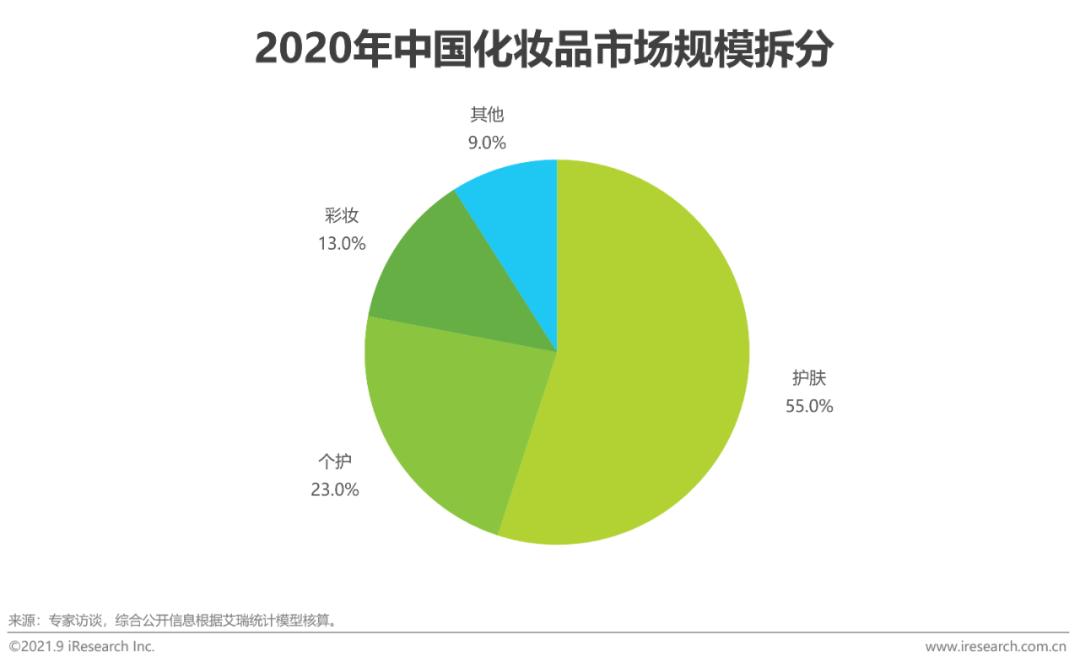

The "14th Five-Year Plan" defined the brand creation action of China, and proposed to protect and develop Chinese time-honored brands, enhance the influence and competitiveness of independent brands, and take the lead in cultivating high-end brands belonging to China in the consumer fields such as cosmetics, clothing, home textiles and electronic products. The future development prospects of the cosmetics industry can be expected. In 2020, China’s cosmetics market will reach 430.3 billion yuan. In the next three years, the overall market size is expected to maintain a stable and sustained growth of about 10% after the epidemic is repaired, and it will reach 600 billion yuan in 2023. As the largest category in the cosmetics industry, skin care products will account for about 55% of the market in 2020, and the growth rate will tend to be stable; In contrast, cosmetics, perfumes, men’s cosmetics and other sub-categories have greater growth potential.

The domestic cosmetics supply chain has gradually matured.

The upstream of the cosmetics industry chain mainly includes raw material suppliers and cosmetics manufacturers who produce cosmetics raw materials and packaging materials. Cosmetic manufacturers mainly adopt two modes: independent production and OEM production. Most cosmetics companies don’t have independent production lines, and usually entrust foundries to produce finished cosmetics. Among them, new domestic brands adopt OEM mode for the sake of cost and new product listing efficiency. The rapid expansion of the cosmetics market and the rise of local brands have promoted the development of the domestic cosmetics OEM market. In recent years, with the gradual maturity of China’s cosmetics supply chain, head cosmetics foundries such as Northbell, Cosmeishi China and Shanghai Zhenchen have cooperated closely with many brands at home and abroad, and the market entry threshold of cutting-edge cosmetics brands has continued to decline.

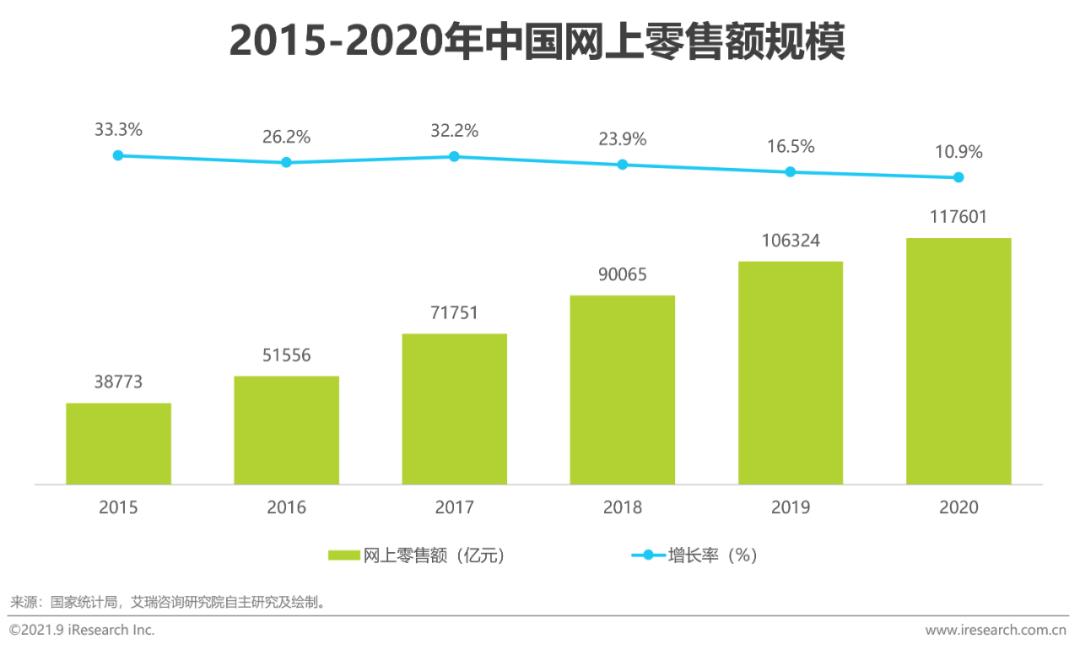

Domestic cosmetics retail online and offline show a trend of integration, promoting the development of beauty collection stores.

In 1990s, international high-end cosmetics brands represented by L ‘Oré al and Lancome entered the China market, taking department store counters as the main channel, which gradually cultivated domestic residents’ awareness of cosmetics consumption and promoted the establishment of marketing awareness of domestic cosmetics industry. Around 2000, a group of regional distributors of foreign brands familiar with cosmetics operation skills began to establish their own domestic brands, and the embryonic forms of classic domestic products such as Marubi, Zirantang and Polaiya were born, which led to the development of traditional beauty collection stores with lower threshold and wider distribution. Around 2012, the growth rate of cosmetics industry was dragged down by weak macro demand, and the competition in offline channels intensified. Domestic and international brands touched the net one after another, and they developed with the help of two waves of dividends from traditional e-commerce and new media e-commerce. However, in recent years, with the high operating cost of e-commerce, the online traffic dividend has declined, high-end products have driven the counter-cyclical growth of the cosmetics industry, and the value of offline channels in terms of user experience and brand building has once again been valued. The channels have shown a trend of online and offline integration, and new beauty collection stores have emerged, driving the beauty collection store channel generate to show new growth vitality.

Traditional VS new business model of beauty cosmetics collection shop

The new beauty collection shop is more suitable for the needs and preferences of contemporary young consumers.

The target customers of the new beauty collection store are directed at young people, so the selection of products and the layout of scenes are all around young consumers who pay attention to experience and cost performance. On the one hand, the new beauty collection store is more tolerant of cutting-edge brands, and cooperates with many online celebrity beauty brands full of design and personality; On the other hand, the new beauty collection store provides consumers with high-value scenes that are convenient for social punching through very stylish store decoration, and at the same time adopts light BA mode to create free shopping space.

Industry insight of beauty collection store

The Driving Force for the Development of New Beauty Collection Store: Client

Consumer demand of new generation beauty users: pursuing scene experience

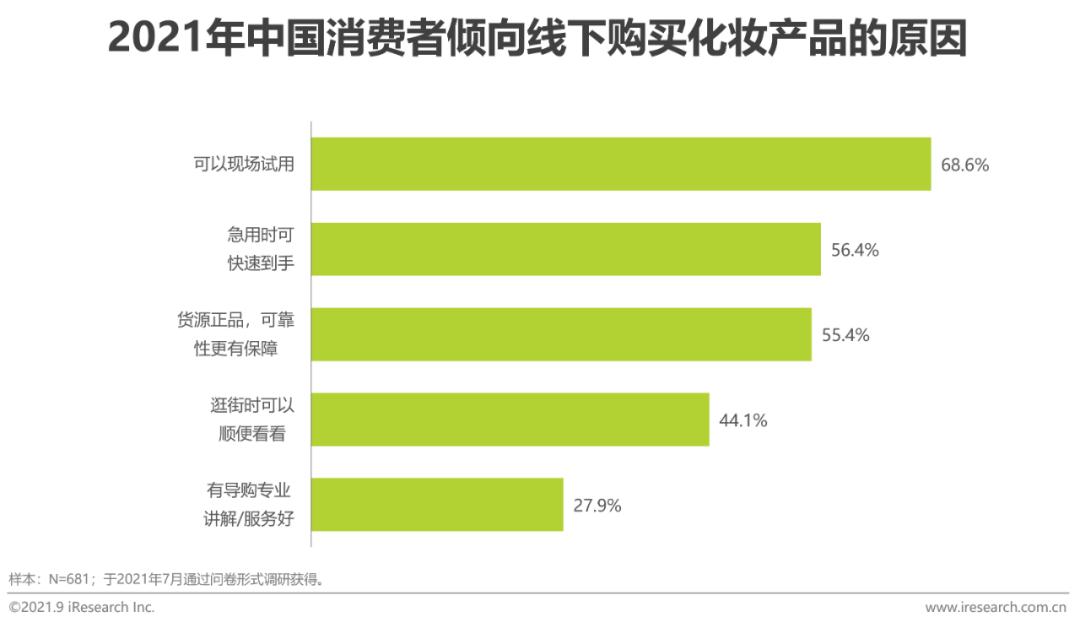

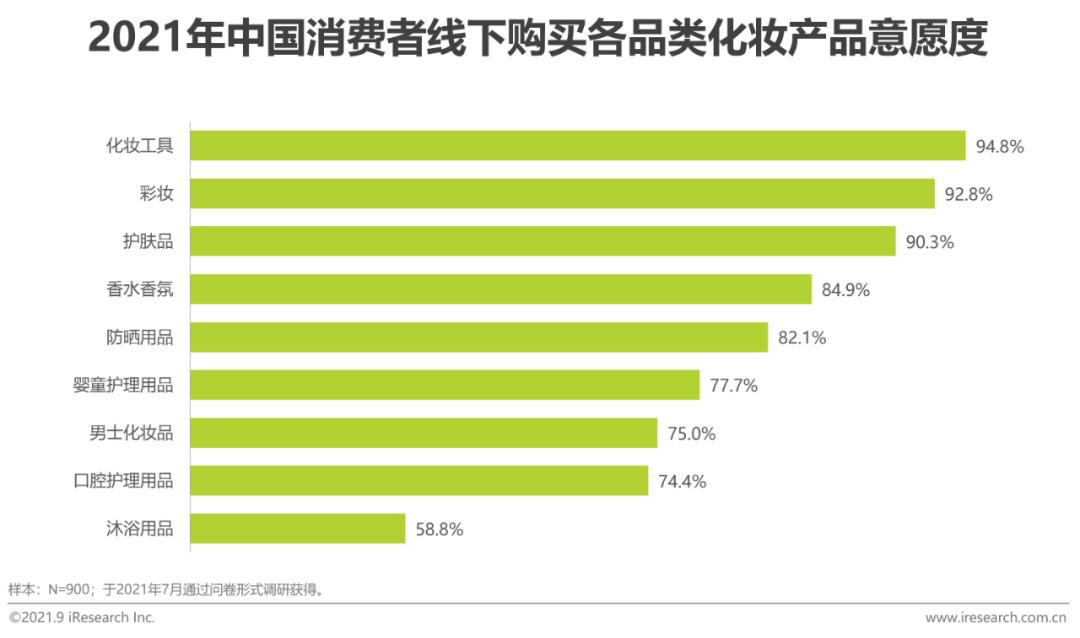

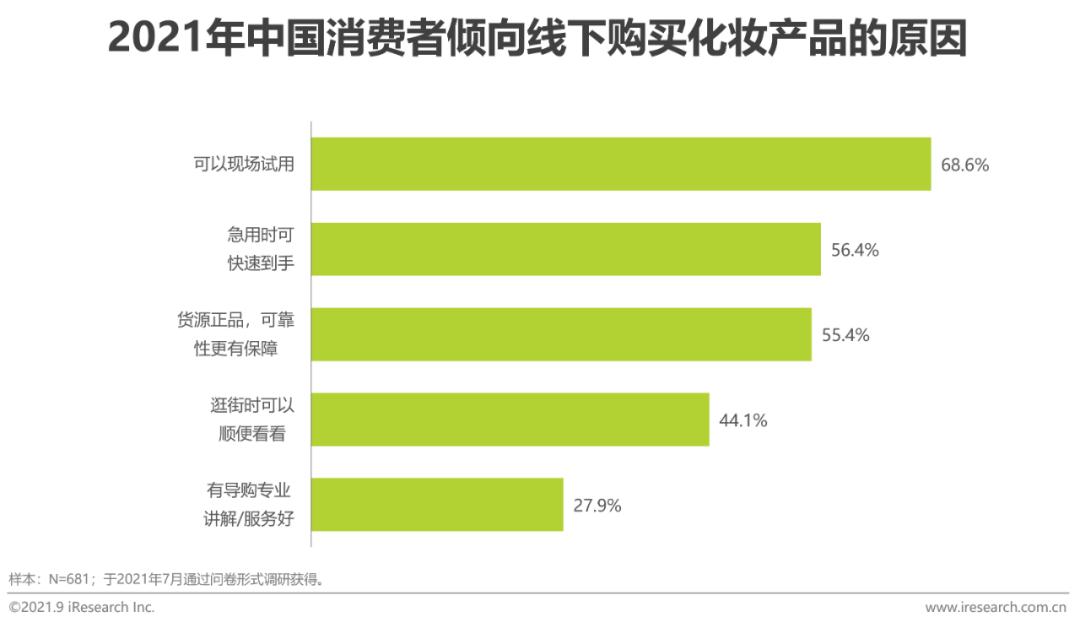

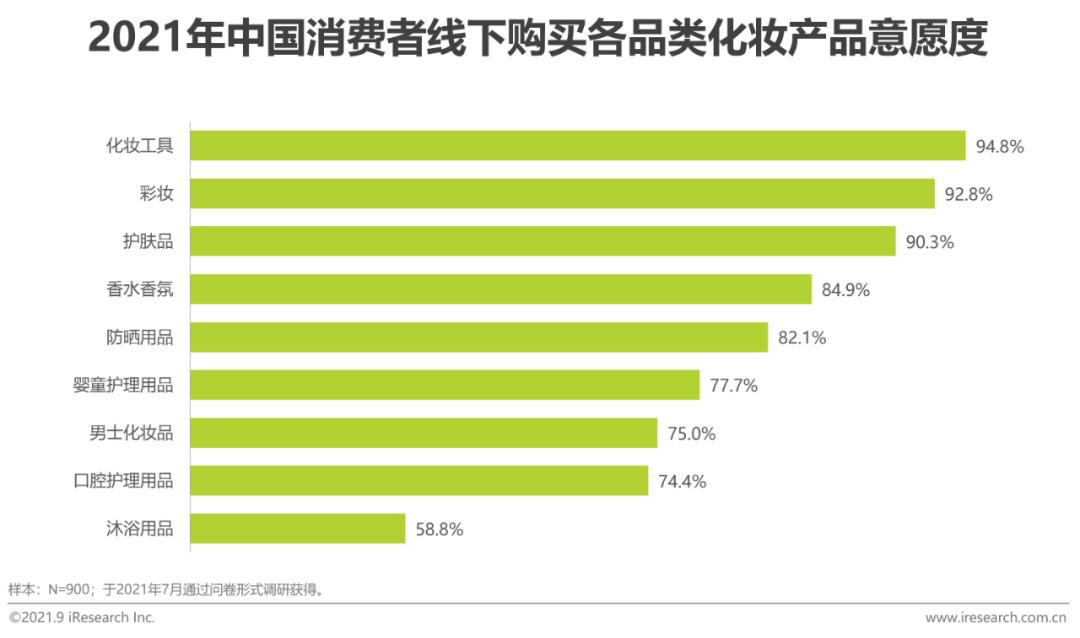

The business areas of offline channels such as beauty collection stores are mainly large business districts, which provide consumers with comprehensive and diverse cosmetic products through rich brand structure and product levels while satisfying convenience. On-site trial can help consumers fully feel the products in a one-stop shopping scene, and make purchase decisions that best meet their personal needs, and its strong experience attributes far exceed online channels. According to the survey data, nearly 70% of consumers choose to buy cosmetic products offline because they want to try them on the spot. Specifically, in terms of product categories, cosmetic tools, cosmetics and skin care products have the highest willingness to buy offline, and more than 90% of consumers have tried and bought these products offline. In addition, the offline purchase intention of perfume fragrance and sunscreen products has reached more than 80%.

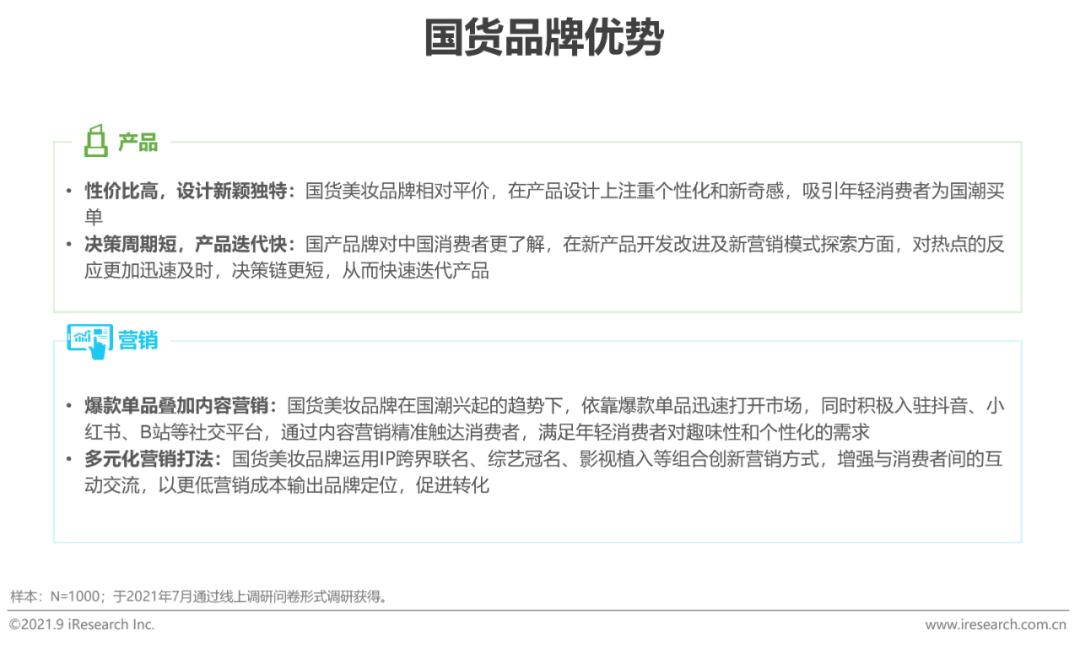

Consumer demand of new generation beauty users: high acceptance of domestic products

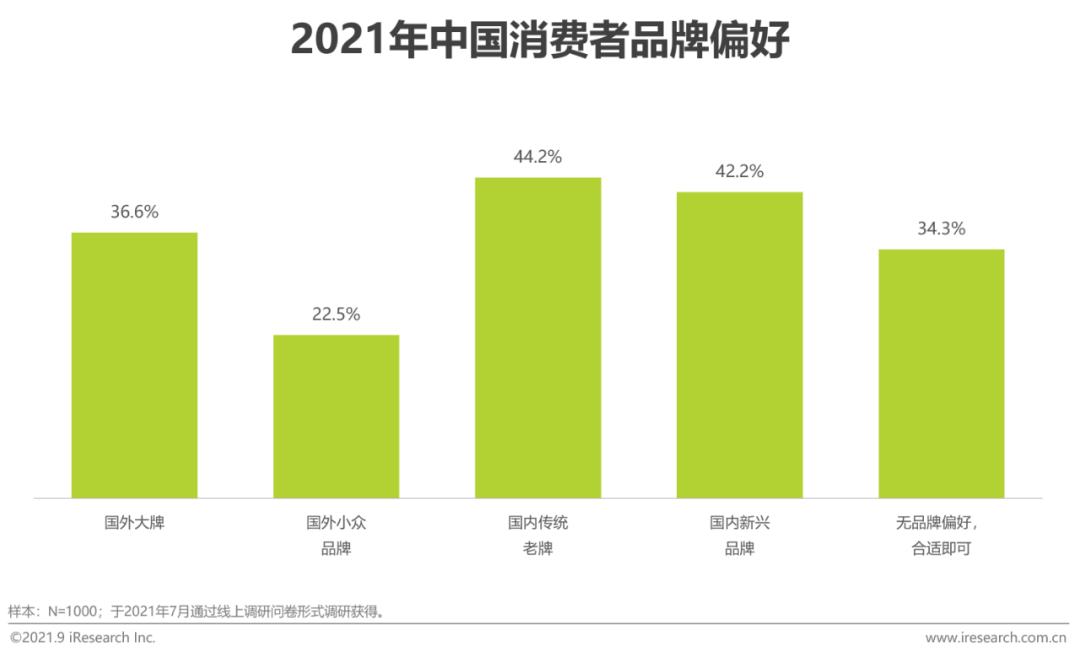

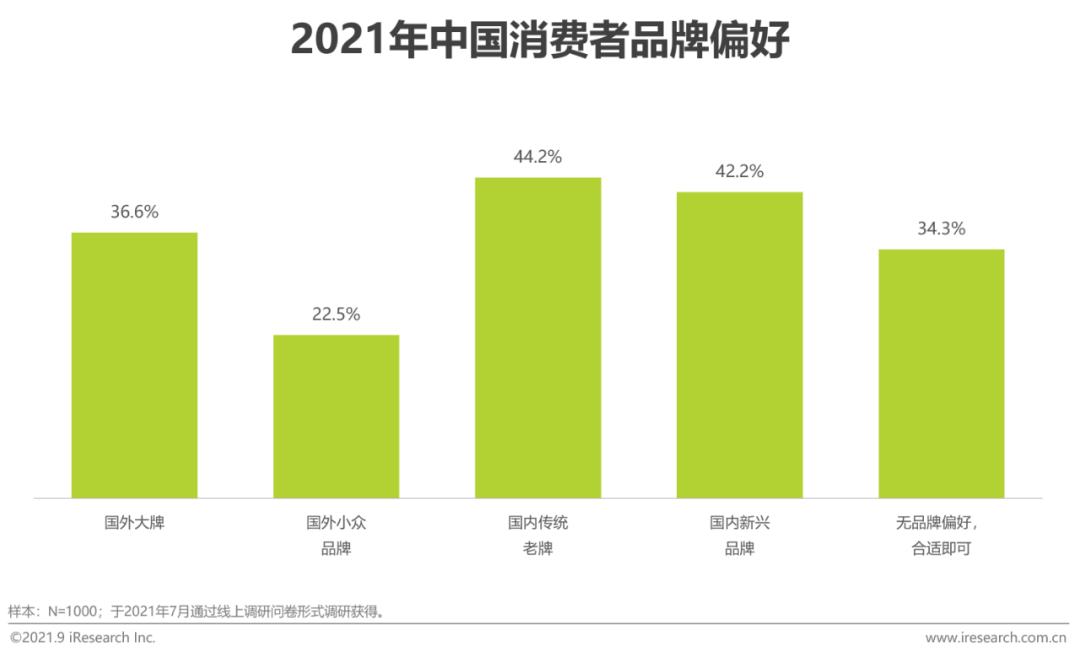

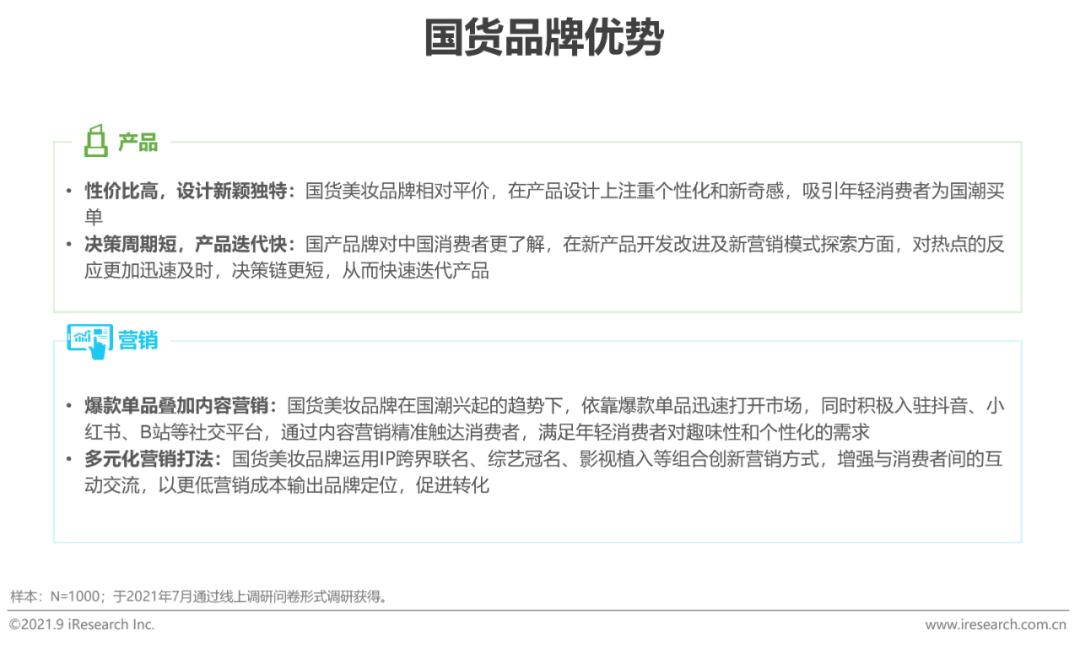

Multiple factors, such as consumption upgrading and the rise of national tide, have jointly promoted the rise of local beauty brands. Many new brands have opened the market with product innovation and diversified marketing models, and achieved breakthroughs under the long-term strong brand effect of international brands. The new generation of beauty consumers, mainly young people, have a higher acceptance of new things, have a more personalized evaluation system in the choice of beauty consumption, are not obsessed with big names, and pay more attention to face value, efficacy, reputation and cost performance. According to the survey data, consumers have a high acceptance of domestic brands, and the proportion of consumers who tend to buy domestic traditional brands and emerging brands is over 40%. Another 34.3% of consumers have no obvious preference for domestic and foreign brands, and pay more attention to whether the products themselves are suitable for them.

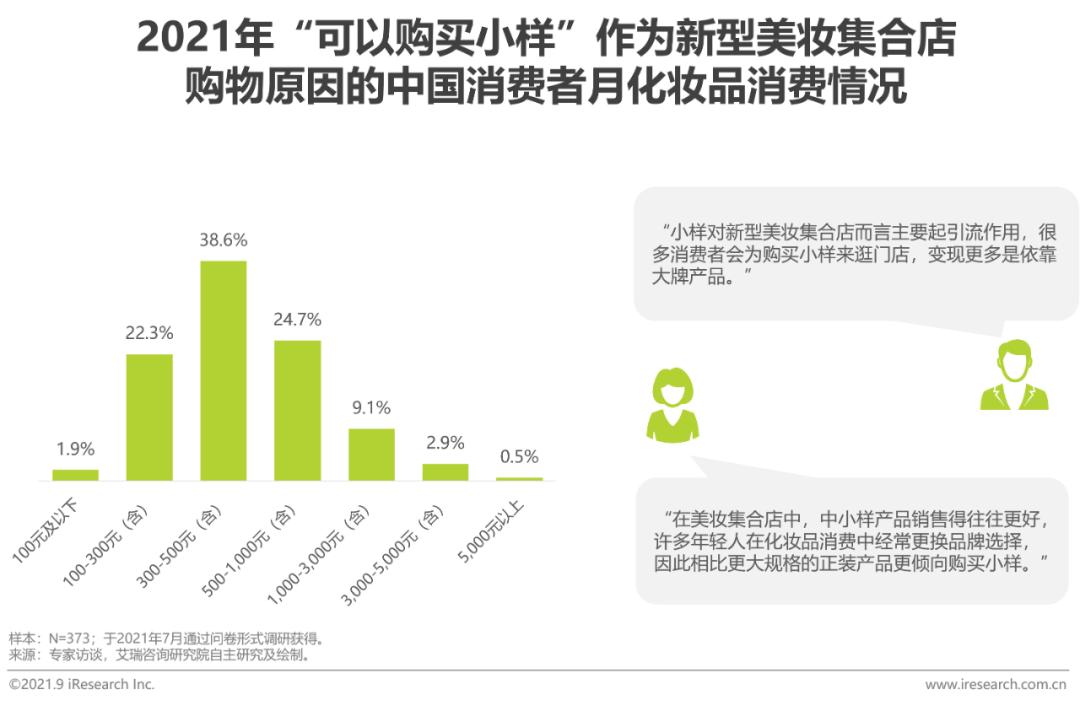

Consumer demand of new generation beauty users: market gap of "sample economy"

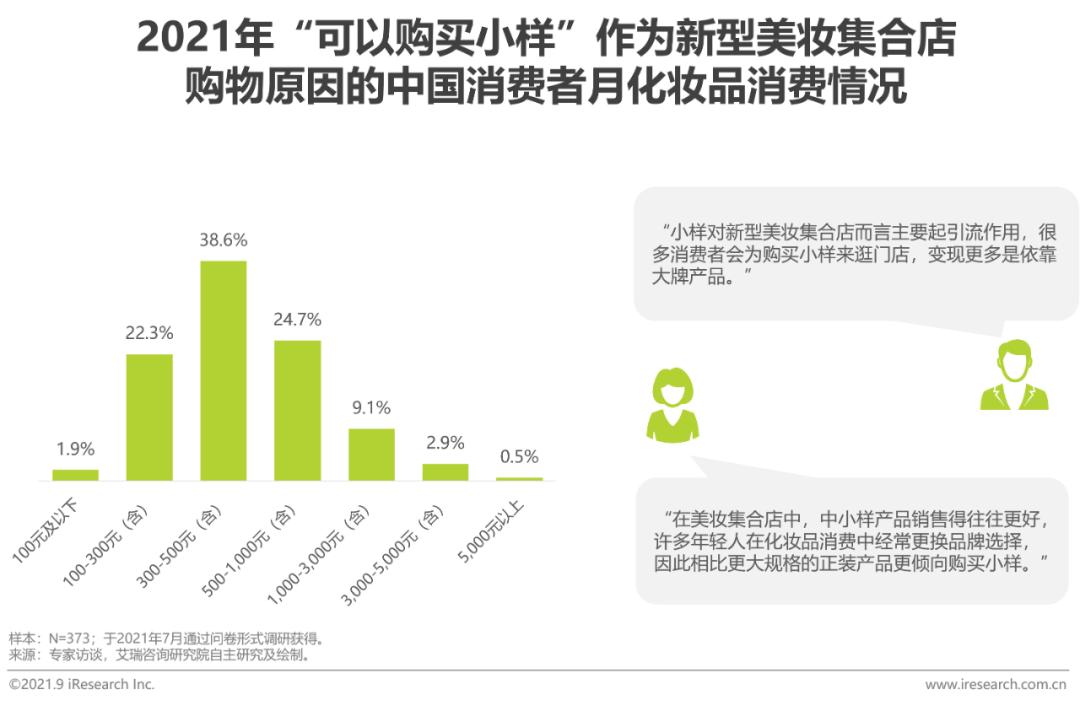

Beauty product samples can make consumers invest lower trial and error costs when fully trying new brands or new products, and it is easier to make purchase decisions, so they can play a greater role in attracting new users and promoting formal dress purchase, and become an important marketing contact for brands. Samples usually reach consumers in the form of brand gifts and holiday suits, and there are few formal channels to sell samples separately in the market. The new beauty collection store captures the demand of the new generation of beauty users for sample products, and sells them as independent products in the store, which can not only attract passengers, but also generate revenue. According to the survey data, users who spend 300-500 yuan per month on cosmetics are most likely to be attracted by the samples, and then go to the new beauty collection store for consumption.

The driving factor of the development of new beauty collection store: brand end

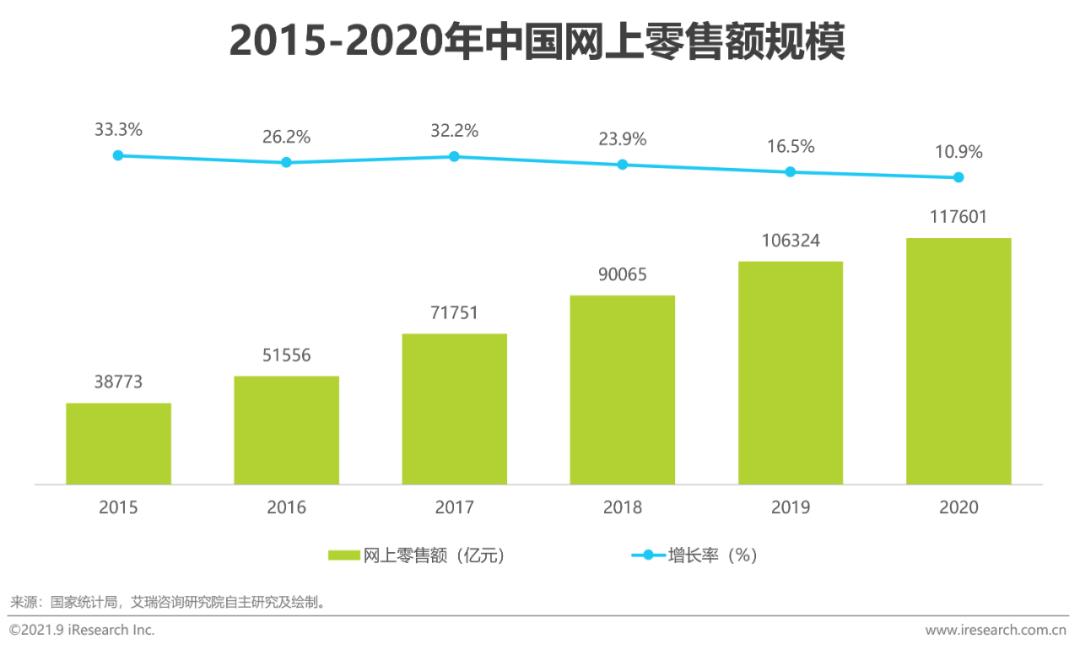

Demand for offline channel expansion of emerging beauty brands: high operating cost of online traffic

The domestic e-commerce industry has entered a stage of rapid growth since 2010. With the mature development of e-commerce, more and more businesses are pouring into the online market, traffic competition is becoming increasingly fierce, e-commerce dividends are gradually declining, and market growth is slowing down. At present, the online platform channels are diversified, and the distribution of consumers is decentralized and the e-commerce traffic is fragmented, which makes it more difficult to obtain customers. Beauty brands, especially domestic emerging beauty brands, have been able to rise rapidly through online channels in recent years, but at the same time, they are faced with the problems of high online traffic cost and continuous increase in marketing and promotion expenses. Expanding offline sales channels and reaching consumers in multiple dimensions will become a breakthrough for beauty brands to achieve long-term development. The new beauty collection store provides a tonal matching channel for emerging beauty brands, which increases brand exposure. At the same time, on the basis of sales, it empowers the brand operation value of the channel. For example, H.E.A.T likes to provide data feedback for the brand, helping the brand to intuitively understand the consumer’s preferences and needs.

Demand for offline channel expansion of emerging beauty brands: the cost of opening independent stores offline is high.

With the rising real estate prices and labor costs in recent years, the cost of facade rent and employee expenses of single-brand beauty stores has increased, and domestic emerging beauty brands have taken on higher operational risks, especially in the initial stage of development and market grabbing. The channel model of beauty collection stores is conducive to reducing the pressure on funds, inventory and operation of emerging beauty brands. For overseas brands, the sales of brands in China are mainly based on the distribution agent model, and department stores or independent stores are mostly located in first-and second-tier cities. The distribution of offline channels in low-tier cities requires fixed costs and labor costs borne by dealers. The model of brand counters or independent stores is risky in the sinking market, and it is relatively difficult to reach. The model of beauty collection stores can alleviate the account period and inventory pressure of dealers to a certain extent, and at the same time meet the demand of consumers for overseas brands in the sinking market.

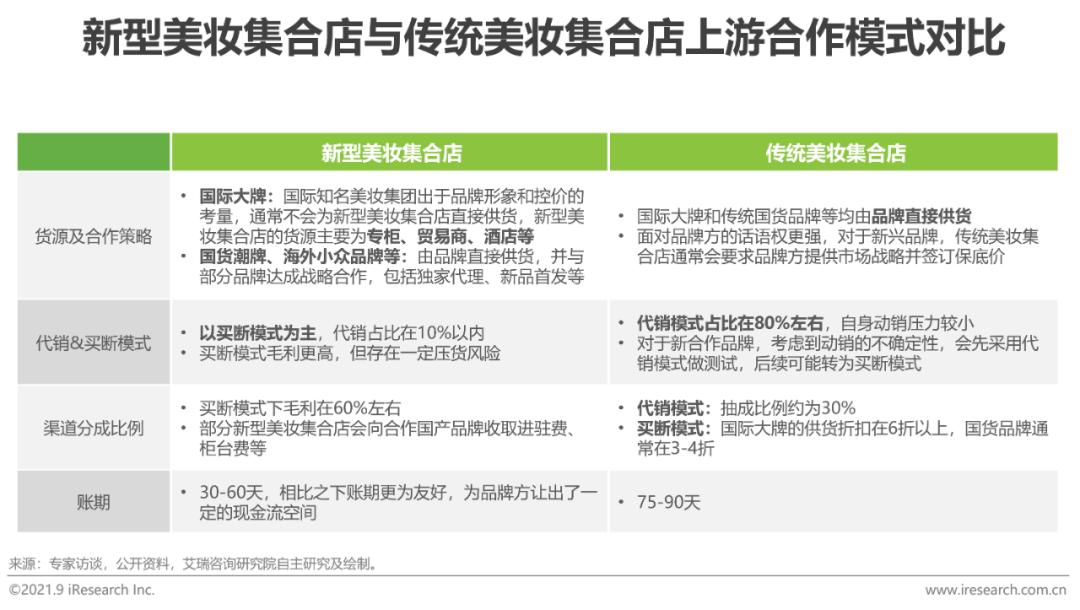

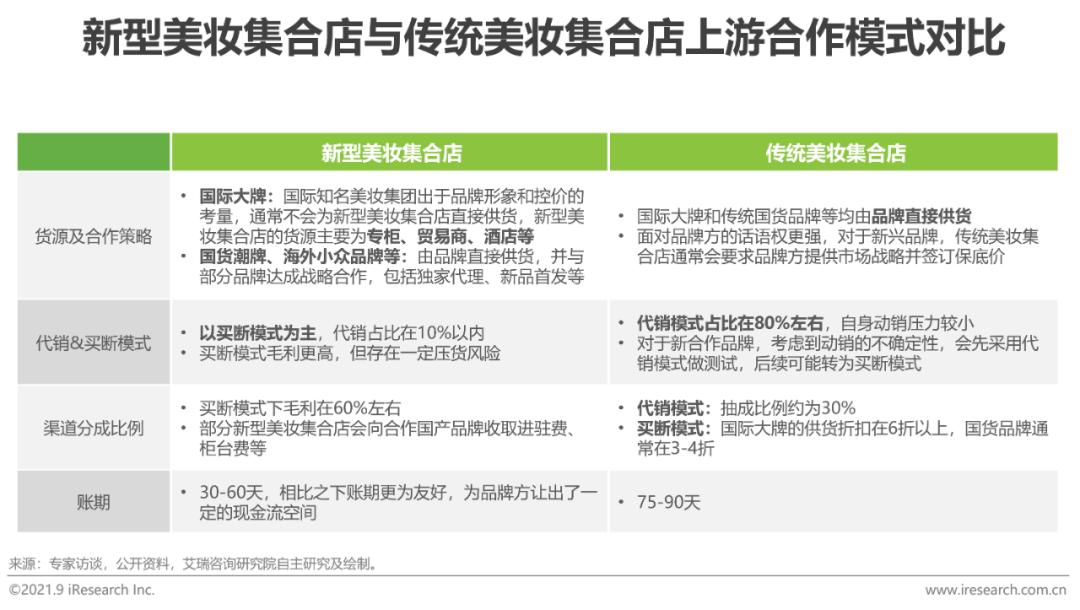

Demand for offline channel expansion of emerging beauty brands: traditional beauty collection stores have high entry barriers.

The purchasing mode of traditional beauty collection stores in China mainly includes consignment and distribution: under the consignment mode, the beauty collection stores adopt actual sales and settlement, and the goods are delivered directly by the brand; Under the distribution mode, the beauty collection store signed a batch sales order with the brand, and the ownership of the goods actually transferred. The traditional beauty collection store has obvious advantages in supply chain, stable channel sales, strong voice, high proportion of consignment mode, sales risk borne by the brand, and relatively long account period. At the same time, the traditional beauty collection store has a certain threshold for the purchase choice of emerging beauty brands because of the consideration of marketing. The purchase mode of new beauty collection stores is mainly one-time buyout, and the account period and supply discount are more friendly to the new brands of the country. On the other hand, the entry of new explosive products attracts consumers to the store, and also brings passenger flow to the new beauty collection store, realizing two-way empowerment.

The Driving Force for the Development of New Beauty Collection Store: Capital End

Players in the new beauty collection store have been favored by capital many times.

The format of the new beauty collection store keeps up with the changes in the new offline retail scene, and has become a "flow harvester" in major business districts with its strong appeal to young consumers. Therefore, it has received great attention from capital and has been frequently financed in recent years. Among them, Colorist, Plum Blossom and WOWCOLOUR have received several rounds of financing, and the financing scale has reached several hundred million yuan; In addition, rising stars such as NoisyBeauty, Hi Burning and Black Hole have also won the favor of well-known investment institutions such as Gaochun Venture Capital and Zhenge Fund. With the help of capital, the new beauty collection store industry has entered the stage of staking.

Market scale of beauty cosmetics collection store

The overall scale of the industry has grown steadily, and the proportion of new beauty collection stores has increased.

With the advantages of multi-brand operation and location close to consumers, the beauty collection store channel can help cooperative brands to effectively explore the market. Watsons, which is positioned in the mass market, and Sephora, which is positioned in the middle and high-end market, have gradually become the mainstream of domestic traditional beauty collection stores after years of deep cultivation, and their chain stores in China have driven the growth of the market scale of traditional beauty collection stores. Since 2019, domestic new beauty collection stores have started to develop, and innovative brands represented by colorists and plum blossoms have emerged one after another, which has had a certain impact on traditional beauty collection stores. At present, the new beauty collection store industry is in transition from the embryonic stage to the stable development stage. In 2020, the domestic new beauty collection store will account for 7.6% of the total beauty collection store market, and its market share is expected to increase to 15.8% in 2023, and the market size is expected to reach 13 billion yuan.

Industry atlas of beauty cosmetics collection shop

The beauty collection store industry is scattered and there are many players.

The head players of traditional beauty collection stores mainly include Watsons, a chain brand of beauty cosmetics and daily chemicals, and Sephora, which focuses on high-end selected brands in Europe and America and its own brands. The new beauty collection store is represented by the colorist under KK Group, WOWCOLOUR under the famous products and the plum originated from online. Colorists and WOWCOLOUR focus on cost-effective domestic and foreign beauty brands, opening hundreds of stores all over the country; Huamei and Heikong mainly sell overseas big-name and niche brands, positioning high-end, and mainly opening street stores in first-tier and new first-tier cities. Other players’ stores are more regional and smaller in scale, and their brand positioning is different. NOISYBeauty, Dongdian West Point and other players cut into the track from the sinking market.

Beauty cosmetics jihe branch industry concentration degree

Many players in beauty collection stores adopt differentiated strategies to cut into the market, and the industry tends to be integrated.

Players in the beauty collection store industry can be divided according to players’ background, brand positioning and store area. In the background of players, it can be divided into independent new brands, retail brand incubation and department store incubation, and the beauty collection stores incubated by the group may be supported in terms of capital and supply chain; In terms of brand positioning and store area, the brand stores located in the high-end niche are mainly large stores, while the players located in the cost-effective and sinking market mainly operate medium-sized stores. In terms of industry structure, the traditional beauty collection store industry developed earlier and the market concentration was higher, while the new beauty collection store is still in a period of rapid development. In the future, head players are expected to gradually increase their market share through industry integration.

Core competitive elements of new beauty cosmetics collection store

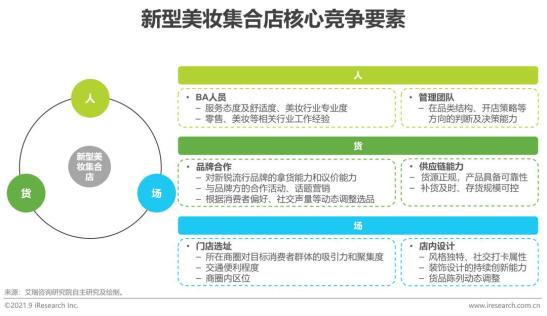

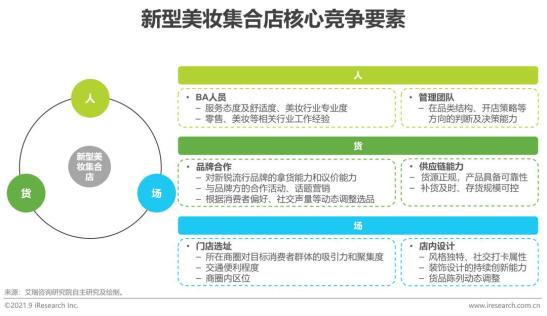

The core competitive advantages of the new beauty collection store are embodied in three aspects: people, goods and market

In order to maintain benign operation and enhance differentiated advantages, the new beauty collection store needs to optimize the service quality and professionalism of the store BA in terms of "people", and requires the management team to be forward-looking in important decisions such as selecting products and opening stores. In terms of "goods", the new beauty collection store needs to match the consumer’s demand preferences to the greatest extent in brand selection, and enhance the interaction with consumers through diversified marketing activities; Improve the supply chain capacity and quality, ensure the regularity of goods, improve the turnover efficiency and control the inventory water level. In terms of "field", new beauty collection stores are usually located in popular areas with dense traffic in key cities, while paying attention to convenient transportation and location in business districts, such as subway floors, escalators or the most conspicuous places near entrances and exits; The decoration style in the store has a strong sense of design, and at the same time, the long-term appeal to consumers is enhanced through regular adjustment of decoration and shelves.

Prospect of the future trend of beauty cosmetics collection store

Long-term challenge of new beauty cosmetics collection store

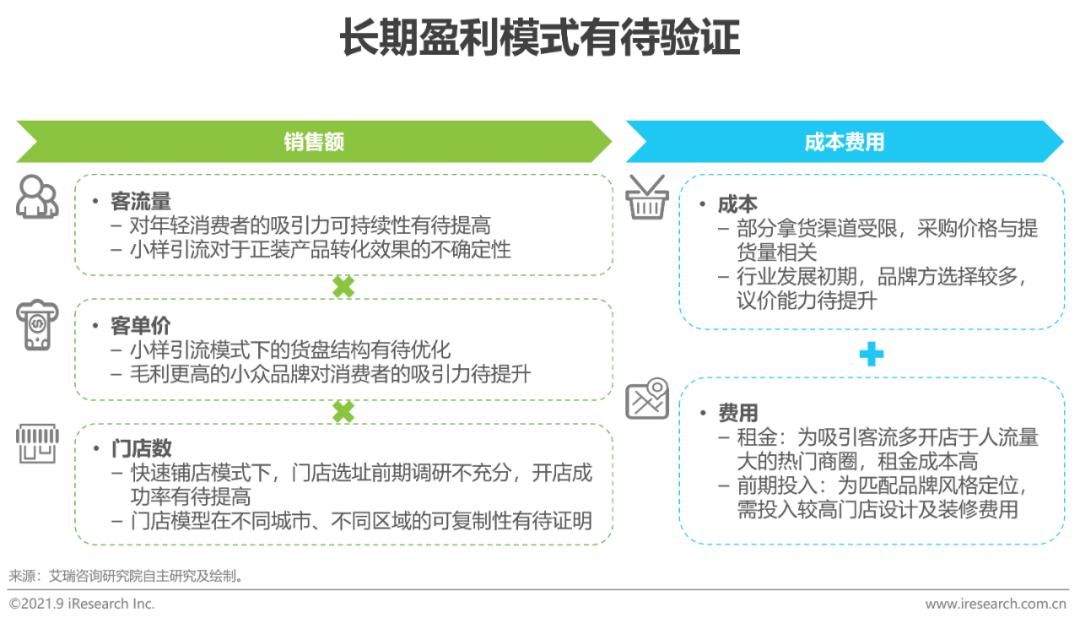

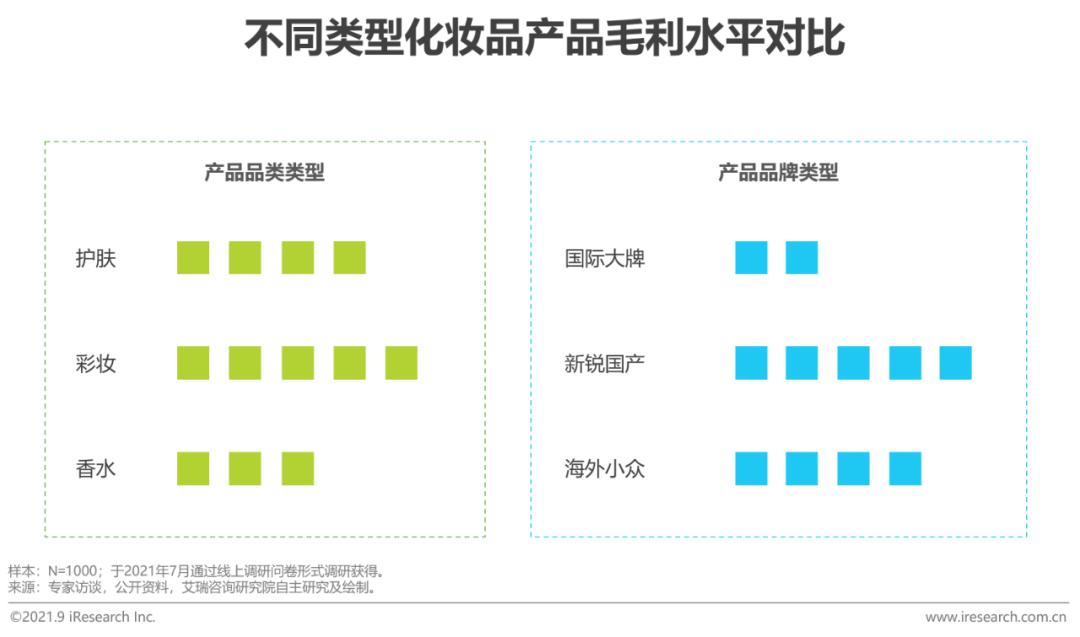

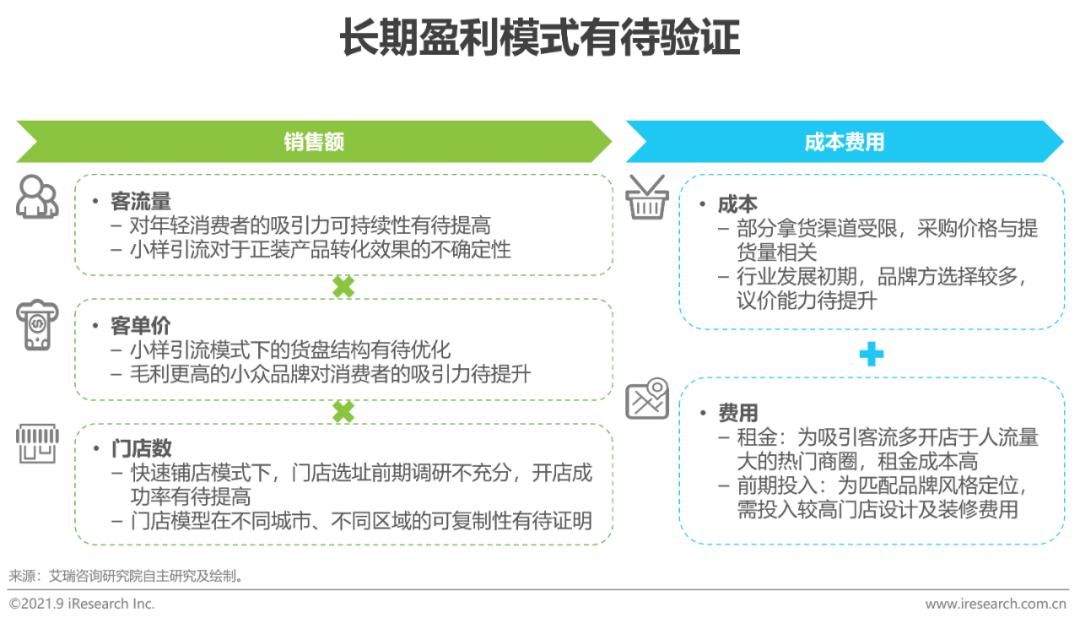

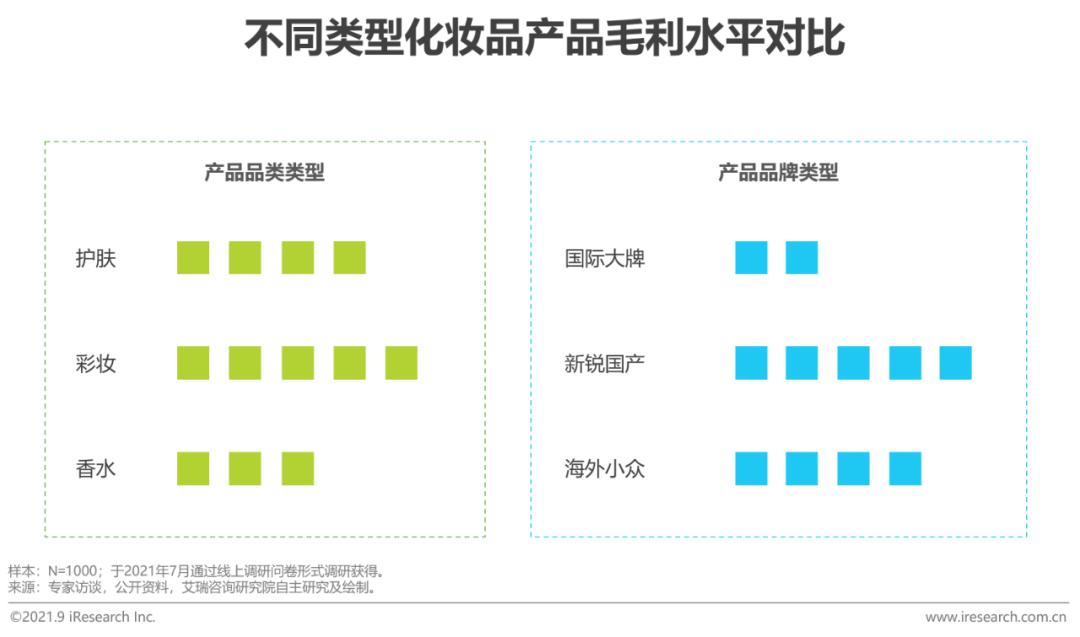

The long-term profit model needs to be verified: low customer unit price and low efficiency.

At the same time of large-scale expansion, the long-term profitability of the new beauty collection store still needs to be verified by the market, and its uncertainty is reflected in many aspects: in terms of passenger flow scale, the new beauty collection store attracts the first batch of young consumers in the city to punch in with its design-conscious store decoration and novel scene experience, but after the novelty gradually ebbs, it still needs stores to give full play to their advantages in product selection to maintain the sustainability of passenger flow; In terms of pallet structure, stores may optimize the store model by increasing the proportion of high-margin products such as cosmetics, niche brands and exclusive agency brands, but it is still uncertain whether the low-margin products and the passenger flow attracted by samples can be converted into the purchasing power of high-margin products; In terms of expenses, the location of new beauty collection stores is usually located at no cost to attract passengers and make positioning. The high rental cost for this purpose is also one of the main reasons for the low efficiency and difficulty in making profits.

Price advantage impact of other channels such as online and duty-free shops.

According to the survey data, 42.2% of the consumers who choose to shop in the new beauty collection store said that one of the main reasons is that the product prices of the new beauty collection store are cheaper than those of department stores and online official stores. Compared with the official channels where there are few discounts except shopping festivals and live broadcast rooms, the price of the new beauty collection store does have certain advantages intuitively. However, the rise of the domestic duty-free market has a certain impact on the price advantage of new beauty collection stores, even without considering the activities such as sample giving and point redemption through official channels. Take HARMAY as an example. The retail price of 30ml Hailan Mystery Essence Cream is 1292 yuan, which is 15% off the official price, while Sanya International Duty Free City is priced at only 1180 yuan. Due to the great difference in pricing between international brands at home and abroad, the pricing of Taobao Haitao purchasing stores is mostly around 800 yuan. In contrast, the price advantage of the new beauty collection store is not obvious, and it is difficult to attract price-sensitive consumers for a long time.

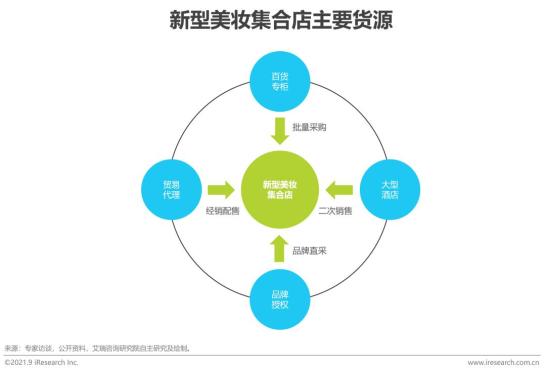

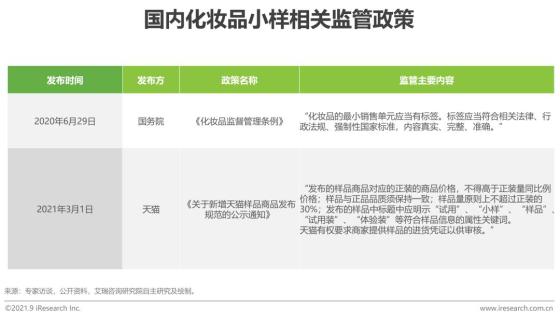

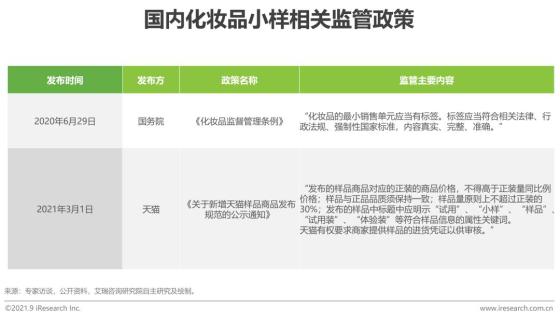

The opaque supply of goods and the stricter regulatory environment will make the continuous supply of products face uncertainty.

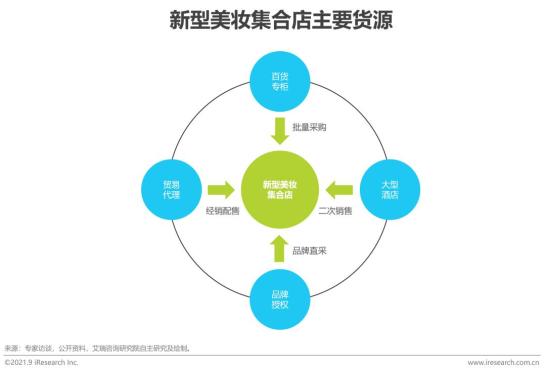

At present, the supply channels of new beauty collection stores in China mainly include: 1) purchasing in large quantities through department store counters, usually obtaining some price discounts and tying a large number of samples; 2) through the purchase of dealers or agents, merchants specializing in wholesale samples have also been formed in the process of industry development; 3) Secondary sales of large hotels, mainly care and fragrance products; 4) A small number of beauty collection stores are authorized by brands to directly purchase products, which are mainly authorized by small and medium-sized overseas brands and domestic brands, and most products are not directly authorized by brands. In addition, some new beauty collection stores take sample products as an important drainage method, which has the problem of opaque supply. With the introduction of relevant national regulatory policies and the requirements of retail platform specifications, beauty collection stores with samples as their selling points may adjust their procurement channels, and there is some uncertainty in the continuous supply of products.

Future trends of new beauty cosmetics collection stores

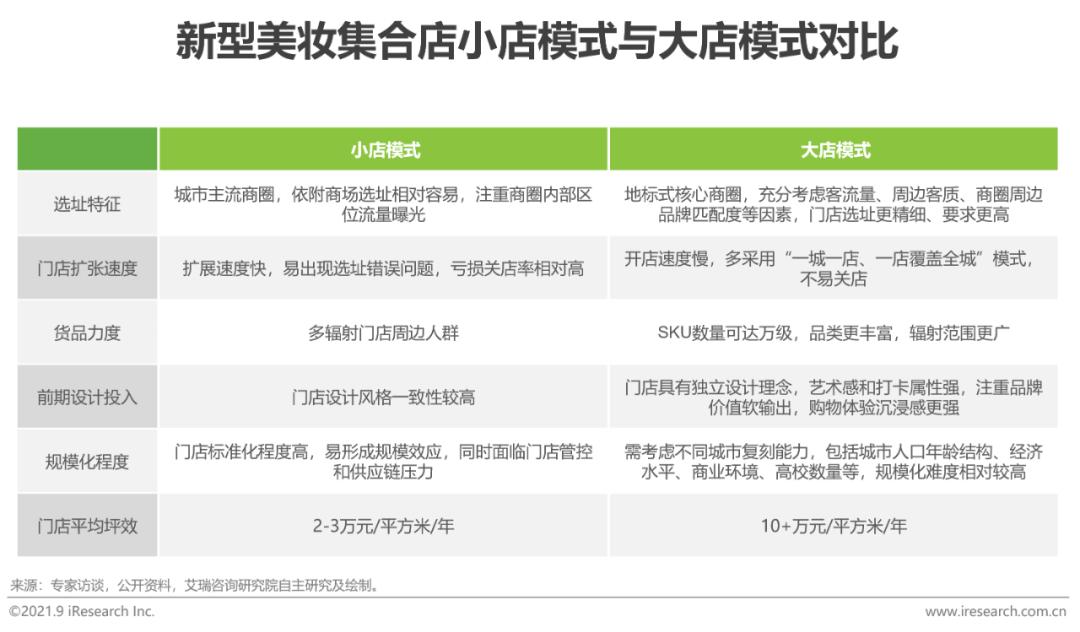

The operation mechanism of the big store model is healthier

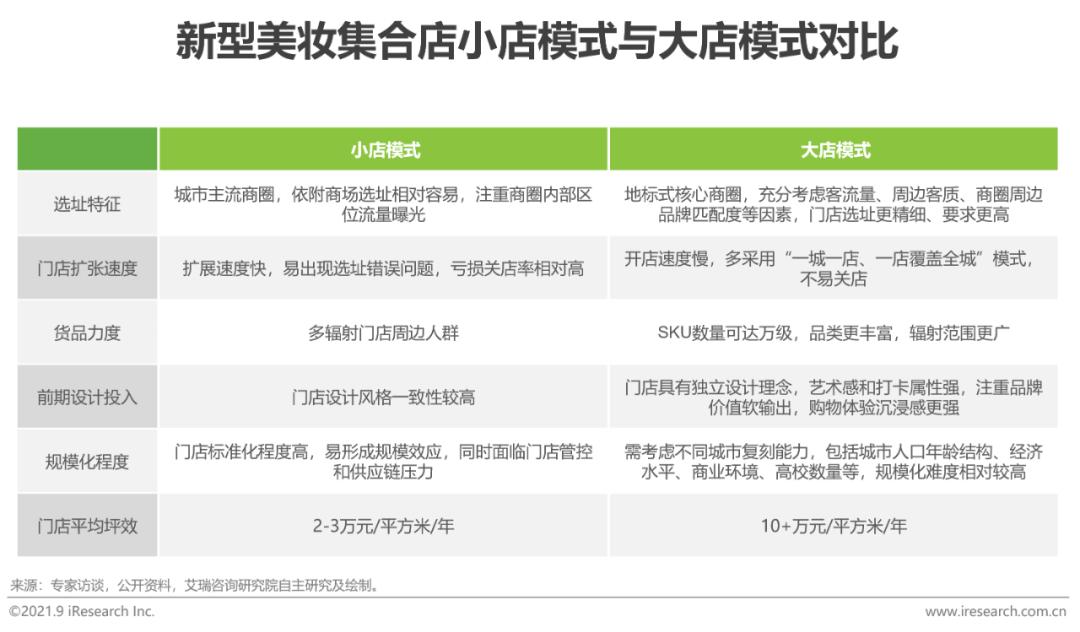

At present, the operation types of new beauty collection stores in China mainly include small stores and big stores. Small-store model is conducive to expanding the market in the early stage, but the speed of opening stores is too fast, and there is a mismatch between the customer quality of some stores and the positioning of new beauty collection stores, especially in the case of limited brand building and supply chain management capabilities, consumers are not sticky enough, which affects the sales and profitability of stores and leads to the closure of stores. Comparatively speaking, the location of large stores with an area of 500 square meters or even more than 1,000 square meters is usually the landmark core business district of the city. The business district has its own high passenger flow, rich SKUs in stores, better shopping scene design experience, better floor efficiency performance of stores, and it is not easy to close stores. The "one city, one store" big store model will become an important development direction of the new beauty collection store industry in the future.

Category and brand structure tend to be diversified, and the pallet structure is optimized.

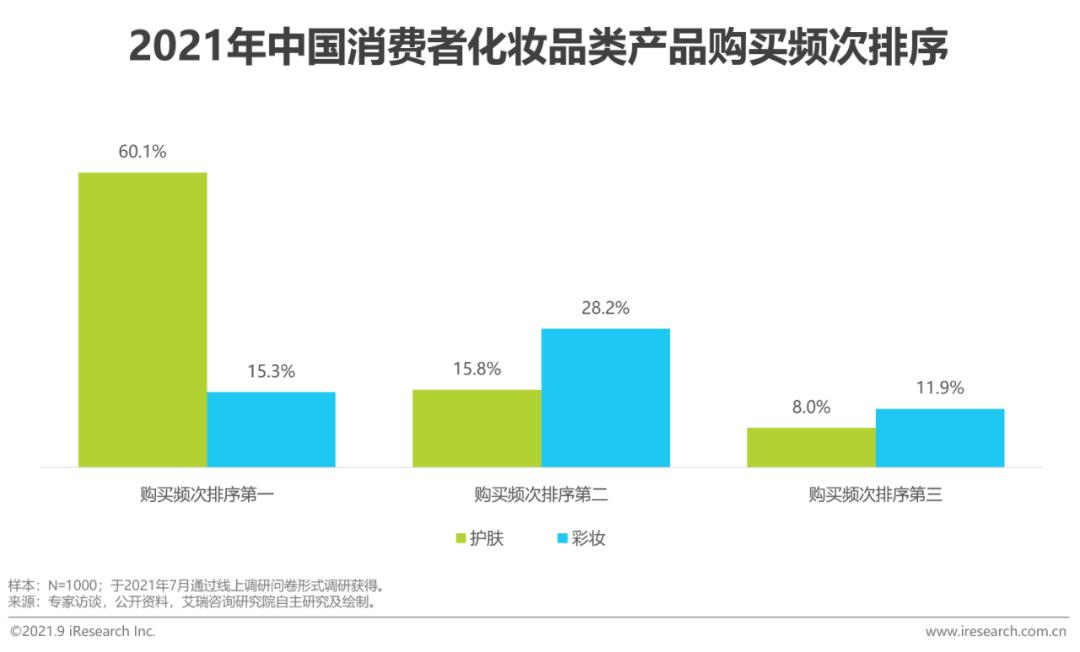

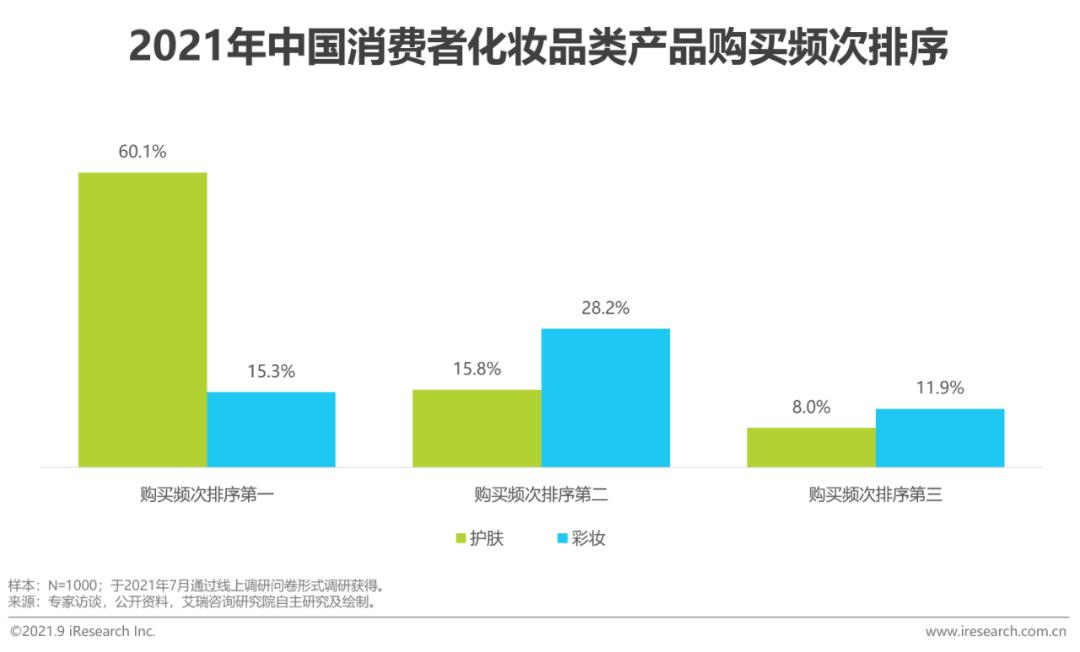

The early product layout of domestic new beauty collection stores mainly focused on make-up, which attracted consumers to enter the store to try on makeup and achieved the purpose of drainage. However, cosmetic products generally have a long use cycle and low consumption frequency, which affects product repurchase. According to the survey data, only 15.8% of users said that they bought makeup most frequently in different categories of cosmetics, while the proportion of users who chose to buy skin care products most frequently was as high as 60.1%. As a fast-growing category, the domestic demand of perfume is gradually increasing, which makes the selection strategy of new beauty collection stores inclined. The new beauty collection store will gradually adjust the category structure and increase the proportion of skin care products and perfume products. In terms of brand types, the new beauty collection store has relatively strong bargaining power and higher gross profit for domestic cutting-edge brands and overseas niche brands, and will become the future development direction of the new beauty collection store.

Original title: China Beauty Collection Store Industry Report in 2021